Table of Contents

IRS Form W-3SS – Transmittal of Wage and Tax Statements – If you’re an employer in U.S. territories like American Samoa, Guam, the U.S. Virgin Islands, or the Commonwealth of the Northern Mariana Islands (CNMI), navigating year-end tax reporting can feel overwhelming. One critical form in this process is IRS Form W-3SS, the transmittal summary for wage and tax statements. This guide breaks down everything you need to know about Form W-3SS for the 2025 tax year, from filing requirements to deadlines and common pitfalls. Whether you’re filing for the first time or refining your process, this SEO-optimized resource ensures compliance and minimizes errors.

What Is IRS Form W-3SS?

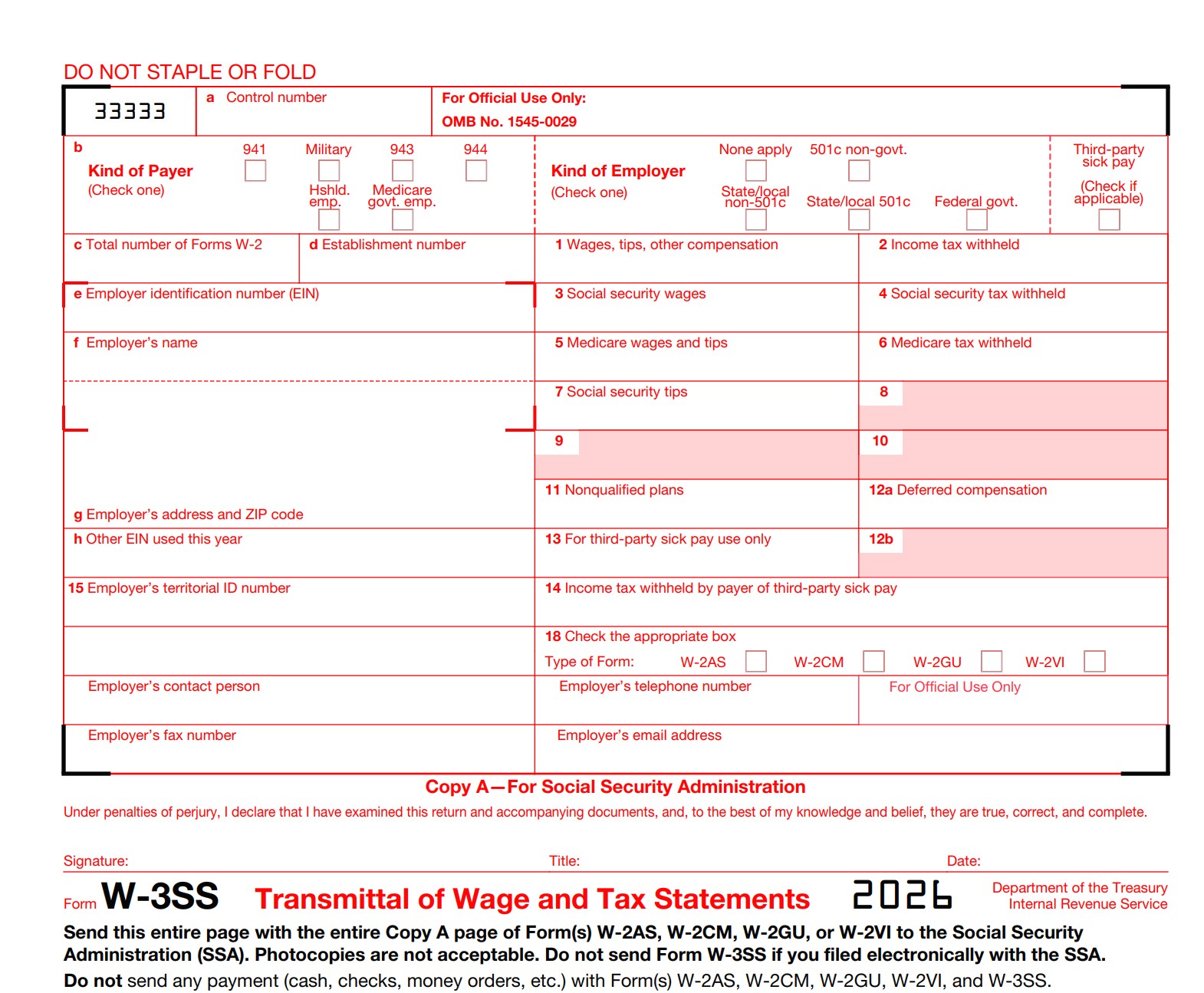

Form W-3SS serves as a transmittal form for employers to submit Copy A of wage and tax statements—specifically Forms W-2AS (American Samoa), W-2CM (CNMI), W-2GU (Guam), and W-2VI (U.S. Virgin Islands)—to the Social Security Administration (SSA). It’s essentially a summary sheet that aggregates totals from multiple W-2 forms, helping the SSA process employee wage data for Social Security and Medicare purposes.

Unlike the mainland U.S. version (Form W-3), W-3SS is tailored for territorial employers and is not filed alone. It’s only used for paper filings and must accompany the corresponding W-2 forms. Electronic filers don’t need to submit a separate W-3SS, as the system generates it automatically.

Who Needs to File Form W-3SS?

Not every employer files Form W-3SS—it’s reserved for those in specific U.S. territories. You must file if:

- You’re an employer in American Samoa, CNMI, Guam, or the U.S. Virgin Islands who paid wages subject to territorial income tax withholding, Social Security, or Medicare taxes.

- You issued Forms W-2AS, W-2CM, W-2GU, or W-2VI to employees, even if just one form.

