Table of Contents

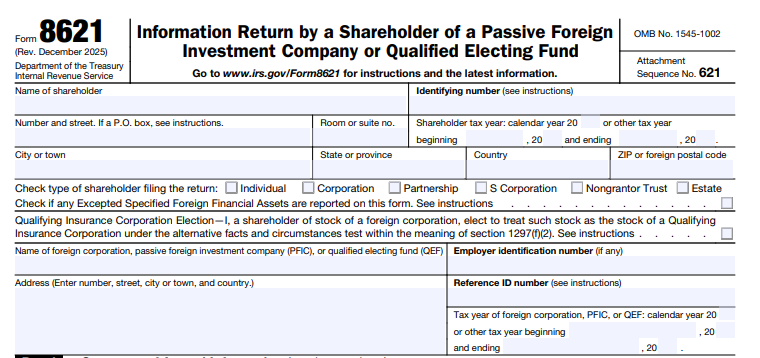

IRS Form 8621 – Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund – In today’s global economy, many U.S. taxpayers hold investments in foreign entities, such as mutual funds or corporations. However, these can trigger specific IRS reporting requirements, particularly if they qualify as Passive Foreign Investment Companies (PFICs) or Qualified Electing Funds (QEFs). IRS Form 8621, titled “Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund,” is a critical tool for complying with these rules. This form ensures that income from such investments is properly reported and taxed, helping avoid hefty penalties. Whether you’re an expat, investor, or tax professional, understanding Form 8621 is essential for 2025 tax filings.

This guide covers everything you need to know about IRS Form 8621, including who must file, step-by-step instructions, available elections, and recent updates for tax year 2025. We’ll draw from official IRS sources to provide accurate, up-to-date information.

What Is IRS Form 8621?

IRS Form 8621 is an information return used by U.S. persons who are direct or indirect shareholders in a PFIC. It reports certain distributions, gains from stock dispositions, and other events related to these foreign investments. The form also handles reporting for QEFs, which are PFICs where shareholders elect to include their pro-rata share of earnings annually.

The primary purpose of Form 8621 is to track and tax passive income from foreign sources under sections 1291, 1293, and 1296 of the Internal Revenue Code. Without proper filing, shareholders may face deferred tax interest charges or unfavorable tax treatment on distributions and gains. A separate form is required for each PFIC, and it must be attached to your federal income tax return (e.g., Form 1040) or filed separately if no return is due.

Who Needs to File IRS Form 8621?

Not every U.S. taxpayer with foreign investments must file Form 8621. Filing is required if you are a U.S. person (including citizens, residents, corporations, partnerships, trusts, or estates) and a direct or indirect shareholder of a PFIC under these scenarios:

- You receive certain direct or indirect distributions from a PFIC.

- You recognize a gain on a direct or indirect disposition of PFIC stock.

- You need to report information for a QEF or a section 1296 mark-to-market election.

- You are making an election reportable in Part II of the form.

- You must file an annual report under section 1298(f).

Indirect shareholders include those holding PFIC stock through pass-through entities like partnerships, S corporations, estates, or trusts. Exceptions apply if the stock is held through tax-exempt organizations, certain retirement plans, or if you’re not the first U.S. person in the ownership chain (unless you recognize income under section 1291).

For Part I (annual summary), filing is generally excused if the PFIC stock value is $25,000 or less ($50,000 for joint filers) at year-end, or $5,000 or less for indirect holdings, provided no excess distributions or gains occur.

Understanding PFICs and QEFs

What Is a Passive Foreign Investment Company (PFIC)?

A PFIC is a foreign corporation that meets either the income test (at least 75% of gross income is passive, like dividends or interest) or the asset test (at least 50% of assets produce passive income or are held for that purpose). Common examples include foreign mutual funds, ETFs, and holding companies. The IRS uses look-through rules for subsidiaries and fair market value for publicly traded stocks.

Exceptions exist for Controlled Foreign Corporations (CFCs) under subpart F rules via section 1297(d).

What Is a Qualified Electing Fund (QEF)?

A QEF is a PFIC for which the shareholder elects (via Election A on Form 8621) to include their pro-rata share of the fund’s ordinary earnings and net capital gains annually. This election avoids the default section 1291 excess distribution regime, which imposes deferred taxes and interest. To make a QEF election, you need annual information from the PFIC or intermediary.

