Table of Contents

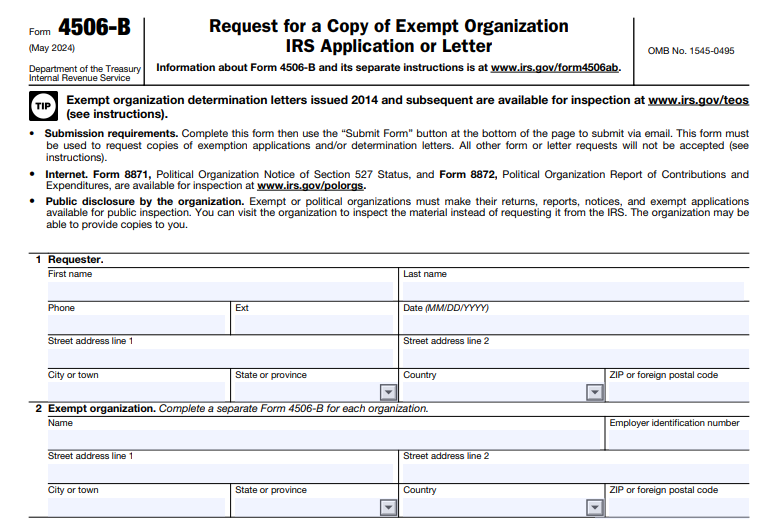

IRS Form 4506-B – Request for a Copy of Exempt Organization IRS Application or Letter – IRS Form 4506-B is an essential tool for anyone needing official copies of a tax-exempt organization’s exemption application or determination letter from the Internal Revenue Service (IRS). This form, titled “Request for a Copy of Exempt Organization IRS Application or Letter,” allows requesters to obtain publicly disclosable documents related to an organization’s tax-exempt status under IRC Section 501(c) or similar provisions.

As of the latest revision (May 2024), Form 4506-B is used exclusively for these purposes and cannot be substituted for requests involving annual returns like Form 990 (use Form 4506-A instead). This guide covers everything you need to know about IRS Form 4506-B, including its purpose, when to use it, how to complete it, and current submission details based on official IRS sources.

What Is IRS Form 4506-B Used For?

Form 4506-B enables individuals, nonprofits, grantors, researchers, or businesses to request:

- The organization’s exemption application (e.g., Form 1023, 1023-EZ, 1024, 1024-A, including supporting documents like articles of incorporation or bylaws).

- The most recently issued exemption determination letter.

- An affirmation letter (a currently dated IRS letter confirming the organization’s ongoing tax-exempt status, often used for donors or grantors).

- Other publicly disclosable items (e.g., Form 8940 requests or group exemption documents).

This form is particularly useful when verifying an organization’s tax-exempt status, especially if the original determination letter is lost or outdated. Note that determination letters issued on or after January 1, 2014, are freely available for download via the IRS Tax Exempt Organization Search (TEOS) tool at irs.gov/teos—no need for Form 4506-B in those cases.

Form 4506-B is not for requesting copies of annual information returns (Form 990 series) or notices; use Form 4506-A for those.

When Should You Use IRS Form 4506-B?

Common scenarios include:

- A nonprofit needs a replacement copy of its determination letter for grant applications or banking.

- Donors or funders require proof of current exempt status (request an affirmation letter).

- Researchers or due diligence professionals need the full exemption application packet.

- Pre-2014 determination letters, which are not on TEOS.

Exempt organizations are required to make these documents available for public inspection, so you can also request them directly from the organization before contacting the IRS.

IRS Form 4506-B Download and Printable

Download and Print: IRS Form 4506-B

How to Fill Out IRS Form 4506-B: Step-by-Step Guide

Download the latest Form 4506-B (Rev. May 2024) and instructions from irs.gov. The form is fillable PDF and must be completed using Adobe Acrobat Reader for electronic submission.

- Requester Information (Line 1): Provide your name, phone number, date, and full mailing address (including street, city, state, ZIP, and country if applicable).

- Exempt Organization Information (Line 2): Enter the organization’s official name (as approved for exemption), address, and Employer Identification Number (EIN). Use the exact name to avoid delays. Submit a separate form for each organization.

- Category of Requester (Line 3): Check one box (e.g., individual, commercial user, etc.).

- Reason for Request (Line 4): Non-commercial requesters must explain how the documents will be used (e.g., “verification for grant application”). This helps qualify for reduced fees.

- Items Requested (Line 5): Check the appropriate boxes:

- Application for exemption (includes supporting docs).

- Exemption determination letter only.

- Affirmation letter.

- Other (specify details).

- Submission: Use the “Submit Form” button in the PDF to email it directly to the IRS. The submission is not encrypted, so avoid including sensitive personal data beyond what’s required.

Processing typically takes up to 60 days. If longer, contact IRS Customer Account Services at 877-829-5500 (do not resubmit).

Fees and Costs for IRS Form 4506-B Requests

There is no filing fee for Form 4506-B itself, but copying charges apply:

- Non-commercial requesters: First 100 pages free; $0.20 per page thereafter.

- Commercial users: $0.20 per page (no free pages).

The IRS will bill you after processing. If costs exceed $250, prepayment may be required.

Alternatives to Form 4506-B

- Recent Determination Letters: Search and download free from TEOS at irs.gov/teos (2014 and later).

- Annual Returns: View or download from TEOS (2017 and later) or request via Form 4506-A.

- Direct from Organization: Nonprofits must provide copies upon request (often for a reasonable fee).

Key Updates and Tips for 2025

The current version of Form 4506-B is from May 2024, with no major revisions announced for 2025 as of late 2025. Always check irs.gov for the latest form. Electronic submission via the PDF’s submit button remains the preferred method for efficiency.

For affirmation letters confirming current status (especially useful for older organizations), specifically check that box on the form.

Sources: Official IRS website (irs.gov/forms-pubs/about-form-4506-a, irs.gov/pub/irs-pdf/f4506b.pdf, irs.gov/pub/irs-pdf/i4506b.pdf, and irs.gov/charities-non-profits).

If you need copies of exempt organization documents, starting with TEOS and then using Form 4506-B ensures you get accurate, official IRS records efficiently. Consult a tax professional for complex situations.