Table of Contents

IRS Form 8881 – Credit for Small Employer Pension Plan Startup Costs – Small business owners looking to establish retirement plans can significantly reduce costs through IRS Form 8881, the Credit for Small Employer Pension Plan Startup Costs. Enhanced by the SECURE 2.0 Act, this tax credit helps eligible employers offset expenses for setting up and administering qualified retirement plans, such as 401(k)s, SEP IRAs, or SIMPLE IRAs. As of 2025, the credit offers up to $5,000 per year for three years, plus additional benefits for employer contributions and other features.

What Is IRS Form 8881?

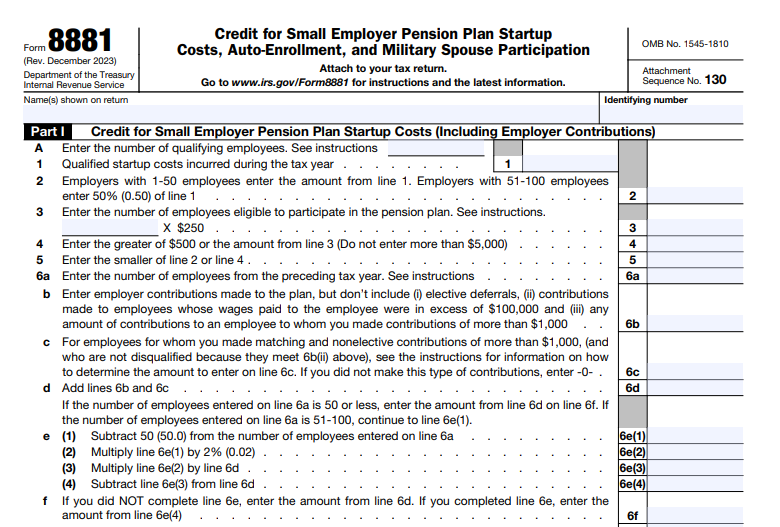

Form 8881 allows small employers to claim a nonrefundable tax credit for qualified startup costs related to new eligible employer plans. The credit applies to expenses paid or incurred in establishing, administering, or educating employees about the plan. It also includes credits for automatic enrollment and military spouse participation.

According to the IRS, eligible small employers use this form to reduce their federal tax liability dollar-for-dollar, making retirement benefits more accessible for workers.

Key Changes from SECURE 2.0 Act (Effective for Tax Years After 2022)

The SECURE 2.0 Act of 2022 substantially improved the credit under Internal Revenue Code Section 45E:

- Employers with 1–50 employees: Increased to 100% of qualified startup costs (up from 50%).

- Employers with 51–100 employees: Remains at 50% of qualified startup costs.

- Additional credit for employer contributions (nonelective or matching, excluding employee deferrals).

- New military spouse participation credit.

These enhancements apply to plans established after December 31, 2022, and remain in effect for 2025 filings.

Eligibility Requirements for Form 8881

To qualify as an eligible small employer:

- You must have had 100 or fewer employees who received at least $5,000 in compensation in the preceding tax year.

- You cannot claim the credit if you had more than 100 employees in the prior year.

- The plan must cover at least one non-highly compensated employee (NHCE).

- The plan must be new: No substantially similar plan covering the same employees in the three prior tax years.

- Controlled groups and predecessors are aggregated for eligibility.

Eligible plans include qualified defined contribution plans (e.g., 401(k), profit-sharing), SEP IRAs, SIMPLE IRAs, and certain defined benefit plans.

IRS Form 8881 Download and Printable

Download and Print: IRS Form 8881

How Much Is the Small Employer Pension Plan Startup Costs Credit?

The base startup costs credit is calculated as:

- 100% (for 1–50 employees) or 50% (for 51–100 employees) of qualified startup costs.

- Limited to the greater of $500 or $250 × number of eligible NHCEs participating.

- Maximum: $5,000 per year.

- Available for up to three tax years (starting with the year the plan becomes effective or the prior year if elected).

Additional Employer Contribution Credit

SECURE 2.0 added a separate credit for employer contributions (not including employee deferrals):

- Up to $1,000 per eligible employee (employees earning ≤ $100,000 in FICA wages, indexed for inflation).

- Phased by plan year:

- Years 1–2: 100%

- Year 3: 75%

- Year 4: 50%

- Year 5: 25%

- After year 5: 0%

- Reduced by 2% for each employee over 50 (for employers with 51–100 employees).

This can add thousands more in credits over five years.

Other Credits on Form 8881

- Automatic Enrollment Credit: $500 per year for three years if the plan includes auto-enrollment.

- Military Spouse Participation Credit: Up to $500 per qualifying military spouse employee (plus contribution credits).

Total potential credits can exceed $16,500 over the initial years for smaller employers.

Qualified Startup Costs

Expenses that qualify include:

- Setup and administration fees (e.g., recordkeeping, TPA services).

- Employee education about the plan and retirement benefits.

Costs must be ordinary and necessary. Note: You must reduce any deductible expenses by the credit amount claimed—no double-dipping.

How to Claim the Credit on Form 8881

- Complete Form 8881 (latest revision: December 2023 or draft 2025 versions available on IRS.gov).

- Attach it to your business tax return (e.g., Form 1040 Schedule C, Form 1065, or Form 1120).

- Report the total credit on Form 3800 (General Business Credit).

- Partnerships and S corporations pass the credit through to owners.

Download the current form and instructions from the official IRS page: About Form 8881.

Why Claim the Form 8881 Credit in 2025?

Offering a retirement plan attracts and retains talent while providing tax advantages. With SECURE 2.0 enhancements, the effective cost of starting a plan can be near zero for many small businesses. Consult a tax professional to confirm eligibility and maximize benefits.

For the most accurate and up-to-date information, refer directly to IRS resources, including Publication 560 (Retirement Plans for Small Business) and the latest Form 8881 instructions.

This credit represents a valuable opportunity under current tax law—don’t leave money on the table when building employee benefits.