Table of Contents

IRS Form 14157 – Return Preparer Complaint – In the complex world of tax preparation, most professionals uphold high ethical standards. However, if you’ve encountered misconduct from a tax return preparer, the IRS provides a straightforward way to report it through Form 14157, also known as the Return Preparer Complaint. This form allows taxpayers and even tax professionals to address issues like fraud, unethical practices, or errors that impact your tax return or refund. Updated processes as of October 2025 ensure complaints are handled efficiently, helping protect consumers and maintain integrity in the tax system. Whether you’re dealing with a diverted refund or a preparer who failed to sign your return, understanding how to use IRS Form 14157 can empower you to take action.

This guide covers everything you need to know about IRS Form 14157, including when to use it, step-by-step filing instructions, and what to expect afterward. We’ll draw from official IRS resources to ensure accuracy and reliability.

What Is IRS Form 14157?

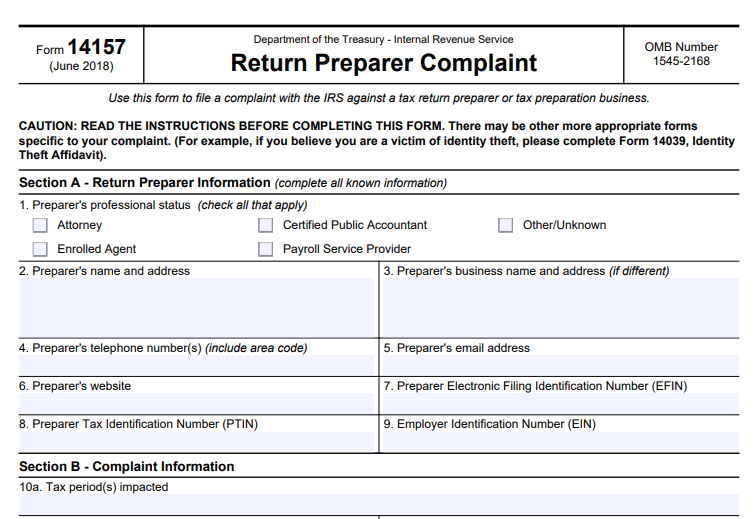

IRS Form 14157 is an official document used to report complaints against paid tax return preparers or tax preparation businesses. It targets violations of ethical standards outlined in Treasury Department Circular 230, which governs tax professionals. Taxpayers can file if their return or refund was affected by misconduct, such as unauthorized changes or false claims. Even tax professionals can use this form to self-report issues like compromised Preparer Tax Identification Numbers (PTINs) or data breaches.

The form, revised in June 2018, includes sections for preparer details, complaint specifics, and taxpayer information. It’s not for identity theft (use Form 14039) or general tax law violations (use Form 3949-A). Instead, it focuses on preparer-specific problems, ensuring the IRS can investigate and potentially impose penalties or revoke credentials.

Key updates in related forms, like Form 14157-A (revised April 2025), reflect ongoing IRS efforts to streamline reporting for fraud or misconduct affidavits.

When Should You File IRS Form 14157?

File a return preparer complaint if you’ve experienced issues that fall into these categories:

- Impacted Tax Return or Refund: This includes unauthorized filing, alterations to your return, incorrect filing status to inflate refunds, false exemptions or dependents, manipulated income, false expenses/deductions/credits, or misdirected refunds.

- Improper Practices Without Direct Impact: Report failures like not entering a PTIN, using another person’s PTIN, refusing to provide a copy of your return, not signing returns, withholding records, using non-commercial software improperly, falsely claiming credentials, or self-reported issues by preparers.

- Other Scenarios: Employment tax failures (e.g., not filing Forms 940, 941, etc.), e-file violations like filing with pay stubs instead of W-2s, or theft of refunds.

