Table of Contents

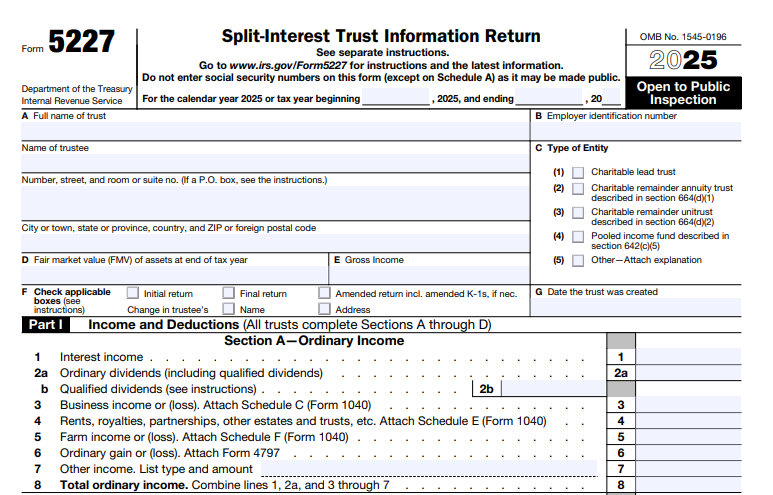

IRS Form 5227 – Split-Interest Trust Information Return – is a critical filing requirement for certain charitable trusts. This form ensures transparency in financial activities, charitable distributions, and compliance with private foundation rules. As of 2025, trustees must stay updated on filing deadlines, electronic requirements, and reporting obligations to avoid penalties.

What Is IRS Form 5227?

Form 5227 is an annual information return used to report the financial activities of a split-interest trust. According to the official IRS description, it serves three main purposes:

- Report the trust’s income, deductions, accumulations, and distributions.

- Provide details on charitable deductions and distributions.

- Determine whether the trust is treated as a private foundation and subject to Chapter 42 excise taxes.

Split-interest trusts benefit both charitable and non-charitable (private) beneficiaries, such as charitable remainder trusts (CRTs) or charitable lead trusts (CLTs). Unlike Form 990-PF for private foundations, split-interest trusts file Form 5227 instead.

The form is open to public inspection (except for certain schedules like Schedule A and beneficiary K-1s).

Who Must File Form 5227?

Not all trusts file Form 5227. The 2025 Instructions specify:

- All charitable remainder trusts (CRTs) described in IRC Section 664, including charitable remainder annuity trusts (CRATs) and charitable remainder unitrusts (CRUTs).

- All pooled income funds under Section 642(c)(5).

- Other split-interest trusts under Section 4947(a)(2), such as charitable lead trusts.

Exception: Certain pre-May 27, 1969, trusts may be exempt unless additional contributions trigger filing.

If the trust has unrelated business taxable income (UBTI), it may also need to file Form 4720 for excise taxes.

Key Types of Split-Interest Trusts

Understanding the trust type is essential for accurate reporting:

- Charitable Remainder Trusts (CRTs): Provide income to non-charitable beneficiaries for a term, with the remainder going to charity.

- Charitable Lead Trusts (CLTs): Pay income to charity first, with the remainder to private beneficiaries.

- Pooled Income Funds: Combine donations from multiple donors, managed by a charity.

Each type has specific sections in Form 5227 (e.g., accumulation schedules for Section 664 trusts).

Filing Deadline for Form 5227 in 2025

For calendar year 2025:

- Due date: April 15, 2026.

- For fiscal-year trusts: 15th day of the 4th month after year-end.

- Final returns: Due by the 15th day of the 4th month following termination.

Extension: File Form 8868 for an automatic 6-month extension (no reason needed).

Late filing can trigger penalties under Section 6652, starting at $20 per day (higher for larger trusts).

Electronic Filing Requirements (Mandatory e-File)

A significant update affects many trustees: If the filer (trust or trustee) is required to file at least 10 returns of any type in a calendar year (including 1099s, W-2s, etc.), Form 5227 must be e-filed. This rule applies to tax years ending on or after December 31, 2023. Paper filing when e-file is required is treated as a non-filing, triggering penalties.

Use IRS-approved e-file providers for submission.

IRS Form 5227 Download and Printable

Download and Print: IRS Form 5227

How to Complete and File Form 5227

- Gather Information: Trust instrument, financial statements, beneficiary details, and prior returns.

- Key Sections:

- Part I-IV: Basic info, income/deductions, distributions, balance sheet.

- Parts for specific trusts (e.g., accumulation for CRTs).

- Schedule A: Charitable distributions (not public).

- Schedule K-1: For beneficiaries (CRTs issue these).

- Attachments: Trust instrument (initial return), amendments, explanations as needed.

- Sign and File: Trustee signs; paid preparers must include PTIN.

Download the latest Form 5227 and Instructions from IRS.gov.

Common Mistakes to Avoid

- Missing K-1 issuance to beneficiaries.

- Incorrect classification of income (e.g., UBTI).

- Failing to report excess business holdings or prohibited transactions (may require Form 4720).

- Ignoring e-file mandate.

Penalties for Non-Compliance

- Late/incomplete filing: Up to $12,000+ per return.

- Failure to provide K-1s: Additional penalties.

- Excise taxes for violations (e.g., self-dealing).

Consult a tax professional for complex trusts.

For the most current details, visit the official IRS page: About Form 5227 or download the 2025 Instructions (PDF).

This guide is based on official IRS sources as of December 2025. Always verify with IRS.gov for any last-minute changes. Proper filing ensures compliance and supports charitable goals.