Table of Contents

IRS Form 13909 – Tax-Exempt Organization Complaint (Referral) – In the world of non-profits and charities, maintaining tax-exempt status requires strict adherence to federal tax laws. If you suspect an organization is violating these rules—such as engaging in prohibited political activities, private inurement, or other abuses—you can report it to the Internal Revenue Service (IRS). IRS Form 13909, also known as the Tax-Exempt Organization Complaint (Referral) Form, is the official tool for submitting such referrals. This article explains what the form is, when to use it, how to complete and submit it, and what to expect afterward, based on the latest IRS guidelines.

Whether you’re a concerned citizen, donor, or former employee, knowing how to file a tax-exempt organization complaint can help ensure accountability. We’ll cover everything from the basics to tips for effective reporting, optimizing your understanding of this important process.

What Is IRS Form 13909?

IRS Form 13909 is a voluntary referral form designed to report potential violations of federal tax laws by tax-exempt organizations. These include 501(c)(3) charities, religious groups, social welfare organizations under 501(c)(4), and other entities exempt from federal income tax. The form helps the IRS’s Tax Exempt and Government Entities (TEGE) division investigate whether an organization’s activities comply with tax-exempt requirements.

The purpose of the form is straightforward: it allows individuals to provide information that could trigger an IRS review or audit. Common issues reported include misuse of funds, excessive compensation to insiders, or failure to operate for exempt purposes. Note that this form is specifically for tax law violations—not general grievances like poor service or ethical concerns unrelated to taxes.

As of 2025, there have been no major structural changes to the form, but the IRS emphasizes providing detailed, factual information to aid investigations. The form remains a key part of the IRS’s oversight of over 1.8 million tax-exempt entities in the U.S.

When Should You Use Form 13909?

You should consider filing IRS Form 13909 if you have evidence or reasonable suspicion that a tax-exempt organization is not following federal tax rules. Examples of reportable issues include:

- Private Benefit or Inurement: When organization assets benefit private individuals, like excessive salaries or personal use of funds.

- Political Campaign Intervention: Tax-exempt groups (especially 501(c)(3)s) cannot endorse candidates or engage in substantial lobbying.

- Unrelated Business Income: Earning income from activities not related to the exempt purpose without proper reporting.

- Failure to File Required Returns: Such as not submitting Form 990 annually.

- Fraud or Abuse: Misrepresentation of charitable status or embezzlement.

This form can be used for any organization claiming tax-exempt status, including churches (though special rules under IRC Section 7611 apply, limiting inquiries—see IRS Publication 1828 for details). If your concern involves state-level issues, like charitable solicitation laws, consider reporting to your state attorney general or charity regulator in addition to the IRS.

Remember, anonymous submissions are allowed, but providing your contact information enables the IRS to follow up if needed. If you’re worried about retaliation, you can check a box on the form to express this concern.

How to Complete IRS Form 13909

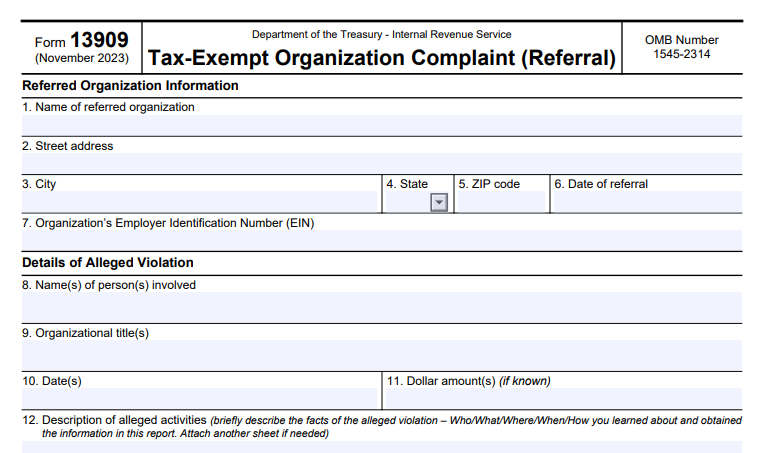

Filling out Form 13909 is relatively simple, but accuracy and detail are crucial for the IRS to act on your referral. The form is divided into three main sections: Referred Organization Information, Details of Alleged Violation, and Submitter Information.

