Table of Contents

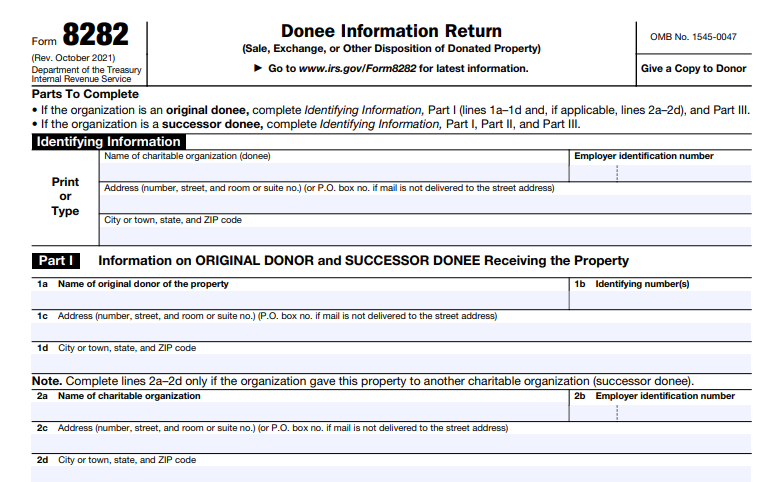

IRS Form 8282 – Donee Information Return (Sale, Exchange or Other Disposition of Donated Property) – IRS Form 8282, known as the Donee Information Return (Sale, Exchange, or Other Disposition of Donated Property), is a critical compliance tool for charitable organizations. It ensures transparency when non-cash donated property is sold or otherwise disposed of shortly after receipt. This form helps the IRS monitor whether high-value donations are used as intended, protecting the integrity of charitable contribution deductions.

As of 2025, requirements remain consistent with prior years, based on official IRS guidance. Charitable organizations (donees) must file this form under specific circumstances to avoid penalties.

What Is IRS Form 8282?

The IRS requires donee organizations—typically tax-exempt charities—to file Form 8282 when they dispose of charitable deduction property within three years of the original donation date. Disposition includes selling, exchanging, consuming, or otherwise transferring the property.

The form reports details to the IRS and provides a copy to the original donor. This allows the IRS (and potentially the donor) to verify if the property was used for the charity’s exempt purpose or sold prematurely, which could affect the donor’s prior tax deduction.

Key source: IRS About Form 8282.

When Must You File Form 8282?

File Form 8282 if all these conditions apply:

- The property qualifies as charitable deduction property: Non-cash items (other than cash or publicly traded securities) with a claimed value over $5,000 per item or group of similar items. The original donee must have signed Section B of the donor’s Form 8283 (Noncash Charitable Contributions).

- The donee (original or successor) disposes of the property within 3 years of the original receipt date.

- No exceptions apply (see below).

Filing deadline: Submit within 125 days after the disposition date. Provide Copy A to the IRS and Copy B to the original donor.

Exceptions—no filing required if:

- The property’s appraised value was $500 or less (if properly identified on the donor’s Form 8283).

- The property was consumed or distributed free of charge for charitable purposes (e.g., food to the needy).

- The disposition resulted from unintended circumstances (e.g., natural disaster), with proper certification on the form.

Successor donees (if property transfers to another charity within the 3-year period) must also comply if they dispose of it.

Source: IRS charitable organizations guidance and Form 8282 PDF (Rev. October 2021, current as of 2025).

IRS Form 8282 Download and Printable

Download and Print: IRS Form 8282

Connection to Form 8283: Noncash Charitable Contributions

Form 8282 ties directly to Form 8283, which donors file for non-cash contributions over $500 (with appraisal required over $5,000).

- Donors attach Form 8283 to their tax return.

- The donee signs the acknowledgment on Form 8283, confirming receipt and agreeing to potential Form 8282 filing if disposed early.

- Early disposition may limit the donor’s deduction or trigger recapture of prior benefits.

This linkage prevents overvaluation or misuse of donations.

Source: Instructions for Form 8283 (Rev. December 2024).

Who Files Form 8282 and Key Requirements

- Original donee: The first charity receiving the property—completes identifying information and disposition details.

- Successor donee: A subsequent charity—provides info on previous donees.

Requirements include:

- Donor details (name, EIN/address if available).

- Property description, vehicle identification if applicable, date received, and disposition details (date, amount received).

- Certification if property was used for exempt purposes or disposition was unintended.

Penalties for non-filing or incomplete forms: Generally $50 per form, with higher penalties for fraudulent statements (up to $10,000).

How to File Form 8282

- Download the latest Form 8282 from IRS.gov (current revision: October 2021; check for updates).

- Complete required parts based on original or successor status.

- File paper copies (no e-filing available).

- Send to the IRS and donor within 125 days.

For transfers to another charity: Provide the successor with Form 8283 copy and filed Form 8282 within 15 days.

Why Compliance Matters in 2025

Proper handling of Form 8282 maintains donor trust, avoids IRS penalties, and supports valid charitable deductions. No major changes occurred for 2025—thresholds ($5,000+ claimed value) and timelines (3 years/125 days) remain unchanged.

Charities should track high-value donations and disposition dates. Donors receiving a Form 8282 copy may need to review prior returns.

For the latest details, visit IRS.gov or consult a tax professional.

Sources: Internal Revenue Service official pages, Form 8282 PDF, Instructions for Form 8283 (December 2024 revision), and Publication 526 (Charitable Contributions, updated 2024-2025).