Table of Contents

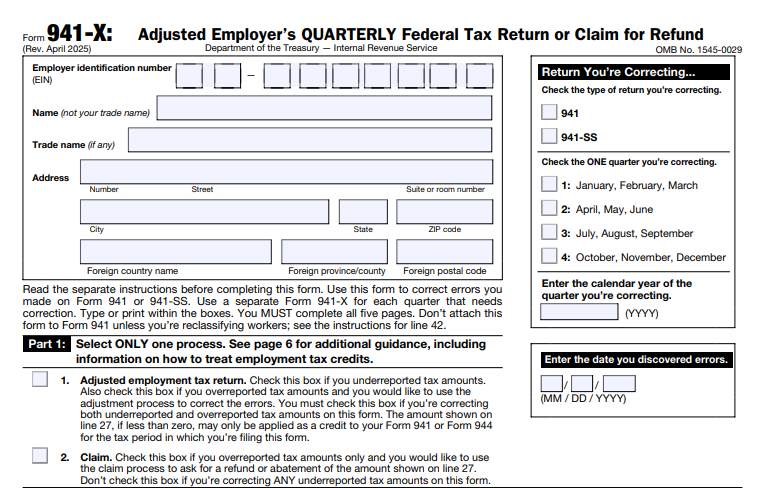

IRS Form 941-X – Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund – In the world of payroll taxes, accuracy is paramount. Mistakes on your Employer’s Quarterly Federal Tax Return (Form 941) can lead to overpayments, underpayments, or compliance issues. That’s where IRS Form 941-X comes in. This form, officially titled the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, allows employers to correct errors on previously filed Form 941s. Whether you’re dealing with misreported wages, incorrect tax withholdings, or unclaimed credits, understanding Form 941-X can save your business time and money. In this guide, we’ll cover everything you need to know about Form 941-X, including its purpose, filing process, deadlines, and recent updates as of 2025.

What Is IRS Form 941-X and When Should You Use It?

Form 941-X is specifically designed for employers to amend errors discovered on a prior Form 941. Form 941 itself reports quarterly federal income tax withholdings, Social Security taxes, and Medicare taxes for employees. If you spot discrepancies after filing—such as underreported wages, overreported tips, incorrect credits for qualified sick or family leave wages, or issues with the COBRA premium assistance credit—Form 941-X is your tool for correction.

Common scenarios for using Form 941-X include:

- Correcting taxable Social Security wages or tips (e.g., if an employee’s earnings were miscalculated).

- Adjusting federal income tax withheld from wages.

- Claiming or correcting credits like the qualified small business payroll tax credit for increasing research activities.

- Fixing errors related to Additional Medicare Tax withholding.

- Reclassifying workers (e.g., from independent contractors to employees under Section 3509 rates).

Important note: You must file a separate Form 941-X for each quarter you’re correcting. Don’t use it for errors in employee counts or federal tax liabilities reported on Schedule B (Form 941)—those require different handling. For territories like American Samoa, Guam, or Puerto Rico, special rules apply, and Spanish-language versions (Form 941-X (sp)) are available.

Adjustment Process vs. Claim for Refund: Which One to Choose?

When filing Form 941-X, you’ll select one of two processes in Part 1:

- Adjustment Process (Line 1): Use this if you’ve underreported taxes (pay the additional amount owed) or overreported taxes (apply the credit to your current or future Form 941). This is ideal for ongoing corrections and can be interest-free if filed timely.

- Claim Process (Line 2): This is for overreported taxes where you want a direct refund or abatement. It’s not available for underreported amounts and requires certification that you’ve repaid or reimbursed employees (or obtained their consent) for any overcollected taxes.

In Part 2, certify that you’ve filed (or will file) corrected Forms W-2 and W-2c with the Social Security Administration (SSA). For overreported taxes, provide details on repayments, reimbursements, or employee consents using Lines 4a–4c (for adjustments) or 5a–5d (for claims).

Step-by-Step Guide: How to Fill Out Form 941-X

Filling out Form 941-X involves five parts and requires precise calculations. Always refer to the official instructions for line-by-line details, and use the provided worksheets for credits. Here’s a high-level overview:

- Header Information: Enter your Employer Identification Number (EIN), business name, address, the quarter and year you’re correcting, and the date you discovered the error.

- Part 1: Select Process: Check Box 1 for adjustment or Box 2 for claim.

- Part 2: Certifications: Confirm W-2 filings (Line 3) and handle employee-related certifications for overreported taxes (Lines 4–5).