Filing Requirements and Deadlines for IRS Form 8621

File Form 8621 with your federal tax return by the due date, including extensions. For calendar-year taxpayers, this is typically April 15, 2026, for tax year 2025, or October 15, 2026, with an extension. If no tax return is required, mail it directly to the IRS center in Ogden, UT.

Use a consistent Reference ID number (alphanumeric, up to 50 characters) to identify the PFIC across years. Elections must generally be made by the return’s due date, though some can be retroactive with IRS consent or via Form 8621-A for late filings.

IRS Form 8621 Download and Printable

Download and Print: IRS Form 8621

How to Complete IRS Form 8621: Step-by-Step Guide

Form 8621 consists of a header and six parts. Here’s an overview based on the 2025 revision:

Header

Provide your name, address, identifying number (SSN or EIN), shareholder type (e.g., individual, corporation), and details about the foreign corporation (name, address, EIN if any, Reference ID, tax year).

Part I: Summary of Annual Information

Report share classes, acquisition dates, number and value of shares at year-end, and types/amounts of PFIC income (e.g., section 1291 excess distributions, section 1293 QEF inclusions).

Part II: Elections

Check boxes and provide statements for elections like treating the PFIC as a QEF (A), extending tax payment (B), mark-to-market (C), deemed sales/dividends (D-H).

Part III: Income From a QEF

Calculate pro-rata ordinary earnings and net capital gains, subtracting section 951 inclusions. If electing to defer tax (Election B), compute deferred amounts and interest.

Part IV: Gain or (Loss) From Mark-to-Market Election

Report fair market value vs. adjusted basis for unrealized and realized gains/losses on marketable PFIC stock.

Part V: Distributions From and Dispositions of Stock of a Section 1291 Fund

Calculate excess distributions and disposition gains, allocating them over the holding period to determine deferred tax and interest. New for 2025: Enter a three-letter currency code and convert foreign amounts to USD.

Part VI: Status of Prior Year Section 1294 Elections and Termination

Track outstanding deferred tax elections and report terminations due to distributions or status changes.

Always consult the official instructions for detailed calculations and attachments.

Elections Available on IRS Form 8621

Form 8621 offers several elections to manage PFIC taxation:

- Election A (QEF): Include annual earnings to avoid excess distribution rules.

- Election B: Defer tax on undistributed QEF earnings (with interest).

- Election C (Mark-to-Market): Annually adjust for market value changes on marketable stock.

- Elections D-H: Deemed sales or dividends for specific scenarios like unpedigreed QEFs or former PFICs.

Additionally, a Qualifying Insurance Corporation (QIC) election under section 1297(f)(2) allows limited reporting for certain insurance entities.

Penalties for Not Filing IRS Form 8621

Failure to file can trigger penalties under sections 6001, 6011, 6012(a), and 6109. While no specific monetary penalty is tied directly to Form 8621, non-filing keeps the statute of limitations open indefinitely for the entire return. Fraudulent filings may lead to criminal charges. Late elections can be addressed via Form 8621-A, but with potential interest.

Recent Changes to IRS Form 8621 for Tax Year 2025

The 2025 revision includes minor updates, such as requiring a three-letter currency code in Part V and converting foreign excess distributions to USD. The IRS also plans to update Publication 54 to clarify that foreign mutual funds or ETFs may qualify as PFICs, increasing awareness for expats. Proposed changes to reporting thresholds are under consideration but not yet implemented. Always check IRS.gov for the latest developments.

Frequently Asked Questions (FAQs) About IRS Form 8621

Do I need to file Form 8621 if my PFIC investment is small?

No, if the value is below the thresholds in Part I and no triggering events occur.

Can I make a late QEF election?

Yes, via Form 8621-A with IRS consent, potentially incurring interest.

What if my PFIC is also a CFC?

Section 1297(d) may provide relief from PFIC rules if subpart F applies.

How does Form 8621 affect my taxes?

It can lead to ordinary income treatment, deferred taxes, and interest on excess distributions.

For more FAQs, refer to the official IRS instructions.

Conclusion

Navigating IRS Form 8621 is crucial for U.S. shareholders of PFICs and QEFs to ensure compliance and optimize tax outcomes. By understanding the form’s requirements, elections, and updates for 2025, you can avoid pitfalls like penalties and unfavorable taxation. Consult a tax professional for personalized advice, and download the latest form and instructions from IRS.gov. Stay informed to make the most of your foreign investments while meeting U.S. tax obligations.