Table of Contents

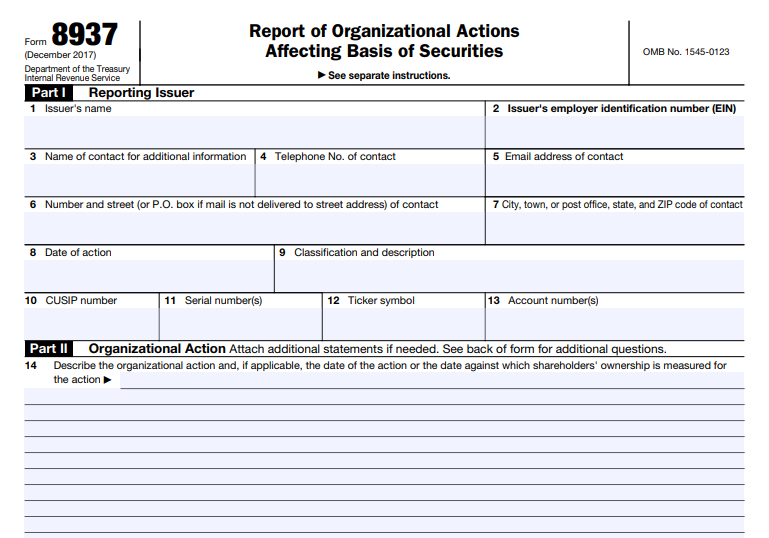

IRS Form 8937 – Report of Organizational Actions Affecting Basis of Securities – is a critical tax document required by the Internal Revenue Service (IRS). This form ensures transparency for investors by reporting corporate events that impact the tax basis of securities, helping shareholders accurately calculate capital gains or losses when selling their holdings.

As of December 2025, the latest version of Form 8937 remains the December 2017 revision, with instructions unchanged since then. Issuers—such as corporations—must file this form for certain “organizational actions” to comply with Internal Revenue Code Section 6045B.

What Is IRS Form 8937?

Form 8937 requires issuers of specified securities to report organizational actions that affect the basis of those securities in the hands of U.S. taxpayers. The “basis” refers to the adjusted cost basis, which determines taxable gain or loss upon sale (generally, sale price minus adjusted basis).

Specified securities include:

- Shares of stock in corporations (including foreign entities treated as corporations for U.S. tax purposes)

- Interests treated as stock (e.g., American Depositary Receipts)

- Certain debt instruments (excluding short-term obligations or those subject to specific rules like contingent payment debt)

- Options, warrants, or other stock rights

The form does not apply to initial public offerings, regular taxable dividend distributions (reported on Form 1099-DIV), or actions where all holders are exempt recipients (e.g., C corporations, charities, or foreign holders).

IRS Form 8937 Download and Printable

Download and Print: IRS Form 8937

Common Organizational Actions Requiring Form 8937

Issuers must file Form 8937 for events that alter the tax basis, such as:

- Nontaxable cash distributions (e.g., return of capital, which reduces basis)

- Nontaxable stock distributions or stock splits (adjusting basis per share)

- Mergers, acquisitions, spin-offs, or reorganizations (reallocating basis between old and new securities)

- Certain debt instrument modifications (e.g., in recapitalizations or bankruptcies)

For instance, in a stock split, the form details how basis allocates across the increased number of shares. In a spin-off, it explains basis allocation between the parent and spun-off entity.

Exceptions include:

- S corporations (if reported on Schedule K-1 of Form 1120S)

- Certain regulated investment companies (RICs) or REITs using Form 2439 for undistributed capital gains

- Money market funds under specific rules

Filing Requirements and Deadlines for Form 8937

Issuers must report if the action affects basis for at least one non-exempt holder.

Key deadlines:

- File with the IRS (or post publicly) by the earlier of 45 days after the organizational action or January 15 of the following year.

- For redemptions, the action date is the last day holders can redeem.

Filing options:

- Mail the completed form to: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0054.

- Post a signed PDF on the issuer’s primary public website in a dedicated, readily accessible area—maintained for 10 years (including on successor sites). This satisfies IRS filing if done by the due date.

Issuers must also provide the form (or website link) to security holders of record and nominees (e.g., brokers) by January 15 of the following year.

If facts change (altering the quantitative basis effect), file a corrected Form 8937 within 45 days of discovery.

How to Complete Form 8937

The form has two parts:

- Part I: Issuer information (name, EIN, contact).

- Part II: Details of the organizational action (date, description, CUSIP numbers, quantitative effect on basis, supporting calculations, and relevant IRC sections).

Attachments are often needed for complex explanations, such as basis allocation formulas in mergers.

The form requires a penalties-of-perjury signature.

Why Form 8937 Matters for Investors

Investors use information from Form 8937 to adjust their cost basis, avoiding overpayment of taxes on sales. Brokers also reference these forms for accurate reporting on Form 1099-B.

Many public companies post Form 8937 filings on their investor relations websites—search there or on the IRS site for specific examples.

Failure to file can result in penalties, so issuers prioritize compliance. For personalized advice, consult a tax professional, as this form’s details can significantly impact capital gains calculations.

For the official form and instructions, visit the IRS website. Stay informed on any future updates, as tax rules evolve.