- Part 3: Enter Corrections: This is the core section. Use columns 1–4 for each line:

- Column 1: Corrected amount.

- Column 2: Originally reported (or previously corrected) amount.

- Column 3: Difference (Column 1 minus Column 2).

- Column 4: Tax correction (apply applicable rates, e.g., 12.4% for Social Security, 2.9% for Medicare).

Key lines include:

- Lines 6–7: Wages and federal income tax withheld (correct only for administrative errors or same-calendar-year discoveries).

- Lines 8–11: Taxable Social Security wages and tips (use 12.4% rate; 6.2% for employer-only corrections).

- Lines 12–13: Medicare and Additional Medicare Tax (rates: 2.9% and 0.9%, respectively).

- Lines 16–18d: Credits (e.g., nonrefundable portions for sick/family leave or COBRA; use Worksheets 1–3).

- Lines 19–22: Additions for reclassified workers (special rates under Section 3509).

- Lines 23–27: Subtotals and total correction amounts.

- Lines 28–40: Supporting details for credits, like qualified health plan expenses or wages.

- Part 4: Explanations: Check boxes for mixed adjustments (Line 41) or worker reclassifications (Line 42). Provide a detailed explanation on Line 43, including affected lines, error discovery date, amounts, and causes.

- Part 5: Sign and Date: Authorize with your signature; paid preparers must include their Preparer Tax Identification Number (PTIN).

Attach any required forms, like a corrected Form 8974 for research credits or Schedule R for aggregate filers. Electronic filing is available through Modernized e-File (MeF) for added convenience.

Deadlines for Filing Form 941-X

Timing is critical to avoid penalties. File Form 941-X as soon as you discover an error.

- For Underreported Taxes: File by the due date of the Form 941 for the quarter in which the error was discovered to qualify for interest-free adjustments. Pay any owed amount at filing.

- For Overreported Taxes:

- Adjustment: File more than 90 days before the period of limitations expires.

- Claim: File anytime before the limitations period ends (generally 3 years from the Form 941 filing date or 2 years from payment, whichever is later).

For example, for a 2023 Q4 Form 941 filed in January 2024, the limitations period ends around April 15, 2027. Note that credits like the Employee Retention Credit (ERTC) have expired limitations (e.g., April 15, 2025, for most 2021 quarters).

IRS Form 941-X Download and Printable

Download and Print: IRS Form 941-X

Where to File Form 941-X

Electronic filing is encouraged via IRS.gov/EmploymentEfile. For paper filings, mail to the appropriate IRS address based on your state:

- Cincinnati, OH 45999-0005 for states like CT, DE, FL, IL, etc.

- Ogden, UT 84201-0005 for others like AK, CA, TX, etc.

- Special addresses for exempt organizations, governments, or private delivery services (PDS).

Penalties and Common Mistakes to Avoid

Late or incorrect filings can trigger penalties:

- Failure to Deposit (FTD) Penalties: Apply if underreported taxes are paid late; attach an amended Schedule B.

- Failure to Pay Penalties: For unpaid balances due.

- Other Issues: Insufficient explanations on Line 43 can delay processing or deny claims. Always keep records for 4–6 years.

Common mistakes include not certifying employee consents, using the wrong process, or failing to explain corrections fully. Double-check calculations using the form’s worksheets and consult Publication 15 (Circular E) for guidance.

Recent Updates to Form 941-X in 2025

As of July 31, 2025, the latest revision of Form 941-X is from April 2025. Key changes include:

- Expanded electronic filing options for amended returns (announced July 17, 2024).

- Replacement of certain forms and instructions for Puerto Rico taxpayers (March 14, 2024).

- Discontinuation of Form 941-SS and 941-PR after 2023; use Form 941 and 941-X instead.

- Expired limitations for certain COVID-era credits, but claims for post-2023 sick/family leave wages (for pre-October 2021 leave) are still possible via Form 941-X.

Stay updated by checking IRS.gov for any new announcements.

Final Thoughts on Managing Form 941-X

Navigating IRS Form 941-X doesn’t have to be overwhelming. By understanding when and how to use it, you can ensure compliance, recover overpayments, and avoid costly penalties. If you’re unsure about your specific situation, consult a tax professional or contact the IRS Business and Specialty Tax Line at 800-829-4933. Remember, proactive error correction keeps your business on solid ground with the IRS.

For the most accurate information, always download the latest form and instructions from the official IRS website. If you’ve recently filed a Form 941 and suspect an error, act quickly—timely adjustments can make all the difference.