Table of Contents

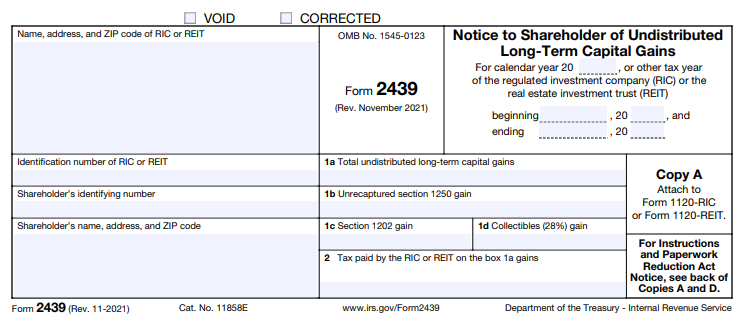

IRS Form 2439 – Notice to Shareholder of Undistributed Long-Term Capital Gains – If you’re an investor in mutual funds, exchange-traded funds (ETFs), or real estate investment trusts (REITs), you might receive IRS Form 2439 — the Notice to Shareholder of Undistributed Long-Term Capital Gains. This form reports long-term capital gains that a regulated investment company (RIC) or REIT retained rather than distributed, along with taxes paid on your behalf. Understanding Form 2439 is essential for accurate tax reporting and claiming potential credits.

What Is IRS Form 2439?

Form 2439 notifies shareholders of undistributed long-term capital gains from a RIC (such as mutual funds or ETFs) or REIT. These entities typically distribute at least 90% of income to avoid corporate taxes, but they may retain long-term capital gains, pay corporate tax, and designate them as undistributed under IRC Sections 852(b)(3)(D) or 857(b)(3)(C).

The IRS treats these gains as if distributed to you, making them taxable even without cash receipt. The company issues Form 2439 to report your share and taxes paid, allowing a credit to avoid double taxation.

Key points from official IRS sources:

- RICs and REITs must provide Copies B and C to shareholders by 60 days after their tax year-end.

- Attach Copy A to the company’s Form 1120-RIC or Form 1120-REIT.

This retention is uncommon, as most funds distribute gains via Form 1099-DIV.

Why Do Funds Retain Capital Gains?

Funds retain gains to:

- Reinvest for growth.

- Manage tax efficiency.

- Meet specific regulatory or strategic goals.

Shareholders still report the gains as long-term capital gains but claim a credit for taxes paid by the fund.

IRS Form 2439 Download and Printable

Download and Print: IRS Form 2439

Key Boxes on Form 2439

The latest revision (November 2021, still current as of 2025 per IRS.gov) includes:

- Box 1a: Total undistributed long-term capital gains allocated to you. Report this as long-term gain on your tax return.

- Box 1b: Unrecaptured Section 1250 gain (from depreciable real property), taxed at up to 25%.

- Box 1c: Section 1202 gain (qualified small business stock), potentially eligible for exclusion.

- Box 1d: Collectibles gain (28% rate gain).

- Box 2: Tax paid by the RIC or REIT on Box 1a gains. Claim this as a credit or refund.

How to Report Form 2439 on Your Tax Return

For individual taxpayers (Form 1040 or 1040-SR):

- Report the Gains:

- Enter Box 1a on Schedule D (Form 1040), Line 11 (long-term capital gains).

- Use Form 8949 if needed for adjustments.

- Apply Boxes 1b, 1c, and 1d to relevant worksheets in Schedule D instructions:

- Box 1b → Unrecaptured Section 1250 Gain Worksheet.

- Box 1d → 28% Rate Gain Worksheet.

- Box 1c → Check for Section 1202 exclusion.

- Claim the Tax Credit:

- Report Box 2 on Schedule 3 (Form 1040), Line 13a (or equivalent) as “Credit for tax paid on undistributed capital gains.”

- Attach Copy B of Form 2439 to your return.

- Adjust Your Basis:

- Increase your cost basis in the shares by (Box 1a minus Box 2). This reduces future capital gains when you sell.

For estates, trusts, or exempt organizations, refer to specific instructions in Schedule D (Form 1041) or Form 990-T.

Tax-deferred accounts (e.g., IRAs) generally do not receive Form 2439, as gains are not currently taxable. If received, the trustee handles it.

Common Questions About Form 2439

- When will I receive it? Typically early in the year following the fund’s tax year (e.g., by March for calendar-year funds).

- What if I don’t receive one but think I should? Contact the fund company for a copy.

- Is this the same as Form 1099-DIV? No—1099-DIV reports distributed gains; 2439 reports undistributed ones.

- Do I owe taxes immediately? Yes, report in the tax year including the fund’s year-end.

Important Reminders for 2025 Tax Filing

As of December 2025, use the latest Schedule D instructions (2025 version) for precise line references. Capital gains tax rates remain preferential (0%, 15%, or 20% depending on income), with additional rates for special categories like unrecaptured Section 1250 (25%) or collectibles (28%).

Always consult a tax professional for your situation, especially with multiple forms or complex investments. For the most current form and instructions, visit IRS.gov.

By properly reporting Form 2439, you ensure compliance and optimize your tax outcome on investment gains. Stay informed to avoid surprises during tax season!