Table of Contents

IRS Form 12277 – Application for Withdrawal of Filed IRS Form 668(Y), Notice of Federal Tax Lien (Internal Revenue Code Section 6323(j)) – If you’re dealing with a federal tax lien from the IRS, it can feel overwhelming. A federal tax lien is a legal claim against your property when you owe back taxes, and it can impact your credit, ability to sell assets, or secure loans. The good news? You may be able to withdraw the Notice of Federal Tax Lien (NFTL) using IRS Form 12277, even if you still owe the debt. This process, outlined under Internal Revenue Code (IRC) Section 6323(j), removes the public notice without erasing your tax obligation.

In this comprehensive guide, we’ll cover everything you need to know about IRS Form 12277, including eligibility, filing steps, and benefits. Whether you’re a small business owner or an individual taxpayer, understanding this form can help restore your financial flexibility. We’ll draw from official IRS resources to ensure accuracy as of late 2025.

What Is a Federal Tax Lien and Why Withdraw It?

A federal tax lien arises automatically when the IRS assesses your tax debt, sends a Notice and Demand for Payment, and you fail to pay in full. It attaches to all your property, including real estate, vehicles, and financial assets, giving the IRS priority over other creditors.

Withdrawing the NFTL doesn’t cancel the lien itself but removes the public record (Form 668(Y)). This means the IRS steps back from competing with other creditors for your assets, making it easier to refinance, sell property, or improve your credit score. Unlike a lien release (which happens after full payment), withdrawal is possible while the debt remains outstanding. It’s especially useful under the IRS Fresh Start initiative, which expanded options in 2011 and remains in effect.

What Is IRS Form 12277?

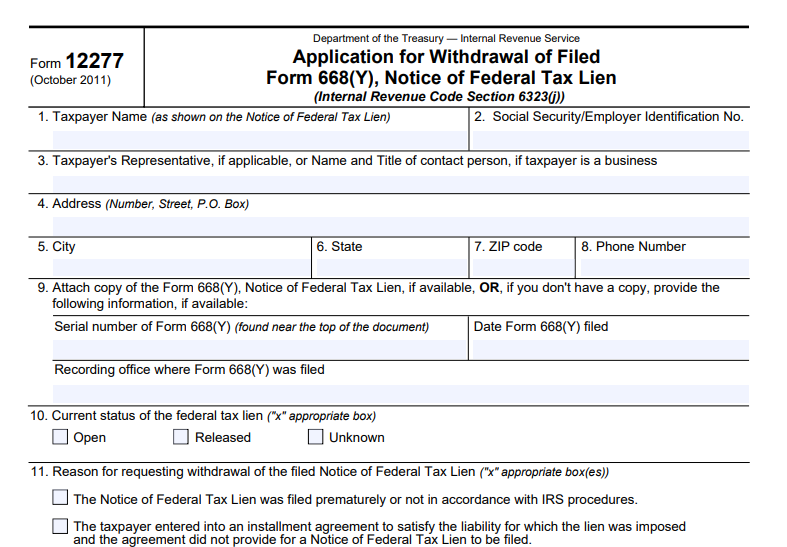

IRS Form 12277, titled “Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien (Internal Revenue Code Section 6323(j)),” is the official document to request NFTL withdrawal. Its primary purpose is to allow taxpayers to apply for removal of the public lien notice if certain conditions are met.

The form requires details about you, the lien, and your reason for the request. It’s a one-page application, but you’ll need to provide supporting evidence. The latest revision is from October 2011, but procedures are updated in IRS manuals and publications as of 2025.

Eligibility Requirements for Withdrawing a Federal Tax Lien

Under IRC Section 6323(j), the IRS may approve withdrawal if at least one of these criteria applies:

- Premature or Non-Compliant Filing: The NFTL was filed too soon or not following IRS rules, such as during a bankruptcy stay or in error (e.g., duplicate filings or for certain assessments like Shared Responsibility Payments).

- Installment Agreement: You’ve entered an installment agreement to pay the debt, and it doesn’t require the lien to remain. Special rules apply for Direct Debit Installment Agreements (DDIAs): You must owe $25,000 or less, plan to pay within 60 months, have made three consecutive payments, and be in full compliance with filings and payments.

