Table of Contents

IRS Form 5754 – Statement by Person(s) Receiving Gambling Winnings – Gambling can be an exciting pastime, but when lady luck smiles and you hit a jackpot, tax implications come into play. If you’re sharing winnings with others or receiving them on behalf of someone else, IRS Form 5754 becomes essential. This form ensures accurate reporting of gambling income to the IRS, helping avoid penalties while complying with tax laws. In this comprehensive guide, we’ll cover everything you need to know about Form 5754, including its purpose, when to use it, step-by-step instructions on how to fill it out, and recent updates for 2025 and beyond. Whether you’re a casual gambler or part of a group pooling bets, understanding this form can save you time and headaches during tax season.

What Is IRS Form 5754?

IRS Form 5754, titled “Statement by Person(s) Receiving Gambling Winnings,” is a document used to identify the actual winners of gambling prizes when the payout is made to someone other than the winner or shared among multiple people. It’s not filed directly with the IRS but provided to the payer (like a casino or lottery operator) to help them prepare Form W-2G, “Certain Gambling Winnings,” for each true recipient.

The form captures details about the winnings, including the total amount, federal income tax withheld (if any), and the allocation among winners. This is crucial because gambling winnings are taxable income, and the IRS requires reporting for amounts meeting certain thresholds. For example, in 2025, winnings from slot machines, bingo, or keno must be reported if $1,200 or more, while other types like horse racing have a $600 threshold if the payout is at least 300 times the wager. Form 5754 ensures that taxes are withheld and reported correctly, even in group scenarios like friends splitting a lottery ticket.

When Do You Need to Use Form 5754?

You must complete Form 5754 if:

- You receive gambling winnings but are not the actual winner (e.g., acting as a nominee or agent).

- The winnings are shared among two or more people, such as group bets on sports, poker, or lotteries.

Common situations include:

- Sharing a winning lottery ticket with family or friends.

- Pooling money for slot pulls or sports wagers in a group.

- Receiving payouts for someone else, like a professional gambler using a proxy.

The payer, such as a casino, will typically request this form if the winnings trigger reporting requirements. Failure to provide it could lead to incorrect withholding or reporting, potentially resulting in IRS audits or penalties. Note that for state-conducted lotteries, you may only need to provide your Taxpayer Identification Number (TIN) without full identification.

IRS Form 5754 Download and Printable

Download and Print: IRS Form 5754

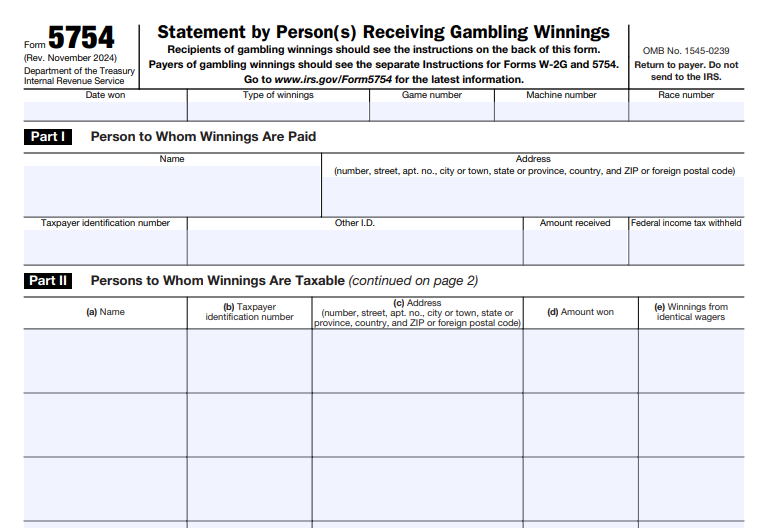

How to Fill Out IRS Form 5754: Step-by-Step Instructions

Filling out Form 5754 is straightforward but requires accuracy to ensure proper tax reporting. The form has two main parts and must be returned to the payer—do not send it to the IRS. Here’s a breakdown:

Part I: Person to Whom Winnings Are Paid

- Name, Address, and TIN: Enter the details of the person or entity receiving the payment from the payer.

