Table of Contents

IRS Form 5405 – Repayment of the First-Time Homebuyer Credit – If you claimed the First-Time Homebuyer Credit for a home purchased in 2008, you may still have repayment obligations on your 2025 tax return. IRS Form 5405, titled Repayment of the First-Time Homebuyer Credit, helps taxpayers notify the IRS of changes in home use and calculate any required repayments. As of 2025, this primarily affects 2008 purchases, since repayment requirements for later years have expired.

Understanding Form 5405 is essential for avoiding penalties and accurately reporting taxes. This guide covers who needs to file, repayment rules, exceptions, and filing tips based on the latest IRS guidelines.

What Is IRS Form 5405?

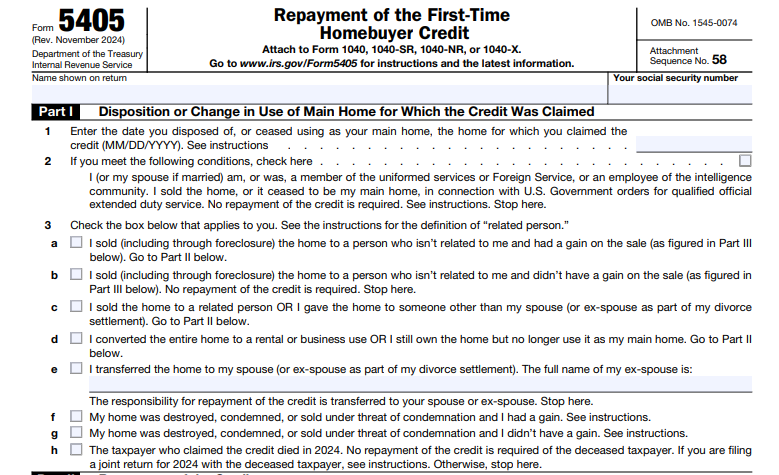

Form 5405 notifies the IRS if a home purchased with the First-Time Homebuyer Credit was sold, disposed of, or no longer used as your main home. It also calculates the repayment amount due with your tax return.

The form applies almost exclusively to homes bought in 2008, when the credit (up to $7,500) functioned as an interest-free loan repaid over 15 years. For purchases after 2008, the credit was generally a true grant with no repayment required (except in specific early disposition cases, which have now passed).

Key source: IRS About Form 5405 and Instructions for Form 5405 (Rev. November 2024).

Who Must File Form 5405 in 2025?

You must file Form 5405 with your 2025 tax return if:

- You purchased the home in 2008.

- The home was disposed of (sold, foreclosed, etc.) or ceased to be your main home in 2025.

- Or other triggering events occurred, such as certain transfers or deaths.

If you still own and use the 2008 home as your principal residence throughout 2025, you do not need to attach Form 5405. Instead, report the annual installment directly on Schedule 2 (Form 1040), line 10.

Note: 2025 marks the final year of the 15-year repayment period for most 2008 claims (starting from 2010 repayments).

Source: IRS Topic No. 611 and Form 5405 Instructions.

Repayment Rules for the 2008 First-Time Homebuyer Credit

The 2008 credit requires repayment of the full amount over 15 years in equal installments (typically $500 annually for a $7,500 credit, or 6.67% of the original credit).

- Repayments began on the 2010 tax return.

- The final installment is due with your 2025 return (for tax year 2025).

- If the home is sold or stops being your main home before full repayment, the remaining balance accelerates and becomes due immediately (with some exceptions).

For post-2008 purchases: No ongoing repayment in 2025, as the 3-year holding periods have long expired.

When Is Accelerated Repayment Required?

Accelerated repayment triggers if the home:

- Is sold or disposed of.

- Ceases to be your principal residence (e.g., converted to rental).

In such cases, repay the outstanding balance (original credit minus prior installments) on your 2025 return using Form 5405.

IRS Form 5405 Download and Printable

Download and Print: IRS Form 5405

Exceptions to Repayment or Acceleration

No repayment (or limited repayment) applies in cases like:

- Death of the taxpayer (no repayment required for the deceased; surviving spouse may continue).

- Divorce (responsibility transfers to one spouse).

- Qualified official extended duty for military, Foreign Service, or intelligence community members.

- Involuntary conversion (e.g., destruction or condemnation) — repayment limited to gain on disposition, or deferred if replaced within 2 years.

- Sale to unrelated person — repayment capped at gain realized.

How to Calculate and Report Repayment

- For ongoing annual installments (home still principal residence): Add the amount (e.g., $500) to Schedule 2, line 10. No Form 5405 needed.

- For disposition or acceleration: Complete Form 5405 Parts II and III to figure the amount.

- Subtract prior repayments from original credit.

- Adjust for basis if calculating gain limitation.

Download the latest Form 5405 (Rev. November 2024) and instructions from IRS.gov.

Note: The IRS First-Time Homebuyer Credit Account Look-up tool is no longer available as of 2025. Track your original credit and prior repayments using old tax returns.

Filing Tips for 2025

- Attach Form 5405 only if required (disposition or specific events).

- Joint filers: Each spouse may need separate forms if both claimed portions.

- Always file a return if repayment is due, even if below filing threshold.

- Consult a tax professional for complex situations like sales with gain/loss.

For the most current details, visit IRS.gov and search for “Form 5405” or “Topic No. 611.”

This repayment phase ends after 2025 for 2008 credits — ensure your final installment is reported accurately!