Table of Contents

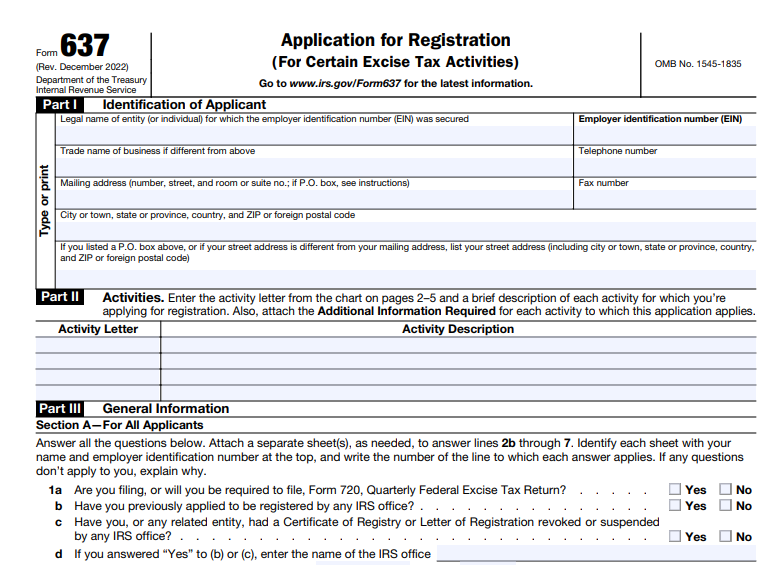

IRS Form 637 – Application for Registration (For Certain Excise Tax Activities) – is a critical document for businesses and individuals engaged in specific excise tax-related operations. This form allows applicants to register with the Internal Revenue Service (IRS) to conduct activities under Internal Revenue Code (IRC) sections 4101 (primarily fuel-related), 4222 (tax-free sales for further manufacture), 4662 (superfund chemical taxes), and 4682 (ozone-depleting chemicals). As of December 2025, the latest revision of Form 637 is dated December 2025, reflecting updates for activities like clean fuel production credits.

Proper registration via Form 637 is mandatory before engaging in taxable excise activities or claiming excise tax benefits, such as purchasing or selling articles tax-free or filing credits/refunds. Failure to register can result in penalties or denial of tax benefits.

What Is IRS Form 637?

Form 637 is used to apply for excise tax registration, enabling qualified entities to participate in regulated activities without upfront tax payments in certain cases. According to the IRS, registration is required for anyone undertaking excise tax-subject activities or seeking benefits like tax-free transactions.

The IRS issues an official Letter of Registration (Letter 3689) upon approval, specifying approved activities, effective date, and registration number. A submitted copy of Form 637 does not serve as proof of registration.

Key updates in recent years include new activity letters for sustainable aviation fuel (SAF) and clean fuel production under IRC section 45Z, such as CA (SAF producer) and CN (non-SAF clean fuel producer).

Who Needs to File Form 637?

You must file Form 637 if your business or operations involve:

- Fuel-related activities under IRC 4101, such as producing, blending, or distributing taxable fuels (e.g., gasoline, diesel, alternative fuels, biodiesel, renewable diesel, or sustainable aviation fuel).

- Tax-free sales or purchases for further manufacture under IRC 4222.

- Handling taxable chemicals subject to superfund taxes under IRC 4662.

- Activities involving ozone-depleting chemicals under IRC 4682.

Common registrants include:

- Fuel producers, blenders, enterers, position holders, refiners, terminal operators, pipeline/vessel operators, and exporters.

- Manufacturers or retailers claiming exemptions for further manufacturing.

- Producers of clean fuels eligible for credits under section 45Z.

- Entities seeking to buy/sell tax-free or claim refunds/credits.

Each separate business unit with its own Employer Identification Number (EIN) must file separately. Registration is required before starting the activity.

Key Activity Letters on Form 637

Form 637 lists various activity letters corresponding to specific excise tax operations. Examples include:

- AB/NB/SA: Biodiesel, renewable diesel, or sustainable aviation fuel mixtures/credits.

- AF/AL/AM: Alternative fuels or mixtures.

- CA/CN: Clean fuel production (SAF and non-SAF) for section 45Z credit.

- K/M/S/X/Y: Various fuel-related (e.g., kerosene, ultimate vendors, exporters).

- UA/UB/UP/UV: Untaxed sales or uses of fuels.

- Others for non-fuel activities like blood collectors or tax-free chemical sales.

Applicants can request multiple activities on one form if applicable.

IRS Form 637 Download and Pprintable

Download and Print: IRS Form 637

How to Apply for Form 637 Registration (2025 Process)

- Obtain the Form: Download the current Form 637 (Rev. December 2025) from the IRS website at irs.gov/pub/irs-pdf/f637.pdf.

- Complete the Application:

- Provide general information (name, EIN, address, contact).

- Select activity letter(s) and complete required questionnaires/schedules.

- For certain fuel activities, answer compliance questions and provide ownership details.

- Attach supporting documents (e.g., business licenses, FDA registration for blood collectors, financial info).

- Submit the Form:

- Mail to: Department of the Treasury, Internal Revenue Service Center, Excise Operations Unit – Form 637, Mail Stop 5701G, Cincinnati, OH 45999.

- Fax to: Toll-free fax number 855-887-7735.

- Processing and Approval:

- The IRS reviews for compliance with “registration tests” (e.g., background checks, site inspections if needed).

- If approved, receive Letter 3689.

- If denied, receive written notification with reasons.

- Processing time varies; incomplete applications delay approval.

- Changes or Updates:

- Report ownership changes over 50% (may require reregistration for section 4101 activities).

- To add activities, submit a new Form 637.

Verify Registration Status

Use the IRS Online Form 637 Registration Status Check tool at apps.irs.gov/app/exciseTax/ to confirm valid registrations by entering the registration number and activity letter suffix.

Important Reminders for 2025

- Registration remains valid until revoked but requires ongoing compliance.

- Approval for one activity (e.g., fuel credits) does not guarantee qualification for all claims.

- Consult IRS Publication 510 (Excise Taxes) for detailed guidance.

- For clean fuel credits, see IRS FAQs on section 45Z registration.

For the latest details, visit the official IRS pages:

- About Form 637: irs.gov/forms-pubs/about-form-637

- 637 Registration Program: irs.gov/businesses/small-businesses-self-employed/637-registration-program

Filing Form 637 correctly ensures compliance and access to excise tax benefits. If your operations involve excise taxes, consult a tax professional or the IRS directly for personalized advice.