Table of Contents

IRS Form 5305 – Traditional Individual Retirement Trust Account – In today’s financial landscape, planning for retirement is essential, and one of the most popular tools for building a nest egg is the Traditional Individual Retirement Account (IRA). If you’re considering setting up a trust-based Traditional IRA, IRS Form 5305 plays a crucial role. This form provides a model agreement for establishing a tax-advantaged retirement account that can help you save for the future while potentially reducing your current tax burden. In this comprehensive guide, we’ll explore what IRS Form 5305 is, its purpose, eligibility requirements, and how to use it effectively. Whether you’re a first-time saver or looking to optimize your retirement strategy, understanding this form can empower you to make informed decisions.

What Is IRS Form 5305?

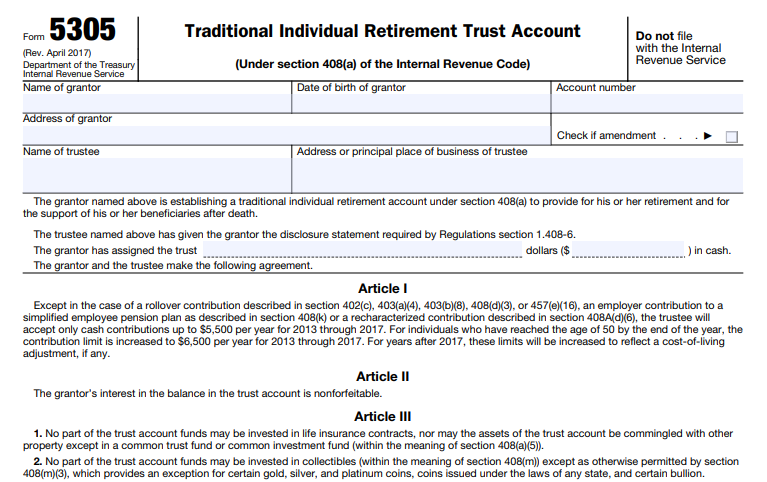

IRS Form 5305, officially titled “Traditional Individual Retirement Trust Account,” is a model trust agreement provided by the Internal Revenue Service (IRS) under Section 408(a) of the Internal Revenue Code. It serves as a template for individuals (known as the grantor) and a trustee—such as a bank or IRS-approved entity—to create a Traditional IRA structured as a trust account. Unlike forms you file with the IRS, Form 5305 is not submitted; instead, it’s executed between you and the trustee and kept with your records.

This form ensures the account meets IRS requirements for tax-deferred growth, making it a foundational document for trust-based IRAs. It’s distinct from Form 5305-A, which is used for custodial accounts, another common setup for Traditional IRAs. The current version of Form 5305 was revised in April 2017, and while contribution limits mentioned in the form are outdated (referencing $5,500 for years 2013–2017), the structure remains valid with adjustments for current limits.

The Purpose and Benefits of a Traditional IRA

A Traditional IRA is a retirement savings account that allows your investments to grow tax-deferred until withdrawal. Contributions are often tax-deductible, lowering your taxable income in the year you contribute, and earnings like interest, dividends, and capital gains aren’t taxed until distributed.

Key benefits include:

- Tax Deductions: If eligible, contributions reduce your current tax bill, making it ideal for those in higher tax brackets now who expect lower rates in retirement.

- Investment Flexibility: You can invest in stocks, bonds, mutual funds, and even certain precious metals, as long as they comply with IRS rules (no life insurance or most collectibles).

- Spousal Contributions: Even non-working spouses can have an IRA funded based on the working spouse’s income.

- Rollover Options: Easily transfer funds from employer plans like 401(k)s without immediate taxes.

However, withdrawals are taxed as ordinary income, and early distributions (before age 59½) may incur a 10% penalty, with exceptions for first-time home purchases or medical expenses.

