Table of Contents

IRS Form 8990 – Limitation on Business Interest Expense Under Section 163(j) – In today’s complex tax landscape, understanding deductions for business interest expenses is crucial for businesses aiming to optimize their tax strategies. IRS Form 8990 plays a pivotal role in this process, helping taxpayers calculate allowable deductions under Internal Revenue Code (IRC) Section 163(j). This provision, introduced by the Tax Cuts and Jobs Act (TCJA) of 2017 and modified by subsequent legislation, limits the amount of business interest expense that can be deducted in a given tax year. Whether you’re a small business owner, a partnership, or a corporation, complying with these rules can significantly impact your bottom line. In this guide, we’ll break down everything you need to know about Form 8990, including who must file, how to calculate limitations, recent 2025 updates, and more—drawing from official IRS sources for accuracy.

What is Section 163(j) and Why Does It Matter?

Section 163(j) imposes a limitation on the deduction for business interest expenses to prevent excessive leveraging and ensure fair taxation. Under this rule, the deductible amount of business interest expense in a taxable year generally cannot exceed the sum of:

- The taxpayer’s business interest income,

- 30% of the taxpayer’s adjusted taxable income (ATI), and

- Floor plan financing interest expense.

Any excess interest expense is disallowed for the current year but can typically be carried forward to future years. This limitation applies broadly to trades or businesses, with exceptions for small businesses and certain electing industries.

The rule matters because it affects cash flow and tax planning. For instance, in years with low income, businesses might face higher disallowed amounts, leading to carryforwards that provide future benefits. Originally capped at 30% of ATI (with add-backs for depreciation and similar items phased out temporarily), recent legislative changes have restored and clarified these computations for 2025 and beyond.

Who Must File IRS Form 8990?

Not every taxpayer needs to file Form 8990. The form is required if you meet any of the following criteria:

- You have business interest expense for the tax year.

- You have disallowed business interest expense carried forward from prior years.

- You’re a partner with excess business interest expense from a partnership.

Pass-through entities like partnerships and S corporations must file if they’re allocating excess taxable income or excess business interest income to owners. Regulated investment companies (RICs) paying section 163(j) interest dividends also file. U.S. shareholders of controlled foreign corporations (CFCs) may need to attach Form 8990 to Form 5471 if the CFC is subject to the limitation.

Exceptions: Who Doesn’t Have to File?

- Small Business Taxpayers: If your average annual gross receipts for the prior three tax years do not exceed the inflation-adjusted threshold ($31 million for tax years beginning in 2025), you’re exempt—unless you’re a tax shelter or have excess business interest expense from a partnership.

- Excepted Trades or Businesses: Activities like employee services, electing real property trades, electing farming businesses, or certain regulated utilities are not subject to the limitation.

- Taxpayers with only excepted businesses or no business interest expense are generally exempt.

If your business mixes excepted and non-excepted activities, you’ll allocate interest expenses based on asset basis to determine applicability.

Key Definitions for Form 8990

To navigate Form 8990 effectively, familiarize yourself with these terms:

- Business Interest Expense: Interest paid or accrued on indebtedness allocable to a trade or business (excluding investment or personal interest).

- Adjusted Taxable Income (ATI): Tentative taxable income (computed without the section 163(j) limitation) plus additions like business interest expense, net operating loss (NOL) deductions, and—for tax years beginning after 2024—depreciation, amortization, and depletion. Subtractions include business interest income and certain gains.

- Floor Plan Financing Interest: Interest on debt used to finance inventory of motor vehicles, boats, or farm machinery (expanded to include trailers and campers for recreational use after 2024).

- Excess Business Interest Expense: For partnerships, the amount of disallowed interest allocated to partners, which they carry forward.

- Tentative Taxable Income: Taxable income disregarding the section 163(j) limitation and certain other deductions.

These definitions ensure accurate calculations and compliance.

How to Calculate the Business Interest Expense Limitation

Calculating the limitation involves several steps:

- Determine Total Business Interest Expense: Include current year expense plus any carryforwards (Line 1 + Line 2 on Form 8990).

- Compute ATI: Start with tentative taxable income, add back items like NOLs and business interest expense, and—for 2025—include depreciation, amortization, and depletion.

- Apply the Formula: Limitation = Business interest income + 30% of ATI + Floor plan financing interest.

- Deductible Amount: The lesser of total business interest expense or the limitation.

- Carryforward: Any excess is carried forward (or allocated in partnerships).

For pass-through entities, the limitation is figured at the entity level, with excesses passed to owners. Use Worksheets A and B in the instructions for allocations.

