Table of Contents

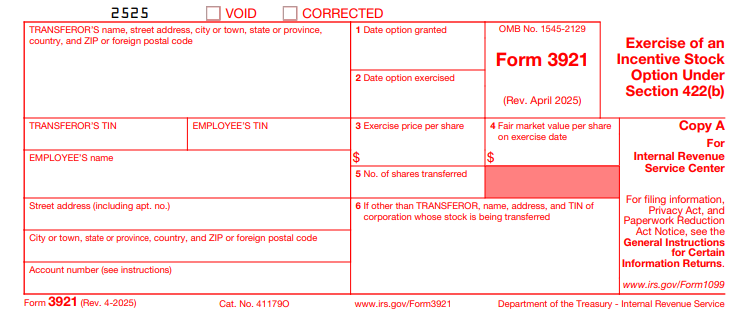

IRS Form 3921 – Exercise of an Incentive Stock Option Under Section 422(b) – Incentive Stock Options (ISOs) are a popular form of employee equity compensation, offering potential tax advantages over non-qualified stock options. When employees exercise these options, corporations must report the transaction using IRS Form 3921, titled “Exercise of an Incentive Stock Option Under Section 422(b).” This informational return ensures compliance with Internal Revenue Code Section 422 and helps employees track their basis for future tax reporting.

As of 2025, the latest revision of Form 3921 is from April 2025, with instructions updated accordingly. This guide explains what Form 3921 is, who files it, key deadlines, and its role in ISO tax treatment, based on official IRS sources.

What Are Incentive Stock Options (ISOs)?

Incentive Stock Options are statutory stock options granted under an employer stock option plan that meets specific requirements in IRC Section 422(b). Key features include:

- No regular income tax recognition at grant or exercise (unlike non-statutory options).

- Potential for long-term capital gains treatment if qualifying disposition rules are met: holding shares at least two years from grant date and one year from exercise date.

- However, the “bargain element” (fair market value at exercise minus exercise price) is an adjustment for Alternative Minimum Tax (AMT) purposes in the year of exercise, unless shares are sold in the same year.

For detailed tax rules, refer to IRS Topic No. 427 and Publication 525, Taxable and Nontaxable Income.

What Is IRS Form 3921?

Form 3921 is an information return filed by corporations to report the transfer of stock pursuant to an employee’s exercise of an ISO. It is required for each transfer (one form per exercise event, even if multiple in a year).

The form captures essential details:

- Box 1: Date the option was granted.

- Box 2: Date the option was exercised.

- Box 3: Exercise price per share.

- Box 4: Fair market value (FMV) per share on exercise date.

- Box 5: Number of shares transferred.

- Box 6: If applicable, name/address/TIN of the corporation whose stock was transferred (if different from the transferor).

This information helps employees calculate their cost basis and any AMT adjustments. Employees receive Copy B for their records; it is informational and not attached to their tax return unless reporting a sale or AMT.

Source: IRS About Form 3921 and Instructions for Forms 3921 and 3922 (Rev. April 2025).

Who Must File Form 3921?

Every corporation (public or private) that transfers stock to an individual upon exercise of an ISO must file Form 3921 for that calendar year. Exceptions:

- No filing required for nonresident aliens not receiving a Form W-2 during the relevant period.

Filing is mandatory regardless of the number of shares or if the exercise results in a same-day sale.

IRS Form 3921 Download and Printable

Download and Print: IRS Form 3921

Filing Requirements and Deadlines for 2025 Exercises

For ISO exercises occurring in calendar year 2025:

- Furnish Copy B to the employee: By January 31, 2026.

- File Copy A with the IRS:

- Paper filing: March 2, 2026 (or next business day if weekend/holiday).

- Electronic filing: March 31, 2026.

Electronic filing is required if filing 10 or more information returns (aggregated across types like 1099s, 3921, etc.) for the year. Use the IRS IRIS system or FIRE for e-filing.

Online fillable Copies B and C are available at IRS.gov/Form3921 to simplify furnishing to employees.

Penalties apply for late filing, incorrect information, or failure to file—up to hundreds per form, depending on delay.

See General Instructions for Certain Information Returns (2025) for full details.

Tax Implications for Employees Receiving Form 3921

- Regular Tax: No income reported at exercise. Basis in shares is the exercise price paid.

- AMT: The bargain element (FMV at exercise minus exercise price, multiplied by shares) is included as AMT income on Form 6251. Use Form 3921 Boxes 3 and 4 to calculate.

- Upon Sale:

- Qualifying disposition: Long-term capital gain on full appreciation.

- Disqualifying disposition: Ordinary income on bargain element, capital gain/loss on remainder.

Keep Form 3921 for records when reporting sales on Schedule D or adjusting for AMT credits.

Common Mistakes to Avoid

- Confusing ISOs with non-qualified options (which trigger W-2 income at exercise).

- Missing deadlines, leading to penalties.

- Incorrect FMV determination (must be reasonable and consistent).

Consult IRS Publication 525 for examples and further guidance.

Conclusion

Form 3921 plays a critical role in ensuring accurate reporting of ISO exercises, benefiting both corporations for compliance and employees for tax planning. With favorable tax treatment possible for ISOs, understanding this form helps maximize equity compensation benefits. Always refer to the latest IRS resources at IRS.gov for updates, as rules can change.

For personalized advice, consult a tax professional. Sources: IRS.gov (Form 3921, Instructions Rev. April 2025, Publication 525, Topic 427).