Table of Contents

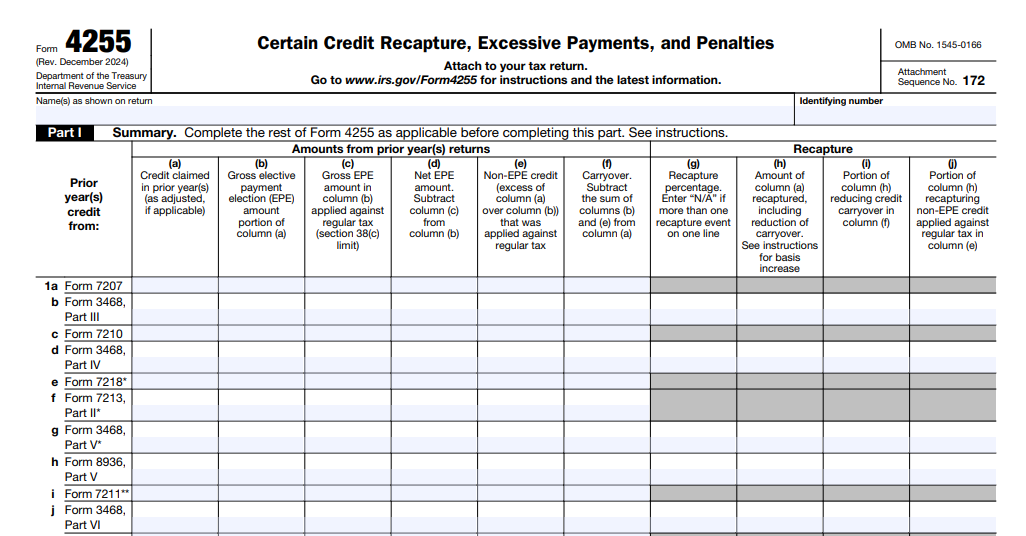

IRS Form 4255 – Certain Credit Recapture, Excessive Payments, and Penalties – IRS Form 4255, titled “Certain Credit Recapture, Excessive Payments, and Penalties,” is a key tax form for taxpayers who have claimed certain investment credits, particularly energy-related credits under the Inflation Reduction Act (IRA). The form calculates any increase in tax liability due to the recapture of previously claimed credits, excessive elective payments or credit transfers, and penalties related to prevailing wage and apprenticeship (PWA) requirements. As of December 2025, the latest revision (Rev. December 2024, applicable for many 2025 filings) reflects updates from the IRS to handle modern clean energy incentives.

According to the official IRS page, Form 4255 is used to figure the amount due for certain credit recaptures, excessive payments, excessive credit transfers, and prevailing wage and apprenticeship penalty amounts.

What Is Form 4255 Used For?

Taxpayers primarily use Form 4255 in these scenarios:

- Recapture of Investment Credits — Under IRC Section 50(a), if investment credit property (e.g., solar panels, wind turbines, or advanced manufacturing facilities) is disposed of, ceases to qualify, or experiences other triggering events before the end of its recapture period (typically 5 years), a portion of the previously claimed credit must be recaptured as additional tax.

- Excessive Elective Payments or Credit Transfers — For credits elected as direct payments (under Section 6417) or transferred to another taxpayer (under Section 6418), if the IRS determines the amount was excessive, the excess (plus a potential 20% penalty if no reasonable cause) is reported here.

- Prevailing Wage and Apprenticeship (PWA) Penalties — Many IRA-enhanced credits require compliance with prevailing wage rates and apprenticeship standards during construction. Failure can trigger penalties, which are now reported on Form 4255 to retain the increased (5x) credit amount.

The form attaches to your tax return (e.g., Form 1120, 1065, or 990-T for exempt entities) and increases your Chapter 1 tax liability.

When Do You Need to File Form 4255?

You must file Form 4255 if any of the following apply in the current tax year:

- You disposed of or stopped using qualified investment credit property within the recapture period.

- Nonqualified nonrecourse financing increased, reducing the qualified credit base.

- An emissions tier change occurred for clean hydrogen facilities.

- The IRS notified you of an excessive elective payment or credit transfer.

- You incurred PWA penalties but wish to pay them to keep the enhanced credit.

Exceptions to recapture include certain transfers (e.g., due to death or within the same trade or business). Always consult the instructions for specifics.

IRS Form 4255 Download and Printable

Download and Print: IRS Form 4255

Key Parts of Form 4255

- Part I: Summary — This aggregates recapture amounts, excessive payments, transfers, and PWA penalties across various credit types (e.g., from Form 3468 or 3800). Columns separate recapture from elective payments, transfers, and penalties.

- Part II: Recapture Calculation — Detailed sections (B, C, D) for refiguring credits based on property type, disposition date, or other events. Worksheets in the instructions help compute unused credits that could offset the recapture.

The recapture percentage decreases over time: 100% in year 1, 80% in year 2, down to 0% after 5 full years.

How to Avoid or Minimize Recapture and Penalties

- Hold qualified property for at least 5 years.

- Ensure compliance with PWA requirements during construction (or cure failures promptly with payments and penalties).

- Accurately register projects and claim credits to avoid excessive payment determinations.

- Document basis adjustments under Section 50(c) for direct pay elections.

Recent Updates for 2025

The December 2024 revision expanded Part I to explicitly handle PWA penalties (column p) and refined columns for elective payments and transfers. Draft 2025 versions show minor clarifications, but the 2024 form applies for most 2025 filings unless updated guidance is issued.

For the latest form and instructions, visit IRS.gov/Form4255. Professional tax advice is recommended, as calculations can be complex, especially for partnerships/S corporations (which report certain amounts directly on their returns).

Understanding Form 4255 helps taxpayers navigate clean energy incentives while avoiding unexpected tax increases. Stay compliant to maximize benefits under current IRS rules.