- Other I.D.: Optional for state lotteries; otherwise, leave blank.

- Amount Received: Total gross winnings before any deductions.

- Federal Income Tax Withheld: Amount withheld by the payer (typically 24% for winnings over $5,000 after subtracting the wager).

- Additional fields: Include date won, type of winnings (e.g., slots, lottery), game/machine/race number for verification.

Part II: Persons to Whom Winnings Are Taxable

- List each actual winner, including yourself if applicable.

- Columns:

- (a) Name

- (b) TIN (Social Security Number for individuals, Employer Identification Number for others)

- (c) Address

- (d) Amount Won (individual share)

- (e) Winnings from Identical Wagers (additional amounts from similar bets with the same payer on the same event)

- If you’re one of the winners, enter “Same as above” for your info if it matches Part I.

- Continue on page 2 if there are more than a few winners.

Signature and Date

- Sign under penalties of perjury if federal tax is withheld; otherwise, a signature isn’t required.

- Return the completed form to the payer immediately. They will use it to issue Form W-2G by January 31 of the following year.

Tips for accuracy:

- Aggregate winnings from identical wagers before allocating shares.

- Use the latest revision (Rev. November 2024 for 2025 filings).

- Keep a copy for your records, as you’ll need it for your tax return.

Related Forms and Gambling Winnings Reporting

Form 5754 directly ties to Form W-2G, which reports winnings to the IRS and the recipient. You’ll receive a W-2G if your winnings meet thresholds, and you must report them on your Form 1040, Schedule 1. Gambling losses can be deducted up to the amount of winnings on Schedule A if you itemize, but only if documented.

Other related aspects:

- Withholding: 24% federal withholding applies to winnings over $5,000 (minus wager) for most games.

- State Taxes: Many states have their own forms (e.g., IL-5754 for Illinois) and withholding requirements.

- Backup Withholding: If no TIN is provided, 24% may be withheld regardless of amount.

Recent Updates to IRS Form 5754 and Gambling Tax Rules in 2025

As of December 2025, Form 5754 itself hasn’t seen major revisions since November 2024, but significant changes are coming for gambling reporting thresholds starting in 2026. The IRS has unified the reporting threshold to $2,000 for most winnings, including slots (up from $1,200) and explicitly including sports wagering for the first time. This threshold will adjust annually for inflation beginning in 2027.

Key impacts:

- For sports betting: Report if winnings (minus wager) are $2,000+ and at least 300 times the wager.

- Withholding remains at 24% for winnings over $5,000 (minus wager).

- Casinos benefit from reduced paperwork for smaller wins, but gamblers must still self-report all income.

- Draft guidance for 2026 emphasizes aggregation of identical wagers and stricter ID requirements.

For 2025 filings (covering 2024 winnings), use the existing thresholds. Check IRS.gov for the latest drafts and updates, as these changes may influence how payers handle Form 5754 in transition years.

Frequently Asked Questions About IRS Form 5754

Do I file Form 5754 with my tax return?

No, submit it only to the payer. They handle W-2G filing with the IRS.

What if winnings are under the reporting threshold?

Form 5754 isn’t needed, but winnings are still taxable income.

Can I e-file Form 5754?

It’s not e-filed; it’s a paper form given to the payer.

What happens if I don’t provide Form 5754?

The payer might withhold taxes on the full amount or report it under one name, leading to mismatches on your return.

Are online gambling winnings treated the same?

Yes, platforms like sportsbooks follow the same rules for W-2G and Form 5754.

Conclusion

Navigating taxes on gambling winnings doesn’t have to be a gamble. IRS Form 5754 simplifies reporting for shared or nominee payouts, ensuring everyone gets their fair share documented correctly. With upcoming 2026 changes streamlining thresholds, staying informed is key. Always consult a tax professional for personalized advice, and keep detailed records of wins and losses. For the most current information, visit the official IRS website or trusted tax resources. Happy (and responsible) gaming!