Table of Contents

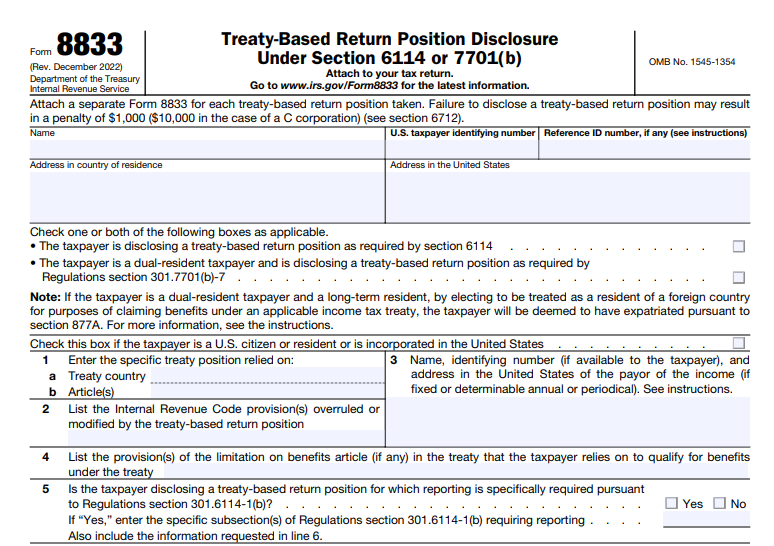

IRS Form 8833 – Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b) – IRS Form 8833, titled Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b), is a critical tax form for taxpayers who claim benefits under a U.S. income tax treaty that overrides or modifies provisions of the Internal Revenue Code (IRC). Filing this form ensures compliance with disclosure requirements and helps avoid penalties while preventing double taxation on international income.

As of December 2025, the current version of Form 8833 is the December 2022 revision, available on the official IRS website. No major updates to the form or its requirements have been announced for 2024 or 2025.

What Is IRS Form 8833?

Taxpayers use Form 8833 to disclose a “treaty-based return position”—a position where a U.S. tax treaty reduces or eliminates U.S. tax liability that would otherwise apply under domestic law. This disclosure is required under IRC Section 6114 for most taxpayers and under Treasury Regulations Section 301.7701(b)-7 for dual-resident taxpayers.

The form notifies the IRS that you rely on specific treaty provisions, providing transparency and allowing the IRS to review the claimed benefits.

Who Must File Form 8833?

You must file Form 8833 if you take a treaty-based position that reduces your U.S. tax liability, such as:

- Claiming a treaty exemption or reduced rate on fixed or determinable annual or periodical (FDAP) income (e.g., dividends, interest, royalties) when it overrides IRC rules.

- Resourcing income (e.g., treating U.S.-source income as foreign-source under a treaty for foreign tax credit purposes).

- Claiming treaty benefits as a dual-resident taxpayer (e.g., a U.S. green card holder treated as a resident of another country under a treaty tie-breaker rule).

- Receiving over $100,000 in reportable income and determining residency under a treaty rather than U.S. domestic rules.

Dual-resident taxpayers often file Form 8833 with Form 1040-NR to claim nonresident status.

A separate Form 8833 is required for each distinct treaty-based position.

IRS Form 8833 Download and Printable

Download and Print: IRS Form 8833

When Is Form 8833 Not Required?

The IRS provides several exceptions where disclosure is not needed, including:

- Treaty-reduced withholding on FDAP income properly reported on Form 1042-S (if the beneficial owner is an individual or government entity and certain conditions are met).

- Positions disclosed by a pass-through entity (e.g., partnership or trust) on its return.

- Total affected income or payments of $10,000 or less in the tax year.

- Certain standard treaty benefits that do not override substantive IRC provisions (e.g., many portfolio interest or pension exemptions).

Always review the latest Form 8833 instructions for the full list of exceptions.

How to File Form 8833

- Download the Form — Obtain the latest PDF from IRS.gov/Form8833.

- Complete Key Lines:

- Identify the treaty country and specific article(s).

- List the IRC section(s) overridden or modified.

- Provide a detailed explanation of the position, including facts, income amounts, and how the treaty applies.

- Attach to Your Return — File Form 8833 with your U.S. tax return (e.g., Form 1040, 1040-NR, or 1120-F) by the due date, including extensions.

- Multiple Positions — Submit a separate form for each.

If you are not otherwise required to file a return, submit Form 8833 standalone to the appropriate IRS service center.

Common Examples of Treaty Positions Requiring Form 8833

- Resourcing U.S.-Source Income → A U.S. expat performs services in the U.S. but claims under a treaty (e.g., U.S.-UK treaty) that the income is foreign-source to avoid U.S. taxation.

- Dual-Resident Tie-Breaker → A green card holder living abroad claims treaty residency in the foreign country, filing as a nonresident alien.

- Reduced Rates on Income → Claiming a lower withholding rate on royalties or dividends that exceeds standard treaty benefits not covered by exceptions.

Penalties for Non-Compliance

Failure to file Form 8833 when required can result in a $1,000 penalty per failure for individuals (or $10,000 for C corporations), even if no tax is underpaid. The penalty applies per position and per year. However, the IRS may waive it for reasonable cause.

Why File Form 8833? Benefits of Proper Disclosure

Filing Form 8833 allows you to legitimately claim treaty benefits, potentially saving thousands in taxes by avoiding double taxation. It ensures IRS compliance and protects against audits or disallowed claims.

For the most accurate application, consult the specific U.S. tax treaty with your country (available on IRS.gov) and consider professional tax advice, especially for complex dual-residency or high-value income scenarios.

Sources: Information based on official IRS resources, including Form 8833 (Rev. December 2022), instructions, and related publications (e.g., Publication 901, U.S. Tax Treaties). Always verify the latest details at IRS.gov.