Table of Contents

IRS Form 5495 – Request for Discharge from Personal Liability Under Internal Revenue Code Section 2204 or 6905 – In the complex world of estate and gift taxes, navigating personal liability can be daunting for executors, trustees, and other fiduciaries. IRS Form 5495, officially titled “Request for Discharge from Personal Liability Under Internal Revenue Code Section 2204 or 6905,” provides a crucial mechanism for seeking relief from such liabilities. This form allows certain individuals to request a discharge from personal responsibility for unpaid estate or gift taxes, ensuring they can distribute assets without lingering tax concerns. Whether you’re handling an estate after a loved one’s passing or managing gift tax obligations, understanding Form 5495 is essential for compliance and peace of mind.

In this comprehensive guide, we’ll break down what IRS Form 5495 is, who qualifies to file it, the filing process, and key considerations. We’ll draw from official IRS resources to ensure accuracy and timeliness as of 2025. If you’re searching for “IRS Form 5495 instructions” or “discharge from estate tax liability,” you’ve come to the right place.

What Is IRS Form 5495 and Its Purpose?

IRS Form 5495 is used to request a discharge from personal liability for estate taxes under Internal Revenue Code (IRC) Section 2204 or for gift taxes under IRC Section 6905. Essentially, it protects fiduciaries—like executors, administrators, or trustees—from being held personally accountable for any deficiencies in estate or gift tax payments after they’ve distributed the assets.

- Under IRC Section 2204: This applies to estate taxes. It allows the executor or fiduciary to request discharge after filing the estate tax return (Form 706) and paying the reported tax. The IRS will review the request and, if approved, issue a certificate of discharge, limiting the fiduciary’s liability to the value of the property they received or distributed.

- Under IRC Section 6905: This pertains to gift taxes. It enables the fiduciary to seek similar relief for unpaid gift taxes from a donor’s estate.

The form’s primary goal is to facilitate the timely distribution of estate assets while ensuring the IRS can still collect any owed taxes from the proper sources. According to the IRS, this process helps prevent undue delays in probate or trust administration.

Who Can File IRS Form 5495?

Not everyone involved in an estate or gift tax situation can file Form 5495. Eligibility is specific to roles and circumstances:

- Executors and Administrators: Those appointed to manage a decedent’s estate under IRC Section 2204.

- Trustees and Fiduciaries: Individuals or entities responsible for trusts or other assets subject to estate or gift taxes.

- Transferees or Donees: In some cases, recipients of gifts or estate property who might face transferee liability under IRC Section 6905.

To qualify, you must have filed the relevant tax return (e.g., Form 706 for estates or Form 709 for gifts) and paid the tax shown as due. The request must be made within the specified time frames—typically within 18 months after the tax becomes due or after payment, whichever is later.

If you’re unsure about your eligibility, consult a tax professional or review the IRS instructions for Form 5495, which provide detailed examples.

Step-by-Step Guide: How to File IRS Form 5495

Filing IRS Form 5495 requires careful preparation to avoid delays or denials. Here’s a streamlined process based on current IRS guidelines:

- Gather Required Information: Collect details from the estate or gift tax return, including the decedent’s or donor’s name, Social Security Number (SSN), date of death or gift, and the amount of tax paid.

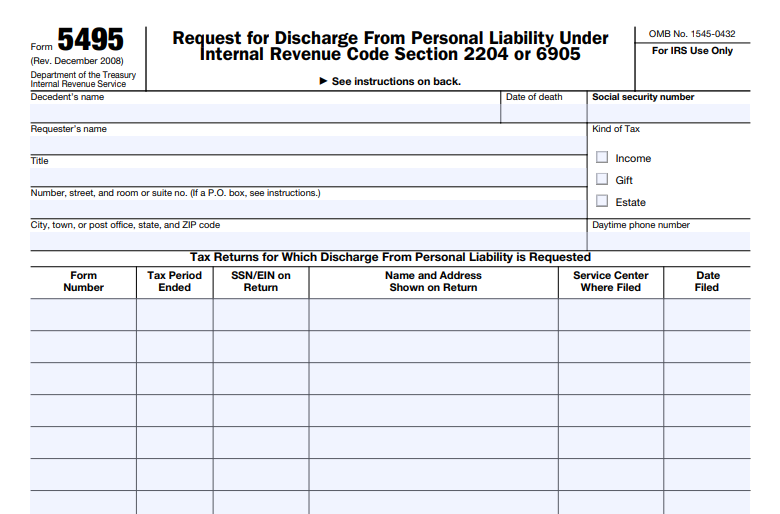

- Complete the Form:

- Part I: Identify the requester and the type of discharge (Section 2204 or 6905).

- Part II: Provide details about the estate or gift, including tax return filing dates and payments.

- Part III: List any distributed property and its value.

- Sign and date the form under penalty of perjury.

- Attach Supporting Documents: Include copies of the tax return, proof of payment, and any relevant fiduciary appointment documents (e.g., letters testamentary).

- Submit the Form: Mail it to the IRS address specified in the instructions—typically the service center where the original tax return was filed. Electronic filing is not currently available for Form 5495.

- Wait for IRS Response: The IRS generally processes these requests within 6-9 months. If approved, you’ll receive a certificate of discharge. If additional taxes are assessed, the fiduciary may still be liable up to the distributed amount.

Key Considerations and Common Mistakes to Avoid

While Form 5495 offers significant protections, there are pitfalls to watch for:

- Timing Is Critical: Requests must be timely; late filings may result in automatic denial.

- Incomplete Information: Failing to provide full details about distributed assets can lead to rejections.

- Transferee Liability: Even with discharge, beneficiaries might still face liability if taxes remain unpaid.

- Amended Returns: If you amend the original tax return after filing Form 5495, you may need to submit a new request.

Recent updates as of 2025 include clarifications on digital asset reporting in estates, which could impact Form 5495 filings involving cryptocurrencies or NFTs. Always check the latest IRS publications for changes.

IRS Form 5495 Download and Printable

Download and Print: IRS Form 5495

Frequently Asked Questions About IRS Form 5495

What happens if my Form 5495 request is denied?

If denied, you remain personally liable. You can appeal or provide additional information to the IRS.

Is there a fee for filing Form 5495?

No, there is no filing fee, but professional tax advice may incur costs.

Can I file Form 5495 for multiple estates?

Yes, but submit separate forms for each estate or gift tax situation.

Where can I download IRS Form 5495?

Visit the official IRS website to download the latest version of the form and instructions.

Conclusion: Secure Your Peace of Mind with IRS Form 5495

Handling estate or gift taxes doesn’t have to leave you exposed to personal liability. By properly using IRS Form 5495, you can request discharge under IRC Sections 2204 or 6905, allowing for efficient asset distribution. Stay compliant by relying on official IRS resources and consulting experts when needed. For more on “estate tax discharge” or related forms like Form 706, explore additional IRS guides.

This article is for informational purposes only and not tax advice. For personalized guidance, contact a qualified tax professional or the IRS directly.