Table of Contents

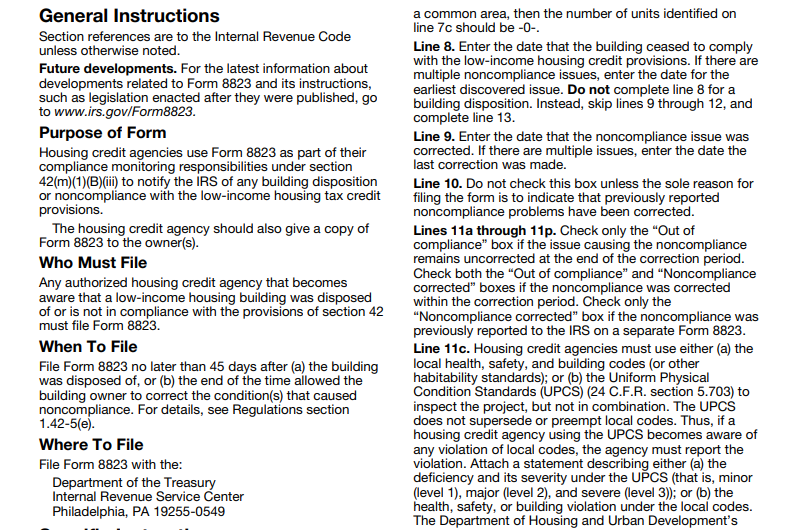

IRS Form 8823 – Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition – The IRS Form 8823, titled “Low-Income Housing Credit Agencies Report of Noncompliance or Building Disposition,” plays a critical role in the Low-Income Housing Tax Credit (LIHTC) program. This federal incentive under Internal Revenue Code Section 42 encourages the development and maintenance of affordable rental housing. State housing credit agencies (HCAs) use Form 8823 to notify the IRS of any noncompliance issues or changes in building ownership during the compliance period.

As of 2025, the current version of Form 8823 is the revision from December 2019 (with accessible updates), and the most recent guidance comes from the IRS’s Guide for Completing Form 8823 (Publication 5913, revised January 2024). Understanding this form is essential for LIHTC property owners, managers, investors, and state agencies to avoid credit recapture and ensure ongoing compliance.

What Is IRS Form 8823?

State housing credit agencies file Form 8823 exclusively with the IRS to report:

- Noncompliance — With LIHTC program requirements, such as tenant eligibility, rent restrictions, or property conditions.

- Building Disposition — Such as sales or transfers of ownership during the 15-year compliance period (or extended use period).

Property owners do not file this form themselves. The HCA submits a separate Form 8823 for each affected building, identified by its Building Identification Number (BIN) from Form 8609.

The IRS uses these reports to determine if previously claimed tax credits remain eligible or if recapture applies. Recapture can occur if noncompliance is not corrected, requiring owners or investors to repay accelerated portions of the credit plus interest.

Who Files Form 8823 and When?

- Filer: State or local housing credit agencies responsible for monitoring LIHTC projects.

- Timing: Agencies must file promptly upon discovering noncompliance or disposition. If corrected within three years, they file a “back in compliance” amended Form 8823.

- Owner Notification: The agency must send a copy of the filed Form 8823 to the property owner.

Common triggers include physical inspections, tenant file reviews, or annual certifications revealing issues.

Key Sections and Categories of Noncompliance on Form 8823

Form 8823 includes specific lines for detailing issues:

- Line 8: Date the building ceased compliance (earliest discovered issue).

- Line 9: Date noncompliance was corrected (if applicable).

- Line 10: Checkbox for filings solely to report correction of prior issues.

- Line 11 (a-q): Checkboxes for specific noncompliance categories, such as:

- 11a: Household income above limit.

- 11b: Incomplete or incorrect tenant income certifications.

- 11c: Physical conditions or UPCS/HQS violations (most common, per industry reports).

- 11e: Gross rent exceeding limits.

- 11k: Failure to provide annual certifications.

- 11q: Other issues (with explanation attached).

The IRS’s Guide for Completing Form 8823 (Rev. January 2024) provides detailed examples for each category, helping agencies classify issues consistently. This guide emphasizes that even minor violations can trigger reporting if they affect qualified units.

IRS Form 8823 Download and Printable

Download and Print: IRS Form 8823

Consequences of Noncompliance Reported on Form 8823

- Uncorrected Issues: The IRS may disallow credits for nonqualified units and initiate recapture.

- Corrected Issues: Filing a “back in compliance” Form 8823 generally prevents recapture if resolved timely.

- IRS Response: The IRS often sends Notification Letter 3464 to owners, advising them to adjust credit claims.

Industry data shows physical violations (11c) and recertification errors (11b) as frequent issues.

How to Correct Noncompliance and Avoid Recapture

- Respond promptly to HCA notices.

- Implement corrections (e.g., repair units, requalify tenants).

- Request the agency file an amended “back in compliance” Form 8823.

- Consult state agency guidance, as it may vary slightly.

The IRS guide stresses that corrections restore compliance without retroactive penalties in most cases.

Recent Updates and Guidance (as of 2025)

- The form itself remains the 2019 revision.

- The companion guide was updated in January 2024 with refreshed examples and process maps.

- No major changes to the form or core requirements have been announced for 2025.

For the latest version, visit the official IRS page at www.irs.gov/forms-pubs/about-form-8823 or download the form and guide directly from IRS.gov.

Best Practices for LIHTC Compliance to Avoid Form 8823

- Conduct regular self-audits and mock inspections.

- Maintain thorough tenant files and annual certifications.

- Train staff on Section 42 requirements.

- Partner with experienced compliance consultants.

Staying proactive minimizes the risk of Form 8823 filings and protects valuable tax credits.

For official details, always refer to IRS.gov resources, including Form 8823, Publication 5913, and Internal Revenue Code Section 42. Consult your state housing agency or tax professional for project-specific advice.