Table of Contents

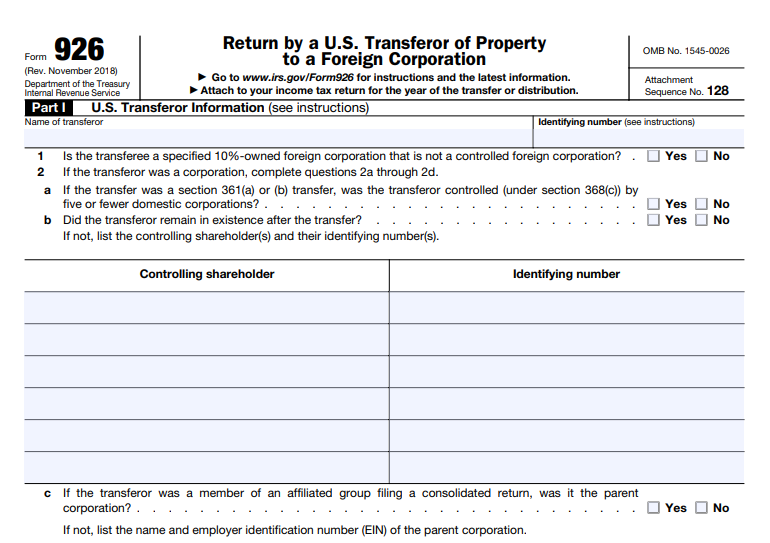

IRS Form 926 – Return by a U.S. Transferor of Property to a Foreign Corporation – In an increasingly global economy, U.S. taxpayers frequently engage in cross-border transactions, including transferring property to foreign corporations. These transfers can trigger significant U.S. tax reporting obligations under Internal Revenue Code (IRC) Section 6038B. The primary tool for compliance is IRS Form 926, titled Return by a U.S. Transferor of Property to a Foreign Corporation.

This form helps the IRS monitor outbound property transfers to prevent tax avoidance, ensure proper gain recognition where required, and track potential shifts of assets or income outside U.S. taxing jurisdiction. Understanding Form 926 is essential for individuals, domestic corporations, partnerships, and trusts involved in international business or investments.

What Is IRS Form 926?

Form 926 is an informational return used to report specific transfers of property (tangible or intangible) by a U.S. person to a foreign corporation in transactions that qualify for nonrecognition of gain or loss under U.S. tax rules (such as IRC Sections 351, 354, 356, 361, or similar provisions). It is required under IRC Section 6038B(a)(1)(A), as well as Sections 367(d) and 367(e) in certain cases.

The form discloses details about the transferor, transferee foreign corporation, type and value of property transferred, any gain recognized, and ownership interests before and after the transfer. It must generally be attached to the U.S. transferor’s timely filed federal income tax return for the year that includes the transfer date.

Key updates in recent years include expanded reporting for cash transfers and questions about whether the foreign corporation is a “specified 10%-owned foreign corporation” (relevant post-2017 Tax Cuts and Jobs Act changes under Section 245A).

As of the latest available IRS information (with the most recent form revision from November 2018 still in use, and no major new revision noted for 2025), the requirements remain consistent.

Who Must File Form 926?

U.S. persons required to file include:

- U.S. citizens or residents

- Domestic corporations

- Domestic estates or trusts

A “U.S. person” transfers property to a foreign corporation in a reportable transaction if it qualifies under Section 6038B(a)(1)(A).

Special rules apply:

- Partnerships — If a partnership (domestic or foreign) transfers property, the domestic partners (not the partnership) must file Form 926 for their proportionate share.

- Spouses — They may file jointly if they file a joint income tax return.

- Cash transfers — Reportable if: (a) immediately after the transfer, the U.S. person holds (directly or indirectly) at least 10% of the voting power or value of the foreign corporation, or (b) cash transferred exceeds $100,000 in the 12-month period ending on the transfer date.

Exceptions exist where no filing is required, such as:

- The transfer is fully taxable and properly reported on a timely return.

- Certain low-value transfers deemed to a foreign corporation under specific regs (fair market value ≤ $100,000).

- Some stock/security transfers qualifying under special rules (e.g., with a filed Gain Recognition Agreement under Section 367(a)).

Always consult the latest IRS instructions to confirm exceptions.

When and Where to File Form 926

File Form 926 with your federal income tax return (e.g., Form 1040, 1120, etc.) for the tax year that includes the transfer date. Attach it to the return.

- Due date — Aligns with your income tax return deadline (typically April 15 for individuals, with extensions available).

- Electronic filing — Generally attached as a PDF if e-filing; paper filing may be required in some cases.

- Late filing — Can extend the statute of limitations on your entire return until Form 926 is filed.

Key Information Required on Form 926

The form is divided into parts:

- Part I: U.S. Transferor Information (name, EIN/SSN, address, etc.).

- Part II: Transferee Foreign Corporation Information (name, address, country, entity classification, ownership percentages before/after transfer).

- Part III: Information on the Transfer (type of property, date, fair market value, adjusted basis, gain/loss recognized, whether cash only, intangible property details, etc.).

- Part IV: Additional Questions (e.g., distributions under Section 367(e), liquidations, etc.).

Detailed schedules may be required for intangible property (Section 367(d)), built-in loss property, or gain recognition agreements.

IRS Form 926 Download and Printable

Download and print: IRS Form 926

Penalties for Non-Compliance

Failure to file Form 926 (or filing incompletely/inaccurately) can result in severe penalties under IRC Section 6038B(c):

- General penalty — 10% of the fair market value of the transferred property (capped at $100,000).

- Intentional disregard — Uncapped penalty.

- Reasonable cause relief — The IRS may waive penalties if you show reasonable cause and good faith (e.g., first-time oversight with prompt correction).

Non-filing also keeps the statute of limitations open on your return, allowing IRS assessments indefinitely until compliance.

Why Form 926 Matters: Tax Implications and Compliance Tips

Form 926 supports broader international tax rules under Section 367, which can trigger gain recognition on outbound transfers to prevent “trafficking” in built-in gains without U.S. tax. It also intersects with other reporting like Form 5471 (for controlling interests in foreign corporations) or FBAR/FinCEN Form 114 (for foreign accounts).

Best practices:

- Consult a tax professional specializing in international tax before any transfer.

- Maintain detailed records of basis, valuations, and ownership.

- Check for related forms (e.g., Form 8832 for entity classification).

- Stay updated via IRS.gov, as rules can evolve (e.g., post-TCJA clarifications).

Conclusion

IRS Form 926 plays a critical role in U.S. international tax compliance, ensuring transparency for property transfers to foreign corporations. Whether you’re incorporating overseas, contributing assets to a foreign entity, or transferring intellectual property, ignoring this requirement can lead to substantial penalties and extended audit exposure.

For the most accurate guidance, visit the official IRS pages:

- About Form 926

- Form 926 Filing Requirement

- Download the latest Form 926 and instructions directly from IRS.gov.

If you’re facing a potential Form 926 filing, seek advice from a qualified tax advisor to navigate the complexities and avoid costly mistakes. Proper reporting protects your interests and maintains compliance with U.S. tax laws.