Table of Contents

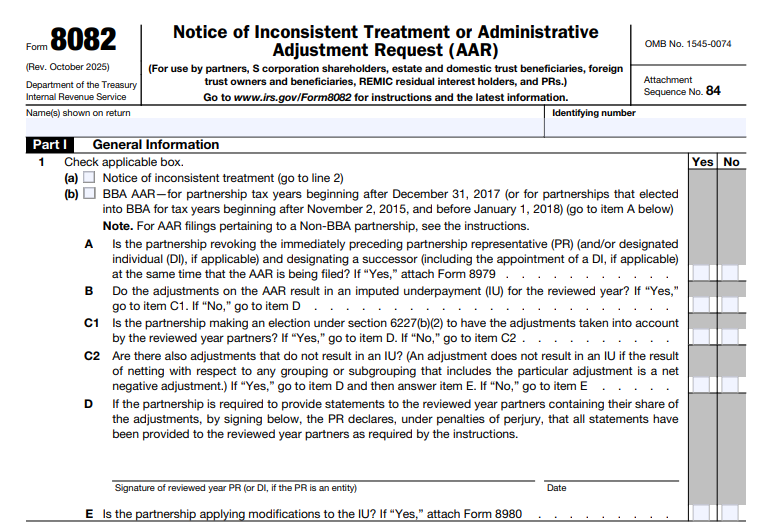

IRS Form 8082 – Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR) – IRS Form 8082, titled “Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR),” is a critical tax document for partners, shareholders, and beneficiaries dealing with pass-through entities. As of the latest revision in October 2025, this form serves two primary purposes: notifying the IRS of inconsistencies in how items are reported on your tax return compared to the pass-through entity’s reporting, and allowing certain partnerships to request administrative adjustments to prior returns under the Bipartisan Budget Act (BBA) rules.

Whether you’re a partner in a partnership, an S corporation shareholder, a trust beneficiary, or involved with a REMIC (Real Estate Mortgage Investment Conduit), understanding Form 8082 can help ensure compliance and avoid penalties. This guide covers what the form is, when to file it, how to complete it, and key updates for 2025.

What Is IRS Form 8082?

Form 8082 allows taxpayers to alert the IRS to discrepancies between their individual tax treatment of items and the treatment reported by a pass-through entity on schedules like Schedule K-1, Schedule K-3, Schedule Q, Form 8986 (from a BBA AAR), or foreign trust statements.

Pass-through entities (such as partnerships, S corporations, estates, trusts, foreign trusts, and REMICs) generally do not pay entity-level taxes. Instead, income, deductions, credits, and other items “pass through” to owners or beneficiaries, who must typically report them consistently with the entity’s filing.

If you report an item differently—intentionally or due to missing information—you must file Form 8082 to notify the IRS. Failure to do so can result in immediate assessment of deficiencies, including penalties.

Additionally, under the BBA centralized partnership audit regime (applicable to most partnerships for tax years beginning after 2017), the partnership representative (PR) or designated individual (DI) uses Form 8082 to file an Administrative Adjustment Request (AAR) correcting errors on a previously filed Form 1065.

When to File Form 8082

You should file Form 8082 in these common scenarios:

- Inconsistent Treatment: You report an item (e.g., income, deduction, credit, or even non-monetary items like capital ownership percentage) differently from the pass-through entity’s Schedule K-1, K-3, Q, Form 8986, or foreign trust statement.

- Missing Schedules: You did not receive required schedules (e.g., Schedule K-1, K-3, or Q) by your return’s due date (including extensions).

- BBA Partnership AAR: As the PR or DI, you’re correcting items on a prior partnership return. This includes calculating any imputed underpayment (IU) or electing to “push out” adjustments to reviewed-year partners via Forms 8985 and 8986.

Note: TEFRA (Tax Equity and Fiscal Responsibility Act) rules no longer apply for tax years beginning after 2017, and references to them have been removed in the 2025 form revision.

Form 8082 must not be filed alone. Attach it to your income tax return (for inconsistent treatment) or to the amended/corrected partnership return (for AAR).

Key Changes in the 2025 Revision of Form 8082

The latest Form 8082 (Rev. October 2025) and its instructions reflect ongoing refinements to the BBA rules:

- Removal of all TEFRA references, as they are obsolete for current tax years.

- Clarified sections for BBA AAR filings, including questions about imputed underpayments, push-out elections under section 6227(b)(2), and revoking/designating a new PR (requiring attachment of Form 8979 if applicable).

- Emphasis on electronic filing for BBA AARs, often paired with a revised Form 1065.

- Updated guidance on handling adjustments that do not result in an IU, requiring push-out statements (Forms 8985 and 8986) to partners.

Always download the current version from IRS.gov to ensure compliance.

IRS Form 8082 Download and Printable

Download and Print: IRS Form 8082

How to Complete and File Form 8082: Step-by-Step

Part I: General Information

- Check box (a) for notice of inconsistent treatment or box (b) for AAR.

- For BBA AARs, answer questions about IU, push-out elections, and PR changes.

Identifying the Pass-Through Entity

- Specify the entity type (e.g., BBA partnership, S corporation).

- Provide the entity’s name, EIN, address, and tax year.

Part II: Inconsistent or AAR Items (Lines 8–11)

- Describe each item (column a).

- Indicate the amount reported by the entity (column c), your reported amount (column d), and the difference (column e).

- For non-monetary items, provide explanations in Part III without filling monetary columns.

Part III: Explanations

- Detail reasons for inconsistencies or adjustments, including IU calculations if applicable.

Filing Tips

- Attach supporting schedules or statements as needed.

- For electronic BBA AARs: File a revised Form 1065 (amended box checked) with Form 8082 attached.

- For paper filings: Use Form 1065-X in some cases.

- Sign the form (manual signature required for certain push-out attestations).

Consult a tax professional for complex AARs involving imputed underpayments or modifications (which may require Form 8980).

Common Mistakes to Avoid with Form 8082

- Filing inconsistently without notifying the IRS via Form 8082, leading to penalties.

- Incomplete IU calculations for BBA AARs.

- Forgetting to furnish Forms 8986 to partners when pushing out adjustments.

- Using outdated form versions—always use the October 2025 revision or later.

Conclusion

IRS Form 8082 is essential for maintaining consistency in pass-through entity reporting and correcting errors under BBA rules. By filing it promptly and accurately, you can avoid assessments and penalties while ensuring proper tax treatment.

For the most up-to-date information, visit the official IRS page on About Form 8082 or download the form and instructions directly from IRS.gov. Tax laws can be complex, so consider consulting a qualified tax advisor for your specific situation.

This article is for informational purposes only and not tax advice. Sources: IRS.gov (Form 8082 Rev. October 2025, Instructions Rev. October 2025).