Step 1: Gather Required Information

Before starting, collect:

- The organization’s name, address, and Employer Identification Number (EIN). If you don’t have the EIN, include the state nonprofit registration number.

- Specific details about the violation: Who was involved? What happened? Where and when? How did you learn about it? Include dates, dollar amounts, and names of other parties if known.

- Supporting documents like emails, financial statements, or news articles.

Step 2: Fill Out the Sections

- Fields 1-7 (Organization Details): Enter the organization’s full name, address (including any prior names or addresses), date of referral, and EIN.

- Fields 8-12 (Violation Details): Provide names and titles of involved individuals, dates, amounts, and a clear description of the activities. Use additional sheets if space is limited.

- Fields 13-20 (Your Information): Include your name, occupation, address, phone number. For anonymity, enter “Anonymous” in the name field and check the retaliation concern box if applicable.

The IRS estimates it takes about 46 minutes total to complete and submit the form, including recordkeeping and preparation, per the Paperwork Reduction Act.

IRS Form 13909 Download and Printable

Download and Print: IRS Form 13909

Tips for Effective Completion

- Be factual and objective—avoid speculation.

- Attach evidence to strengthen your complaint.

- If reporting a church, reference Publication 1828 for procedural notes.

- For reward claims related to underpayments of tax, use Form 211 instead.

How to Submit Your Complaint

Once completed, you can submit Form 13909 in one of two ways:

- Email: Send to [email protected]. Note that emails are not encrypted, so avoid including sensitive personal data beyond what’s necessary.

- Mail: Address to TEGE Referrals Group, 1100 Commerce Street, MC 4910 DAL, Dallas, TX 75242.

You can also submit the same information in a letter format without using the form, as long as you include all relevant details and attachments. If you have additional information later, resubmit with a copy of your original referral.

For broader oversight, copy your state tax agency or charity regulator—they handle complementary aspects of non-profit compliance.

What Happens After You Submit?

Upon receipt, the IRS will send an acknowledgment letter to non-anonymous submitters (via mail, not email). This confirms they’ve received your referral but doesn’t provide details on next steps.

Your identity remains confidential, and due to tax privacy laws under Internal Revenue Code Section 6103, the IRS cannot share updates on the investigation or outcomes. The TEGE division reviews referrals to decide if further action, like an audit, is warranted. Not all complaints lead to investigations, but your input helps prioritize oversight.

If the IRS finds violations, consequences for the organization could include revocation of tax-exempt status, back taxes, or penalties.

Frequently Asked Questions About IRS Form 13909

Can I file anonymously?

Yes, simply mark yourself as anonymous on the form. However, this means no acknowledgment letter or potential follow-up.

Is there a deadline for filing?

No, but report as soon as possible while details are fresh.

What if my complaint isn’t about taxes?

Form 13909 is for federal tax law violations only. For other issues, contact the Federal Trade Commission, state regulators, or law enforcement.

Can I get a reward?

For cases involving tax underpayments, file Form 211 for whistleblower rewards, but this is separate from Form 13909.

Conclusion: Promoting Transparency in Tax-Exempt Organizations

Filing IRS Form 13909 is a civic duty that supports the integrity of the non-profit sector. By reporting suspected abuses, you help ensure donations are used appropriately and tax benefits are granted fairly. Always rely on official IRS resources for the most accurate guidance, and consider consulting a tax professional if you’re unsure about a situation.

For the latest form and instructions, visit the IRS website directly. If you have evidence of wrongdoing, don’t hesitate—your referral could make a difference.