Table of Contents

IRS Form 461 – Limitation on Business Losses – Business owners and noncorporate taxpayers often rely on deducting losses to offset other income, but federal tax rules impose limits. IRS Form 461, Limitation on Business Losses, calculates the excess business loss (EBL) disallowance under Internal Revenue Code Section 461(l). This provision prevents excessive business losses from reducing nonbusiness income beyond a certain threshold.

As of 2025, this limitation is permanent, thanks to the One Big Beautiful Bill Act (OBBBA, P.L. 119-21), which extended and solidified the rule originally introduced by the Tax Cuts and Jobs Act (TCJA).

What Is the Excess Business Loss Limitation?

Section 461(l) limits deductions for net losses from trades or businesses for noncorporate taxpayers (individuals, estates, trusts, and certain exempt organizations). The rule applies after other limitations, such as:

- Basis rules

- At-risk rules (Form 6198)

- Passive activity loss rules (Form 8582)

An excess business loss occurs when aggregate trade or business deductions exceed aggregate trade or business gross income/gains plus an inflation-adjusted threshold.

Disallowed excess losses do not disappear—they become a net operating loss (NOL) carryover to future years, deductible under NOL rules (see Form 172 and Pub. 536).

Key exclusions:

- Capital gains/losses from asset sales are generally not included

- Wages from employment are treated as business income for this calculation

- Section 199A qualified business income deductions and prior NOLs are disregarded in the EBL computation

2025 Threshold Amounts

For tax year 2025, the thresholds are:

- $313,000 for single filers, heads of household, or married filing separately

- $626,000 for married filing jointly or qualifying surviving spouses

These amounts are inflation-adjusted annually (per Rev. Proc. 2024-40).

If net business losses exceed the threshold, the excess is disallowed in 2025 and carried forward as an NOL.

Who Must File Form 461?

File Form 461 if you are a noncorporate taxpayer and:

- Net losses from all trades or businesses exceed $313,000 ($626,000 joint), or

- Any single line (1–8) on the form shows a loss over $156,500 (half the base threshold, to catch concentrated losses).

Attach Form 461 to your return (e.g., Form 1040, 1041, or 990-T).

IRS Form 461 Download and Printable

Download and Print: IRS Form 461

How to Calculate Excess Business Loss on Form 461

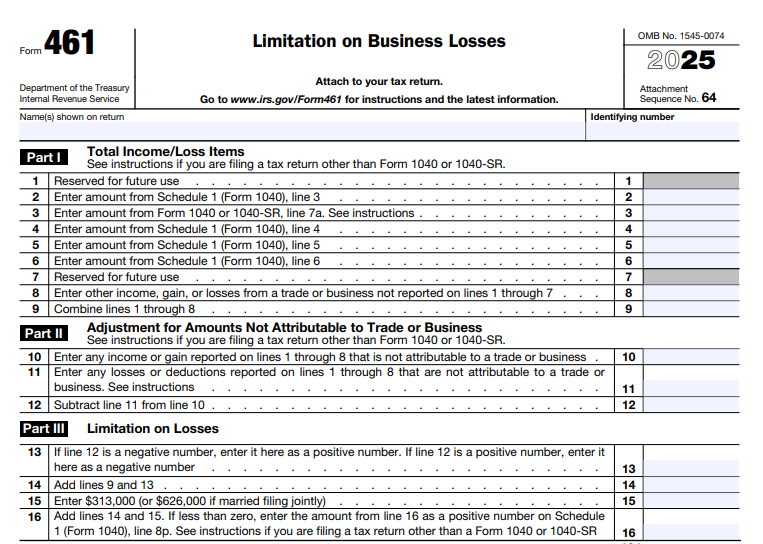

Form 461 has three parts:

Part I: Total Income/Gain or Loss/Deduction Attributable to Trade or Business

Pulls amounts from Schedule 1 (Form 1040) lines, including:

- Nonemployee compensation

- Business income/loss (Schedule C)

- Rental real estate/partnership/S corp (Schedule E)

- Farm income/loss (Schedule F)

- Other gains/losses (Form 4797)

Adjust for non-business items.

Part II: Adjustments for Non-Trade or Business Amounts

Remove items like capital losses or personal deductions.

Part III: Limitation Calculation

- Combine adjusted business income/loss

- Subtract non-business income/gains

- Apply the threshold

- Resulting negative amount (if over threshold) = excess business loss (reported as positive income on Schedule 1, line 8p, effectively disallowing the deduction)

Special rules apply for farming vs. nonfarming losses—farming losses get priority allocation of the threshold.

Example: 2025 Excess Business Loss Calculation

Assume a married couple filing jointly with:

- $100,000 business income

- $800,000 business deductions/losses

Net business loss: $700,000

Threshold: $626,000

Allowable loss: $626,000 (offsets other income)

Excess: $74,000 → disallowed in 2025, carried forward as NOL

The couple adds $74,000 as “other income” on their return, increasing taxable income accordingly.

Planning Tips for Business Owners

- Monitor aggregate losses across all activities (sole prop, partnerships, S corps, rentals)

- Consider timing income acceleration or deduction deferral to stay under thresholds

- Track NOL carryforwards carefully—EBL-generated NOLs follow standard rules (generally no carryback, 80% income limitation in some cases)

- For pass-through entities: Limitation applies at owner level

Consult a tax professional for complex situations, especially with passive activities or multiple entities.

Sources and Further Reading

- IRS Form 461 (2025): https://www.irs.gov/pub/irs-pdf/f461.pdf

- Instructions for Form 461 (2025): https://www.irs.gov/pub/irs-pdf/i461.pdf

- IRS Newsroom: Excess Business Losses – https://www.irs.gov/newsroom/excess-business-losses

- Publication 536: Net Operating Losses

Stay compliant and maximize allowable deductions by understanding Form 461’s role in your 2025 tax return.