Table of Contents

IRS Form 4626 – Alternative Minimum Tax – Corporations – In the ever-evolving landscape of U.S. tax regulations, IRS Form 4626 plays a crucial role for large corporations navigating the Corporate Alternative Minimum Tax (CAMT). Introduced as part of the Inflation Reduction Act of 2022, this form ensures that profitable corporations pay a minimum level of tax based on their financial statement income. Whether you’re a tax professional, corporate executive, or business owner, understanding Form 4626 is essential to comply with IRS requirements and optimize your tax strategy. This comprehensive guide covers everything you need to know about IRS Form 4626, including its purpose, filing requirements, calculation methods, and recent updates for 2025.

What Is IRS Form 4626?

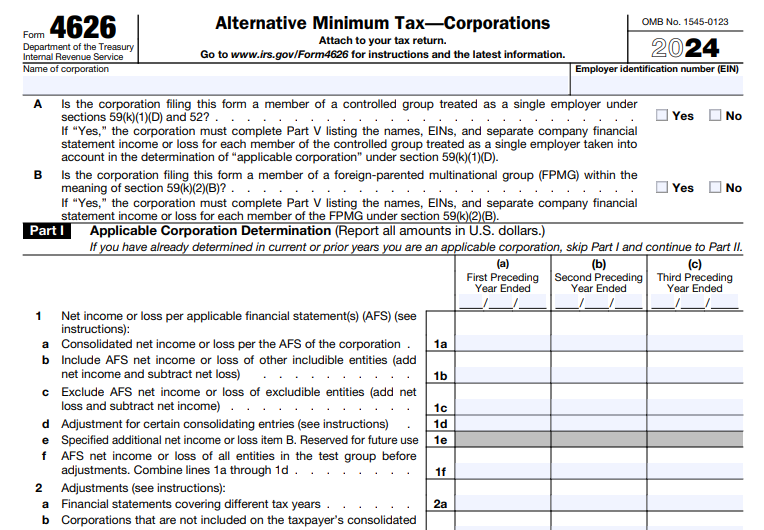

IRS Form 4626, titled “Alternative Minimum Tax – Corporations,” is used by corporations to determine if they qualify as an “applicable corporation” under Internal Revenue Code (IRC) Section 59(k) and to compute any Corporate Alternative Minimum Tax owed under Section 55. Unlike the pre-2018 corporate AMT, which was repealed by the Tax Cuts and Jobs Act (TCJA), the current CAMT targets large corporations with significant book income but potentially low taxable income due to deductions and credits.

The form calculates a 15% minimum tax on adjusted financial statement income (AFSI) after certain adjustments, ensuring these entities contribute a fair share to federal revenues. It’s attached to the corporation’s income tax return, such as Form 1120, and must be filed by the return’s due date, including extensions.

Key features of Form 4626 include:

- Part I: Determines applicable corporation status based on average annual AFSI thresholds.

- Part II: Computes AFSI with adjustments for taxes, depreciation, and other items.

- Part III: Calculates the tentative minimum tax and any CAMT liability.

- Schedules: Additional worksheets for foreign tax credits and controlled foreign corporations (CFCs).

For the latest version, visit the IRS website to download Form 4626 and its instructions.

Who Needs to File IRS Form 4626?

Not every corporation is required to file Form 4626. The form applies primarily to large entities that meet the “applicable corporation” criteria. Here’s a breakdown:

Applicable Corporation Status

A corporation (excluding S corporations, regulated investment companies (RICs), and real estate investment trusts (REITs)) is considered applicable if:

- Its average annual AFSI over the three prior tax years exceeds $1 billion (aggregated for controlled groups).

- For foreign-parented multinational groups (FPMGs), an additional test requires average AFSI of at least $100 million from U.S. effectively connected income.

Once a corporation qualifies as applicable, it retains this status unless it receives IRS approval for a change or meets specific de minimis exceptions.

Exemptions and Exceptions

- Tax-Exempt Organizations: Generally exempt from filing Form 4626, even if they have unrelated business income, as confirmed by IRS guidance for tax year 2023 (extended applicability).

- Small Corporations: Those not meeting the AFSI thresholds or using the simplified method (detailed below) may avoid filing.

- Prior Non-Applicable Entities: If a corporation was not applicable in previous years and doesn’t meet thresholds, filing isn’t required.

Small corporate taxpayers who inadvertently reported CAMT for 2023 can seek relief through amended returns.

To determine status, use the optional interim simplified method from IRS Notice 2025-27, which raises thresholds to $800 million (general) and $80 million (FPMG) for easier testing.

IRS Form 4626 Download and Printable

Download and Print: IRS Form 4626

How to Calculate the Corporate Alternative Minimum Tax Using Form 4626

Calculating CAMT involves several steps, starting with financial statement data and applying IRS-specific adjustments. Here’s a high-level overview:

- Gather Financial Data: Collect applicable financial statements (AFS), such as SEC Form 10-K or audited statements, for the current and prior three years.

- Determine AFSI (Part II): Start with net income from the AFS and make adjustments, including:

- Disregarding federal income taxes.

- Aligning depreciation with tax rules.

- Including pro-rata shares from CFCs.

- Reducing by financial statement net operating losses (FSNOLs), capped at 80% of AFSI.

- Compute Tentative Minimum Tax (Part III): Apply a 15% rate to AFSI, minus the CAMT foreign tax credit (FTC), which includes credits for foreign taxes paid by CFCs and domestic corporations.

- Compare to Regular Tax: CAMT is owed if the tentative minimum tax exceeds the corporation’s regular tax plus base erosion anti-abuse tax (BEAT).

For consolidated groups, calculations are done on a group basis. Use U.S. dollars for all amounts, and rely on interim guidance from IRS Notices (e.g., 2023-7, 2024-10) until final regulations are issued.

Pro Tip: Software like Bloomberg Tax or Thomson Reuters can streamline complex calculations.

Recent Changes and Updates for 2025

The IRS continues to refine CAMT rules. Key updates include:

- Notice 2025-27: Provides an interim simplified method for status determination, effective for 2025 tax years.

- Final 2024 Form 4626 Instructions: Released in December 2024, with detailed guidance on AFSI adjustments and FTC calculations.

- Proposed Regulations: Issued in September 2024, offering elective safe harbors and reliance options for earlier years.

Stay informed by checking the IRS website for 2025 form releases, expected early in the year.

Common FAQs About IRS Form 4626

Is the Corporate AMT Still in Effect After TCJA?

Yes, but it’s a new version. The old corporate AMT was repealed, but CAMT was enacted in 2022 for tax years after 2022.

What If My Corporation Is Part of a Multinational Group?

FPMGs face additional thresholds and must aggregate AFSI accordingly.

Can I Carry Forward CAMT Credits?

Yes, unused CAMT FTCs can be carried forward indefinitely.

Where Can I Find More Help?

Consult the IRS instructions for Form 4626 or a qualified tax advisor.

Conclusion

Mastering IRS Form 4626 is vital for large corporations to avoid penalties and ensure compliance with the Corporate Alternative Minimum Tax. By understanding its requirements and staying updated on IRS guidance, you can effectively manage your tax obligations in 2025 and beyond. For personalized advice, consult a tax professional. Remember, this article is for informational purposes only and not a substitute for official IRS guidance.