Table of Contents

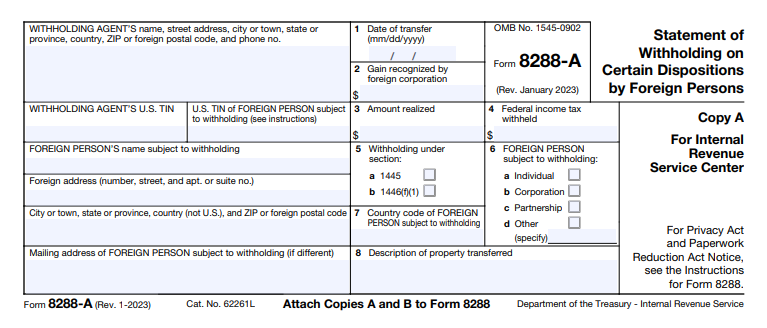

IRS Form 8288-A – Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property Interests – When a foreign person sells or disposes of a U.S. real property interest (USRPI), U.S. tax rules require withholding to ensure compliance with the Foreign Investment in Real Property Tax Act (FIRPTA) under Internal Revenue Code Section 1445. IRS Form 8288-A, titled Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property Interests, plays a critical role in this process. This form documents the tax withheld and allows the foreign seller (transferor) to claim credit for it on their U.S. tax return.

As of December 2025, the current version of Form 8288-A is the January 2023 revision, per the official IRS website. Understanding Form 8288-A is essential for buyers, sellers, and withholding agents involved in international real estate transactions to avoid penalties and ensure proper tax reporting.

What Is FIRPTA and Why Does Withholding Apply?

FIRPTA, enacted in 1980, authorizes the United States to tax foreign persons on gains from the disposition of U.S. real property interests. A USRPI includes real estate like land, buildings, and certain interests in U.S. corporations holding real property.

The buyer (transferee) is typically responsible for withholding tax, acting as the withholding agent. The standard withholding rate is 15% of the amount realized (generally the sales price), unless reduced by exceptions or a withholding certificate.

Without proper withholding and reporting via Forms 8288 and 8288-A, the buyer may face liability for the tax, plus interest and penalties.

Purpose of IRS Form 8288-A

Form 8288-A serves as a statement verifying the amount withheld from the foreign seller. It is prepared for each foreign transferor involved in the disposition.

Key functions include:

- Providing details about the transferor, transferee, property, and withheld amount.

- Allowing the IRS to validate the withholding.

- Enabling the foreign seller to receive a stamped Copy B, which they attach to their U.S. tax return (e.g., Form 1040-NR) to claim credit for the withheld tax.

The form has three copies:

- Copy A and B: Attached to Form 8288 and sent to the IRS.

- Copy C: Retained by the withholding agent.

The IRS processes the forms and, if complete (including the transferor’s TIN), stamps and returns Copy B to the seller for credit claiming.

IRS Form 8288-A Download and Printable

Download and Print: IRS Form 8288-A

How Form 8288-A Works with Form 8288

Form 8288-A is used in conjunction with Form 8288, the U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests.

Process overview:

- The buyer withholds the required tax at closing.

- Within 20 days after the date of transfer, the buyer files Form 8288 with the IRS, attaching Copies A and B of Form 8288-A.

- The withheld tax is remitted to the IRS (electronically via EFTPS for payments after September 30, 2025).

- The IRS validates and returns stamped Copy B of Form 8288-A to the foreign seller.

If the transferor’s U.S. taxpayer identification number (TIN, such as an ITIN) is missing, the IRS will not stamp and return Copy B until the TIN is provided.

Who Must File Form 8288-A?

The buyer or transferee (withholding agent) prepares and submits Form 8288-A along with Form 8288. Foreign sellers do not file it directly but use the stamped copy for their tax return.

Exceptions where withholding (and thus these forms) may not apply include:

- The sales price is $300,000 or less, and the buyer intends to use the property as a residence.

- The seller provides a certification of non-foreign status.

- A withholding certificate reduces or eliminates the requirement.

Applying for Reduced Withholding: Form 8288-B

If the actual tax liability is expected to be less than the standard 15% withholding (e.g., due to low gain or loss), the seller or buyer can apply for a withholding certificate using Form 8288-B. Approval can reduce withholding to the anticipated tax amount, potentially allowing more proceeds to the seller at closing.

Applications should be submitted before or at closing for best results.

Recent Updates and Filing Requirements (as of 2025)

- The January 2023 revisions to Forms 8288 and 8288-A incorporate rules for certain partnership interest transfers under Section 1446(f).

- FIRPTA withholding payments must now be made electronically via the Electronic Federal Tax Payment System (EFTPS), with paper checks phased out after September 30, 2025.

- Always check the IRS website for the latest forms and instructions, as rules can evolve.

Tips for Compliance and Claiming Credit

- Foreign sellers should obtain an ITIN if needed by filing Form W-7.

- Attach the stamped Form 8288-A to your U.S. tax return to claim the withholding credit—overwithholding often results in refunds.

- Consult IRS Publication 515 (Withholding of Tax on Nonresident Aliens and Foreign Entities) for detailed guidance.

Proper handling of Form 8288-A ensures smooth FIRPTA compliance, minimizes delays in refunds, and avoids IRS penalties. For personalized advice, consult a tax professional familiar with international real estate transactions.

Sources: Official IRS website (irs.gov/forms-pubs/about-form-8288-a, irs.gov/instructions/i8288, and related pages), Publication 515, and FIRPTA withholding guidance as of late 2025.