Table of Contents

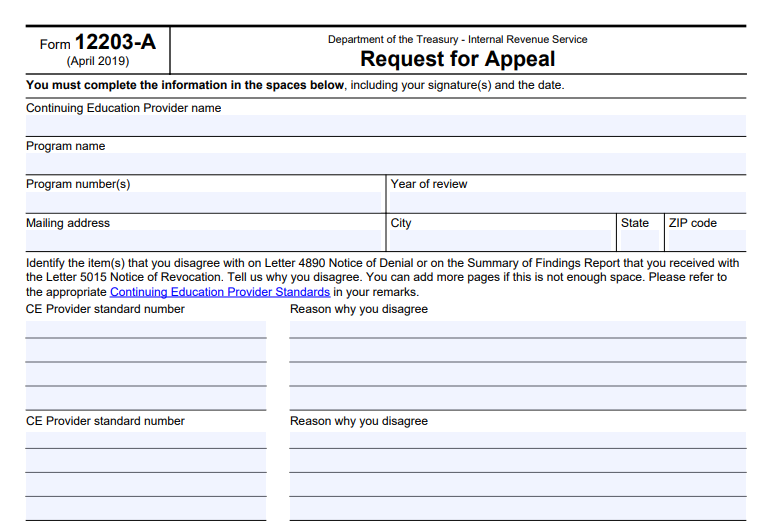

IRS Form 12203-A – Request for Appeal – is a specialized form used by Continuing Education (CE) Providers to challenge certain IRS decisions regarding their provider status. If you’re a tax professional or education provider involved in IRS-approved continuing education programs, this form is essential for appealing denials or revocations. As of December 2025, the latest version remains the April 2019 revision, available directly from the IRS website.

This guide explains the purpose of Form 12203-A, who needs it, how to complete and submit it, and key deadlines—based on official IRS sources for accuracy and compliance.

What Is IRS Form 12203-A Used For?

Form 12203-A allows IRS-approved Continuing Education Providers to appeal:

- A Letter 4890 (Notice of Denial of IRS Continuing Education Provider Status)

- A Letter 5015 (Notice of Revocation of IRS Continuing Education Provider Status)

The IRS approves CE providers to offer qualifying courses for enrolled agents, tax return preparers, and other professionals earning credits toward credentials like the Annual Filing Season Program or Enrolled Agent status. Denial or revocation can impact your ability to offer credited courses and appear on the IRS’s public directory of approved providers.

Unlike the more general Form 12203 (Request for Appeals Review, used for individual taxpayer audit disputes), Form 12203-A is specifically tailored for CE provider appeals.

Key Differences Between Form 12203 and Form 12203-A

| Feature | Form 12203 (Rev. 8-2022) | Form 12203-A (Rev. 4-2019) |

|---|---|---|

| Primary Use | Appeal IRS audit adjustments or proposed changes for individual/business taxpayers (typically $25,000 or less per tax period) | Appeal denial or revocation of IRS CE Provider status |

| Who Uses It | Taxpayers disagreeing with exam/audit results | Continuing Education Providers |

| Related Letters | 30-day audit letters, CP2000 notices, etc. | Letter 4890 (Denial) or Letter 5015 (Revocation) |

| Submission Deadline | Usually 30 days from letter date | 30 calendar days from denial/revocation letter date |

Who Should File Form 12203-A?

You should file if:

- You applied for IRS CE Provider status and received a denial (Letter 4890).

- Your existing approval was revoked (Letter 5015), often due to non-compliance with CE standards (e.g., course content, recordkeeping, or advertising rules).

- You have supporting documentation to contest the IRS’s decision.

Note: Failure to appeal a revocation within 30 days may result in removal from the IRS public listing of approved providers.

IRS Form 12203-A Download and Printable

Download and Print: IRS Form 12203-A

How to Complete and File IRS Form 12203-A

- Download the Form: Get the official PDF from the IRS website: Form 12203-A (Rev. 4-2019).

- Required Information:

- Continuing Education Provider name

- Program name and number(s)

- Year of review

- Your contact details (address, phone, email)

- Explanation of disagreement, referencing specific CE Provider Standards

- Signature(s) and date

- Attachments:

- All supporting information, explanations, or documents (e.g., course materials, compliance records).

- The form must be completed in its entirety for the appeal to be valid.

- Submission Options:

- Upload via secure email in your online CE provider account (preferred).

- Mail to the address shown on your Letter 4890 or 5015.

- Deadline: The IRS must receive your appeal within 30 calendar days of the letter date. Late submissions may not be accepted.

What Happens After Filing?

- The IRS reviews your appeal and attached evidence.

- You’ll receive a notice stating whether the appeal is upheld (original decision stands) or overturned (status approved or restored).

- Appeals are handled independently, but outcomes are final within the administrative process—no direct court appeal for CE status decisions.

Tips for a Successful Appeal

- Be thorough: Clearly explain how your program complies with IRS standards.

- Attach evidence: Include course outlines, attendance records, or corrections made.

- Act quickly: Missing the 30-day window can permanently affect your provider status.

- Seek professional help: Consult a tax advisor familiar with IRS CE requirements if needed.

For general IRS appeals information, visit the IRS Appeals page. Always use the official IRS site for the latest forms and guidance.

This information is based on current IRS publications and forms as of late 2025. Tax rules can change, so verify with irs.gov for updates.