Complaints for issues over three years old are typically not actionable unless under active audit or investigation. The IRS emphasizes that most preparers are honest, but reporting helps weed out bad actors. If you’ve received an IRS notice related to preparer misconduct, include it with your submission.

How to Fill Out IRS Form 14157: Step-by-Step

Filling out Form 14157 is straightforward, but accuracy is crucial. Here’s a breakdown based on the form’s sections:

- Section A: Return Preparer Information

- Check the preparer’s professional status (e.g., Attorney, Enrolled Agent, CPA, Payroll Service Provider, or Other/Unknown).

- Provide the preparer’s name, address, phone, email, website, EFIN, PTIN, and EIN if known.

- Section B: Complaint Information

- List affected tax periods (e.g., calendar year 2024 for a return filed in 2025).

- Indicate if you paid a fee, the amount, and how (e.g., deducted from refund).

- Check all applicable complaint types, such as theft of refund, e-file issues, preparer misconduct, PTIN problems, false items, employment taxes, or other.

- Describe facts in detail and attach supporting documents (e.g., tax returns, business cards, Form 8879).

- Section C: Taxpayer’s Information

- Confirm if you’re the affected taxpayer.

- Enter your name, address, phone, email, and sign/date the form.

- Section D: Your Information (If Not the Taxpayer)

- Provide your details, relationship to the preparer (e.g., client, another preparer), and contact info.

If your account needs changes due to unauthorized filing or alterations, also complete Form 14157-A (Tax Return Preparer Fraud or Misconduct Affidavit).

Required Supporting Documents for Your Complaint

To strengthen your return preparer complaint, include:

- Copies of your tax return and related documents.

- IRS notices or letters.

- Proof from the preparer (e.g., advertisements, contracts, refund agreements).

- For employment taxes, a Contract for Service Agreement.

- Additional sheets for detailed explanations.

Do not send originals or payments. If filing Form 14157-A, include a copy of the unauthorized return, your correct version (if available), and identity verification like a driver’s license.

IRS Form 14157 Download and Printable

Download and Print: IRS Form 14157

How to Submit IRS Form 14157

Submission options are flexible:

- Online: Use the IRS’s secure online submission process for Form 14157.

- Fax: Send to 855-889-7957.

- Mail: Address to Internal Revenue Service, Attn: Return Preparer Office, 401 W. Peachtree Street NW, Mail Stop 421-D, Atlanta, GA 30308.

If responding to an IRS notice, use the address provided in it. For Form 14157-A, follow its specific instructions.

What Happens After You File a Return Preparer Complaint?

Once submitted, the IRS reviews your complaint for potential violations of internal revenue laws. They may investigate the preparer, which could lead to penalties, suspension, or revocation of their ability to practice. You won’t receive updates on the investigation due to confidentiality, but your report contributes to broader enforcement. If your taxes were affected, the IRS might adjust your account based on Form 14157-A.

The process helps combat terrorism, enforce tax laws, and share info with relevant agencies if needed, all under 26 U.S.C. § 7801 and § 7803.

Common Mistakes to Avoid When Filing IRS Form 14157

- Using the wrong form (e.g., for identity theft).

- Omitting details or documents, weakening your case.

- Reporting fee disputes (handle via local courts) or state/local tax issues (IRS lacks jurisdiction).

- Filing outdated complaints without ongoing audits.

Always gather evidence first and consult the IRS instructions.

FAQs About IRS Form 14157

What if my complaint is about a free tax preparer?

Form 14157 is for paid preparers. For volunteers (e.g., VITA programs), contact the program directly.

How long does it take to process?

The IRS doesn’t specify timelines, but investigations vary based on complexity.

Can I file anonymously?

While contact info is optional, providing it allows the IRS to seek clarification if needed.

Is there a deadline for filing?

Generally within three years, but exceptions apply for audits.

For the most current details, visit the IRS website or download Form 14157 directly. If you’re searching for “how to file a complaint against a tax preparer,” this guide provides the essential steps to get started confidently.