Eligibility and Contribution Limits for 2025

To contribute to a Traditional IRA using Form 5305, you must have taxable compensation, such as wages, salaries, or self-employment income. There’s no upper age limit for contributions, thanks to the SECURE Act of 2019, but you need earned income. If you’re covered by an employer retirement plan, your deduction may phase out based on modified adjusted gross income (MAGI)—for 2024, full deductions for singles start phasing out at $77,000 and end at $87,000; for married couples filing jointly, $123,000 to $143,000. These limits typically adjust annually.

For 2025, the contribution limits are:

- $7,000 for individuals under age 50.

- $8,000 for those age 50 or older (including a $1,000 catch-up contribution).

Looking ahead to 2026, limits increase to $7,500 (under 50) and $8,500 (50+). Contributions must be in cash and can be made until the tax filing deadline (usually April 15 of the following year).

How to Set Up a Traditional IRA Using Form 5305

Setting up involves selecting a trustee (e.g., a bank or financial institution) and executing the agreement. Here’s a step-by-step guide:

- Choose a Trustee: Ensure they’re IRS-approved and provide the required disclosure statement under Regulations section 1.408-6.

- Complete the Form: Fill in details like your name, the trustee’s name, and the initial contribution amount. The form outlines the trust in Articles I–VIII.

- Fund the Account: Make your initial cash contribution; rollovers don’t count toward annual limits.

- Retain Records: Don’t file with the IRS—keep the signed form for your files.

- Invest Wisely: Work with your trustee to select investments compliant with IRS rules.

For spousal IRAs, create a separate trust account. Consult a financial advisor to ensure compliance, especially under the Retirement Security Rule for fiduciary standards.

IRS Form 5305 Download and Printable

Download and Print: IRS Form 5305

Key Provisions in IRS Form 5305

The form is divided into articles that govern the account:

- Article I: Caps annual contributions and specifies they must be cash (excluding rollovers).

- Article II: Ensures your interest is nonforfeitable.

- Article III: Prohibits certain investments like life insurance or collectibles, with exceptions for specific metals.

- Article IV: Details distribution rules, including required minimum distributions (RMDs) starting at age 73 (for those born 1951–1959) or later, based on life expectancy tables.

- Articles V–VIII: Cover reporting, amendments, and additional provisions compliant with state and federal law.

Only Articles I–VII are IRS-reviewed; custom additions in Article VIII must not conflict.

Traditional IRA vs. Roth IRA: Key Differences

While both offer retirement savings, a Traditional IRA uses pre-tax contributions with taxable withdrawals, ideal if you expect lower taxes in retirement. A Roth IRA involves after-tax contributions but tax-free qualified withdrawals and no RMDs during your lifetime. Roth eligibility phases out at higher incomes (e.g., $150,000–$165,000 MAGI for singles in 2025). Traditional IRAs require RMDs, which can be satisfied across multiple accounts.

Tax Implications and Distribution Rules

Contributions may be deductible, but withdrawals are taxed as income. RMDs prevent indefinite tax deferral, calculated by dividing your account balance by your life expectancy factor. Upon death, beneficiaries inherit per rules: spouses can delay distributions, while others may need to withdraw over 5–10 years or life expectancy.

Frequently Asked Questions About IRS Form 5305

- Do I need to file Form 5305 with the IRS? No, it’s a model agreement kept privately.

- Can I use Form 5305 for a Roth IRA? No, it’s specifically for Traditional IRAs; use Form 5305-R for Roth trusts.

- What if I exceed contribution limits? Excess contributions incur a 6% tax; remove them by your tax deadline to avoid penalties.

- Is a trust account better than a custodial one? Trusts offer more control for complex estate planning, but custodial accounts (Form 5305-A) are simpler for most.

- Where can I get help? Refer to IRS Publications 590-A (contributions) and 590-B (distributions), or consult a tax professional.

By leveraging IRS Form 5305, you can establish a solid foundation for your retirement savings. Always verify the latest rules on the IRS website, as tax laws evolve. Start planning today to secure a comfortable tomorrow.