Table of Contents

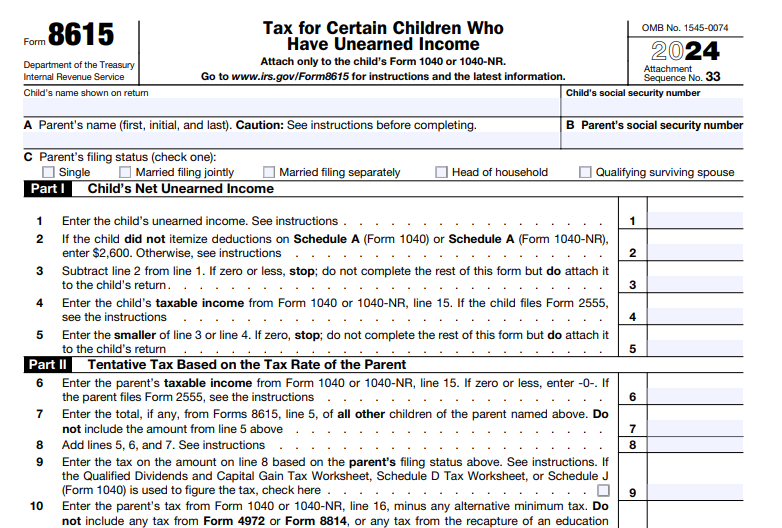

IRS Form 8615 – Tax for Certain Children Who Have Unearned Income – IRS Form 8615, officially titled “Tax for Certain Children Who Have Unearned Income,” is used to calculate the kiddie tax. This tax rule prevents parents from shifting investment income to their children to benefit from lower tax rates. Commonly known as the kiddie tax, it applies higher parental tax rates to a portion of a child’s unearned income exceeding certain thresholds.

Understanding Form 8615 is essential for parents with children who receive investment income, such as interest, dividends, or capital gains. For the 2025 tax year, key thresholds have been adjusted for inflation, and failing to file when required can lead to penalties.

What Is the Kiddie Tax?

The kiddie tax taxes a child’s net unearned income above a specified amount at the parent’s marginal tax rate, rather than the child’s usually lower rate. This rule, introduced in the Tax Reform Act of 1986, closes a loophole where families transferred assets to children for tax advantages.

Unearned income includes:

- Taxable interest

- Ordinary dividends and capital gain distributions

- Capital gains

- Rents, royalties

- Taxable social security benefits, pensions, annuities

- Income from trusts or estates

Earned income (wages, salaries, self-employment) is not subject to the kiddie tax and is taxed at the child’s rate.

IRS Form 8615 Download and Printable

Download and Print: IRS Form 8615

Who Must File Form 8615 in 2025?

A child must file Form 8615 (attached to their Form 1040 or 1040-NR) if all of the following apply (per IRS Instructions for Form 8615 and Topic No. 553):

- The child has unearned income over $2,700.

- The child is required to file a tax return.

- The child meets age requirements:

- Under age 18 at the end of 2025, or

- Age 18 at the end of 2025 and did not have earned income providing more than half of their support, or

- A full-time student aged 19–23 at the end of 2025 and did not have earned income providing more than half of their support.

- At least one parent is alive at the end of the year.

- The child does not file a joint return.

Even if net unearned income is $2,700 or less, Form 8615 may need to be attached (with no tax due) if unearned income exceeds certain amounts.

2025 Kiddie Tax Thresholds and How It’s Calculated

For 2025 (as confirmed in IRS Revenue Procedure 2024-40 and draft instructions):

- The first $1,350 of net unearned income is tax-free (covered by the child’s standard deduction).

- The next $1,350 is taxed at the child’s tax rate (typically 0%–12% for most).

- Any net unearned income over $2,700 is taxed at the parent’s marginal federal income tax rate.

Example: A 16-year-old child has $5,000 in unearned income (dividends and interest) and no earned income.

- $1,350: Tax-free

- $1,350: Taxed at child’s rate (e.g., 10% = $135 tax)

- $2,300 ($5,000 – $2,700): Taxed at parent’s rate (e.g., 24% = $552 tax)

- Total kiddie tax: Approximately $687 (plus any child’s rate tax)

Form 8615 computes this by:

- Calculating the child’s net unearned income.

- Figuring a tentative tax using the parent’s rate on excess amounts.

- Combining with tax on the child’s other income.

Children with kiddie tax may also owe the 3.8% Net Investment Income Tax (NIIT) if thresholds are met (use Form 8960).

Alternative: Parent’s Election (Form 8814)

If the child’s gross income is only from interest/dividends (including capital gains distributions), less than $13,500 (10x the base amount), and meets other rules, parents can report it on their return using Form 8814. This simplifies filing but may increase the parent’s tax.

Tips to Minimize or Avoid the Kiddie Tax

- Keep child’s unearned income under $2,700.

- Invest in tax-free municipal bonds or growth stocks (low dividends).

- Use 529 plans or Roth IRAs (for earned income) where growth is tax-deferred.

- Consider UGMA/UTMA accounts carefully.

Where to Find Official Resources

- Download Form 8615 and instructions: IRS.gov/Form8615

- Kiddie tax overview: IRS Topic No. 553

- Publication 929 (Tax Rules for Children and Dependents) for detailed examples.

Always consult a tax professional for your specific situation, as rules can be complex with multiple children or special circumstances.

This article is for informational purposes only and based on IRS guidelines as of December 2025. Tax laws may change.