IRS Form 8990 Download and Printable

Download and Print: IRS Form 8990

Example Calculation Table

| Step | Description | Example Amount |

|---|---|---|

| 1 | Current Business Interest Expense | $100,000 |

| 2 | Prior Year Carryforward | $20,000 |

| 3 | Total Expense (1+2) | $120,000 |

| 4 | Business Interest Income | $10,000 |

| 5 | ATI | $300,000 |

| 6 | 30% of ATI | $90,000 |

| 7 | Floor Plan Interest | $5,000 |

| 8 | Limitation (4+6+7) | $105,000 |

| 9 | Deductible Amount (min of 3 or 8) | $105,000 |

| 10 | Carryforward (3-9) | $15,000 |

This simplified example assumes no other adjustments; actual calculations may vary.

Step-by-Step Instructions for Filling Out Form 8990

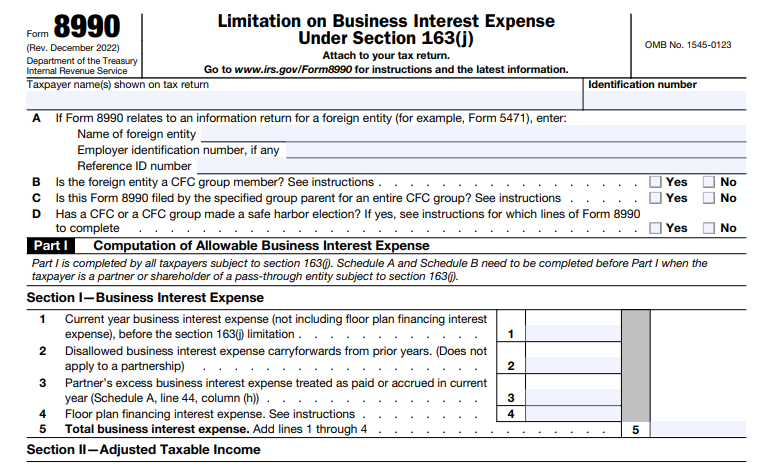

Form 8990 consists of Part I (Computation), Part II (Partnership Items), Part III (S Corp Items), and Schedules A/B for summaries.

- Part I, Section I: Enter current expense, carryforwards, and floor plan interest.

- Section II: Calculate ATI by adding/subtracting specified items from tentative taxable income.

- Section III: Enter business interest income.

- Section IV: Compute 30% ATI, total limitation, deductible amount, and carryforward.

- Schedules A and B: Summarize pass-through items from partnerships/S corps before completing Part I.

Attach election statements for excepted businesses, including your name, TIN, and business description. For CFCs, use Worksheet C for safe-harbor elections.

Recent Updates to Form 8990 and Section 163(j) for 2025

As of 2025, several updates enhance clarity and ease deductions:

- Gross Receipts Threshold: Increased to $31 million for the small business exemption.

- ATI Add-Backs: For tax years beginning after 2024, depreciation, amortization, and depletion are added back to ATI, potentially increasing the limitation.

- One Big Beautiful Bill Act (OBBBA) Changes: Effective for years beginning after December 31, 2025, OBBBA clarifies that business interest expense includes capitalized interest (except under certain sections), restores favorable rules, but adds anti-abuse provisions prohibiting elective interest capitalization to bypass limitations.

- Form Revisions: The January 2025 instructions reflect these changes, with the form itself revised in December 2025.

Stay updated via IRS Fact Sheet 2025-09 for the latest inflation adjustments.

Common FAQs About IRS Form 8990

- What if my gross receipts fall below the threshold? The limitation doesn’t apply, and prior carryforwards become fully deductible.

- How do elections work? Elections for excepted businesses are irrevocable and require attached statements; they mandate alternative depreciation systems (ADS).

- What about foreign corporations? CFCs are treated like domestic C corps; group elections or safe-harbors can simplify compliance.

- Can I elect out of higher limits? Yes, for certain CARES Act provisions, but most are historical now.

For more, refer to the IRS Q&A on business interest limitations.

Final Thoughts on Managing Business Interest Deductions

Mastering IRS Form 8990 and Section 163(j) can help businesses maximize deductions while avoiding penalties. With 2025 updates providing more favorable ATI calculations and clarified rules, now is the time to review your interest expenses. However, tax laws are intricate—consult a qualified tax professional or use IRS resources for personalized advice. By staying compliant, you can focus on growing your business rather than navigating tax pitfalls. For the latest forms and instructions, visit the official IRS website.