Table of Contents

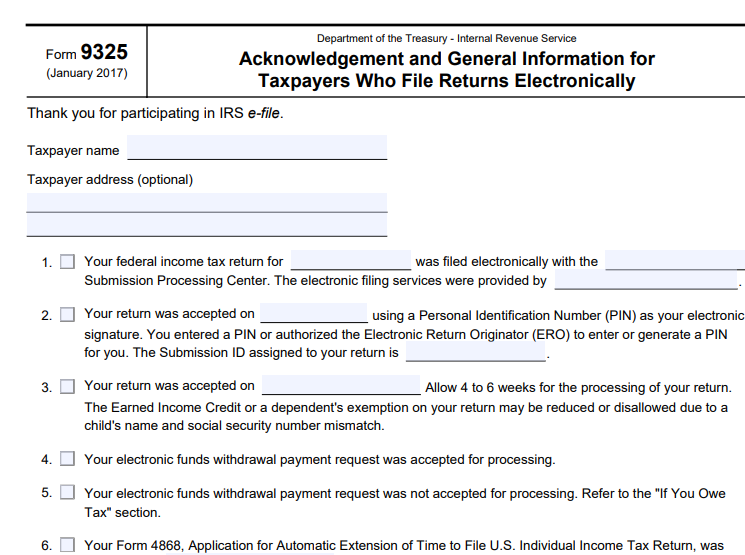

IRS Form 9325 – Acknowledgement and General Information for Taxpayers Who File Returns Electronically – In the digital age of tax filing, millions of Americans opt for electronic filing (e-filing) through IRS-approved providers for its speed, accuracy, and convenience. If you’ve e-filed your individual income tax return or extension, you may receive or request IRS Form 9325 — the official Acknowledgement and General Information for Taxpayers Who File Returns Electronically. This form serves as proof that the IRS has received and accepted your electronic submission.

As of 2025, Form 9325 remains an essential document for confirming e-file status, tracking refunds, and maintaining records. Below, we’ll explore what Form 9325 is, its purpose, key details, and why it matters for e-filers.

IRS Form 9325 Download and Printable

Download and Print: IRS Form 9325

What Is IRS Form 9325?

IRS Form 9325 is a confirmation document generated after the IRS accepts an electronically filed individual tax return (Form 1040 series) or extension (Form 4868). It is not a form you fill out or submit yourself — instead, your Electronic Return Originator (ERO), such as a tax professional or software provider, uses IRS acknowledgement data to create and provide it to you.

The latest version of Form 9325 is the January 2017 revision, available directly from the IRS website at irs.gov/pub/irs-pdf/f9325.pdf. Despite changes in tax laws and e-filing capabilities (like amended returns), this version is still in use as of late 2025.

Key points:

- It confirms acceptance of your original return or extension.

- It does not apply to amended returns (Form 1040-X), business returns, or paper filings.

- Taxpayers often request it as proof of timely filing, especially for visa applications, loans, or audits.

Purpose of Form 9325 for E-Filers

The primary role of Form 9325 is to provide peace of mind and documentation:

- Confirmation of Acceptance: The IRS typically acknowledges e-filed returns within 24-48 hours. Acceptance means your return passed initial checks and is in processing.

- Proof of Filing: It includes a unique Submission ID (a tracking number) and acceptance date, useful for verifying filing status.

- General Guidance: It outlines next steps, such as what to do if payments fail, how to amend returns, or how to check refund status via “Where’s My Refund?” on IRS.gov.

- Record-Keeping: Many tax preparers automatically generate and provide this form for their records and yours.

Unlike rejection notices (which explain errors), Form 9325 indicates success. If your return is rejected, you’ll need to correct and resubmit — no Form 9325 is issued until accepted.

Key Information on IRS Form 9325

Form 9325 includes taxpayer details and specific checkboxes filled by the ERO based on IRS acknowledgement data:

- Taxpayer Name and Address

- Tax Year and IRS Submission Processing Center

- Acceptance Date and Submission ID

- Checkboxes for scenarios like:

- PIN usage (Practitioner PIN or Self-Select PIN)

- Payment issues (e.g., if electronic funds withdrawal failed)

- Extension approval (for Form 4868)

It also reminds taxpayers:

- To use Form 1040-X for amendments (mailed, as e-filing amendments may have separate processes).

- Options for installment agreements (Form 9465) if you owe taxes.

- How to inquire about payments or refunds.

How to Obtain Form 9325 in 2025

- Through Your Tax Preparer: Most professional software (e.g., TaxSlayer, Drake, TaxAct) automatically generates it upon IRS acceptance.

- Self-Prepared Returns: If using software like TurboTax or direct IRS Free File, check your account for an e-file confirmation letter, which often includes similar details (Submission ID and acceptance date). Some users report challenges getting the exact Form 9325 format.

- Request from IRS: Not directly issued by the IRS to taxpayers, but your ERO can provide it using official data.

For the blank form or more details, visit the official IRS source: IRS.gov Form 9325 PDF.

Why Form 9325 Matters for Your Tax Refund and Compliance

Having Form 9325 helps:

- Track Your Refund: Use the Submission ID on IRS.gov’s “Where’s My Refund?” tool.

- Prove Timely Filing: Essential for avoiding late penalties or supporting claims in disputes.

- Handle Issues Promptly: Alerts you to payment problems or other flags.

E-filing is the preferred method for over 90% of returns, offering faster refunds (often within 21 days). Always retain Form 9325 with your tax records for at least three years.

If you’re preparing your 2025 taxes (for tax year 2024), ensure your e-file provider supplies this acknowledgement. For questions, contact the IRS at 1-800-829-1040 or consult a tax professional.

Sources: Official IRS Form 9325 (Rev. January 2017) and related publications from IRS.gov.