- Facilitates Collection: Withdrawal would help the IRS collect more taxes, such as by enabling you to secure better financing or increase your income.

- Best Interests: It’s in the best interest of both you (or as determined by the Taxpayer Advocate) and the government, often for post-release withdrawals after the debt is paid but the notice lingers.

For post-release withdrawals (after the lien is satisfied), you must have filed all returns for the past three years and be current on estimated payments. Note: Withdrawal isn’t guaranteed except in cases like bankruptcy violations.

Step-by-Step Guide to Filing IRS Form 12277

Filing is straightforward but requires attention to detail. Here’s how:

- Gather Information: Collect your taxpayer details (name, SSN/EIN), lien details (serial number, filing date, recording office), and evidence supporting your request.

- Complete the Form:

- Sections 1-3: Enter your name, TIN, and preparer’s info if applicable.

- Sections 4-8: Provide contact details.

- Section 9: Attach or describe the NFTL.

- Section 10: Indicate lien status (open, released, or unknown).

- Section 11: Check the reason(s) for withdrawal.

- Section 12: Explain in detail with supporting docs.

- Sign and date under penalties of perjury.

- Attach Supporting Documents: Include NFTL copy, explanations, affidavits, or proof of compliance (e.g., installment agreement details).

- Submit: Mail or fax to the appropriate IRS office (more below). You can also submit via Your Online Account on IRS.gov for faster processing.

If incomplete, the IRS may request more info within 21 days.

Required Documents and Attachments

- A copy of Form 668(Y) or lien details if unavailable.

- Detailed explanation in Section 12, with extra sheets if needed.

- Proof for your eligibility reason, such as installment agreement copies or evidence of erroneous filing.

- Written request to notify third parties (e.g., credit bureaus) if desired.

For joint liabilities, all parties must sign or consent.

Where to Send Your IRS Form 12277 Application

Send to the IRS Advisory Group Manager in your area. Use Publication 4235 for addresses. Alternatively:

- Mail: IRS, Advisory Consolidated Receipts, 7940 Kentucky Drive, Stop 2850A, Florence, KY 41042-2915.

- Fax: 844-201-8382.

- Online: Through IRS.gov Your Online Account.

If assigned to a revenue officer, submit directly to them.

IRS Form 12277 Download and Printable

Download and print: IRS Form 12277

Processing Time and What to Expect

The IRS aims to review complete applications within 30 days and approve/deny within another 10 days. If approved, they’ll file Form 10916(c) with the recording office and send you a copy within 15 days. You’ll get a letter confirming the decision.

If denied, you’ll receive appeal rights via Form 9423 and Publication 1660. Processing can take longer for complex cases.

Benefits of Withdrawing a Federal Tax Lien

- Improves credit by removing public notice (though liens haven’t been reported to credit agencies since 2018).

- Eases selling or refinancing property without IRS priority.

- Facilitates business operations or personal loans.

- May help in bankruptcy or collection scenarios.

Common Reasons for Denial and How to Appeal

Denials often occur if withdrawal risks collection, like if subordination is a better option or if you’re not in compliance. Appeal by requesting a conference with the IRS Independent Office of Appeals within the timeframe specified.

Frequently Asked Questions About IRS Form 12277

Can I withdraw a lien after paying my taxes?

Yes, via post-release withdrawal if you’re compliant with filings.

Does withdrawal forgive my tax debt?

No, you still owe the amount; it just removes the public notice.

How does this affect my credit report?

It helps by eliminating the public record, potentially improving scores over time.

What if I need help filing?

Contact the Taxpayer Advocate Service (TAS) for guidance or Low Income Taxpayer Clinics.

Conclusion: Take Control of Your Tax Lien Today

Withdrawing a federal tax lien via IRS Form 12277 can be a game-changer for your finances. By meeting eligibility and following the steps, you can reduce the lien’s impact while working toward resolution. Always consult official IRS resources or a tax professional for personalized advice. For the latest forms and pubs, visit IRS.gov. If you’re ready to apply, download Form 12277 and get started.