Table of Contents

IRS Form 1125-A – Cost of Goods Sold – Understanding IRS Form 1125-A, Cost of Goods Sold (COGS), is essential for businesses that maintain inventory and deduct production or purchase costs from gross receipts to calculate taxable income. This form ensures accurate reporting of COGS, which directly impacts gross profit and tax liability.

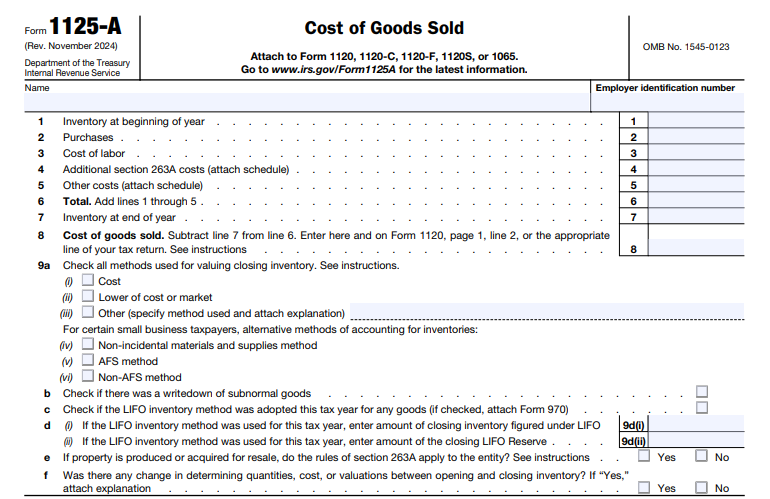

Businesses filing certain corporate or partnership returns must attach Form 1125-A when claiming a COGS deduction. As of the latest revision (November 2024), applicable for tax year 2025 filings, this guide draws from official IRS sources to help you comply correctly.

What Is IRS Form 1125-A?

Form 1125-A is a tax document used to calculate and report the cost of goods sold for the tax year. COGS includes direct costs tied to producing or acquiring goods sold by the business, such as materials, labor, and certain overhead.

The IRS requires filers of the following forms to complete and attach Form 1125-A if reporting a COGS deduction:

- Form 1120 (U.S. Corporation Income Tax Return)

- Form 1120-C (U.S. Income Tax Return for Cooperative Associations)

- Form 1120-F (U.S. Income Tax Return of a Foreign Corporation)

- Form 1120-S (U.S. Income Tax Return for an S Corporation)

- Form 1065 (U.S. Return of Partnership Income)

- Form 1065-B (for certain electing large partnerships)

Businesses without inventory (e.g., pure service providers) generally do not need this form. The COGS amount from Line 8 transfers to the main tax return (e.g., Form 1120, Line 2).

Who Must File Form 1125-A?

You must file if your business:

- Produces, purchases, or sells physical goods

- Maintains inventory

- Claims a COGS deduction on an applicable return

Small business taxpayers (generally those with average annual gross receipts of $29 million or less for 2025, adjusted for inflation) may qualify for exceptions from certain rules, like uniform capitalization under Section 263A.

IRS Form 1125-A Download and Printable

Download and Print: IRS Form 1125-A

How to Fill Out Form 1125-A: Step-by-Step

Form 1125-A has two main sections: COGS calculation and inventory valuation methods. Use the latest version from IRS.gov.

Section I: Cost of Goods Sold Calculation

- Line 1: Inventory at beginning of year

Enter the value of inventory from the end of the prior tax year (matches prior year’s Line 7). - Line 2: Purchases

Enter cost of goods purchased for resale, minus any items withdrawn for personal use. - Line 3: Cost of labor

Include direct labor costs (not salaries for administrative staff). - Line 4: Additional Section 263A costs

Add costs required to be capitalized under uniform capitalization rules (attach schedule if applicable). Small businesses may be exempt. - Line 5: Other costs

Include additional direct costs (e.g., freight-in, overhead allocable to production; attach statement). - Line 6: Total

Add Lines 1 through 5. - Line 7: Inventory at end of year

Enter the value of closing inventory. - Line 8: Cost of goods sold

Subtract Line 7 from Line 6. This is your COGS deduction—carry it to your main return.

Section II: Inventory Valuation Methods (Line 9)

Check applicable boxes for valuation methods:

- Cost

- Lower of cost or market

- LIFO (if used, provide details and attach Form 970 if adopting)

- Other (explain)

Answer questions about:

- LIFO adoption or use

- Section 263A applicability

- Changes in inventory valuation

Consistency in methods is required; changes need IRS approval.

Key Considerations for 2025

- Small Business Exceptions — Many small taxpayers avoid full Section 263A capitalization and can treat inventory per their books.

- Inventory Methods — Common options include FIFO, LIFO, or specific identification. LIFO requires specific elections.

- Common Mistakes to Avoid — Inconsistent inventory valuation, forgetting to attach schedules for Lines 4 or 5, or mismatching beginning/ending inventory.

Always download the current form and instructions from IRS.gov, as rules can update.

Frequently Asked Questions

Is Form 1125-A required every year?

Yes, if you have inventory and claim COGS on an applicable return.

Where do I get the form?

Directly from the IRS website: Form 1125-A (Rev. November 2024).

Can I e-file with Form 1125-A?

Yes, when attached to an e-filed main return.

For personalized advice, consult a tax professional. Accurate COGS reporting reduces taxable income legally and helps avoid audits.

Sources: IRS.gov (About Form 1125-A, Form 1125-A PDF Rev. November 2024, Instructions for Form 1120 and related forms).