- Total payments (including noncash) for services reached $600 or more, or any taxes were withheld.

Household employers qualify too, even with a single employee—check the “Hshld. emp.” box on the form. Federal, state, or local government employers in these territories follow the same rules, with options for 501(c)(3) nonprofits or military payers.

Pro Tip for SEO and Compliance: If your business operates across territories, double-check territorial ID numbers to avoid mismatches with your Employer Identification Number (EIN).

Key Information Required on Form W-3SS

Form W-3SS captures employer details and totals from attached W-2 forms. Here’s a quick overview of the essential boxes:

| Box/Section | Description | Key Notes |

|---|---|---|

| EIN (Box e) | Your federal Employer Identification Number | Use the EIN from your employment tax returns (e.g., Form 941). |

| Territorial ID Number (Box 15) | Local tax ID for the territory | Required for CNMI federal employers under agreement 5517. |

| Total Wages (Box 1) | Sum of wages, tips, and other compensation from all W-2s | Do not exceed Social Security wage base of $176,100 for 2025. |

| Social Security Tax Withheld (Box 4) | Total SS tax (6.2% of wages up to base) | Max per employee: $10,918.20. |

| Medicare Tax Withheld (Box 6) | Total Medicare tax (1.45% of all wages) | No wage cap; additional 0.9% for high earners. |

| Kind of Payer (Box b) | Select: 941, Military, 943, 944, Hshld. emp., Medicare govt. emp. | Matches your quarterly filing form. |

| Third-Party Sick Pay | Check if applicable | Report separately in Boxes 13–14. |

For a full list, download the 2026 Form W-3SS PDF (used for 2025 filings).

How to Complete Form W-3SS: Step-by-Step Instructions

Filling out Form W-3SS is straightforward but requires accuracy to match your W-2 totals. Follow these steps:

- Gather Your W-2 Forms: Ensure all Copy A sheets are scannable and error-free.

- Enter Employer Info: Fill Boxes e–h with your EIN, name, address, and any other EINs used.

- Tally Totals: Sum Boxes 1–12 from all W-2s (e.g., total wages in Box 1).

- Specify Form Type (Box 18): Check the box for W-2AS, W-2CM, W-2GU, or W-2VI.

- Add Contact Details: Include a contact person, phone, fax, and email.

- Sign and Date: Certify under penalty of perjury—electronic signatures aren’t allowed for paper forms.

Reconcile totals with your employment tax returns (e.g., Form 941) to avoid IRS notices. For detailed guidance, refer to the General Instructions for Forms W-2 and W-3 (2025).

IRS Form W-3SS Download and Printable

Download and Print: IRS Form W-3SS

Filing Methods: Paper vs. Electronic for W-3SS

The SSA encourages electronic filing for speed and accuracy, especially if you file 10 or more information returns (including W-2 variants).

- Electronic Filing (Recommended):

- Use SSA’s Business Services Online (BSO) for up to 50 forms.

- Upload wage files via payroll software compliant with EFW2 specs.

- No separate W-3SS needed—the system creates it.

- Benefits: Free, secure, and timely even if submitted by 11:59 p.m. on the due date.

- Paper Filing:

- Allowed if under 10 returns or granted a waiver (file Form 8508 at least 45 days early).

- Print on official red-ink forms; photocopies are rejected.

- Mail with W-2 Copy A—no stapling or folding.

2025 Update: E-filing waivers are harder to get; apply early for extraordinary circumstances.

Important Deadlines for Tax Year 2025

Timely filing is crucial to avoid penalties. For wages paid in 2025:

- File with SSA: February 2, 2026 (paper or electronic).

- Furnish to Employees (Copies B, C, 2): January 31, 2026 (or within 30 days of a written request).

- File Copy 1 with Territorial Tax Offices: Same as SSA deadline; addresses vary by territory.

Extensions: 30 days via Form 8809 for SSA filing (rarely granted); 15–30 days via Form 15397 for employee copies. If a holiday falls on the due date, it shifts to the next business day.

Where to File Form W-3SS

- SSA (Copy A): Social Security Administration, Direct Operations Center, PO Box 3333, Wilkes-Barre, PA 18767-3333.

- Territorial Copies (Copy 1):

- American Samoa: Department of Treasury, Pago Pago, AS 96799.

- Guam: Department of Revenue and Taxation, PO Box 23607, Barrigada, GU 96921.

- U.S. Virgin Islands: Bureau of Internal Revenue, 6115 Estate Smith Bay, St. Thomas, VI 00802.

- CNMI: Division of Revenue and Taxation, PO Box 5234, CHRB, Saipan, MP 96950 (include Form OS-3710).

Use certified mail or approved private delivery services for proof.

Common Mistakes and How to Avoid Them

- Mismatched Totals: Cross-check W-3SS sums against W-2s and tax returns.

- Wrong Form Type: Use W-2 (not W-3SS) for mainland wages or U.S.-taxable territorial income.

- Non-Scannable Paper Forms: Stick to official stock; test prints.

- Missing Territorial Filings: Always send Copy 1 locally.

- Forgetting Corrections: File W-2c ASAP for errors.

Retain copies for 4 years.

Penalties for Non-Compliance with W-3SS Filing

The IRS doesn’t take late or incorrect filings lightly. For 2025 returns due after Dec. 31, 2025:

- Late/Incorrect Filing: $60 per form (within 30 days), up to $340 (after Aug. 1); max $4,098,500.

- Failure to Furnish to Employees: Same tiers.

- Intentional Disregard: $680+ per form, no cap.

- Fraud: $5,000+ civil damages.

Small businesses get lower caps ($1,366,000 max). Claim reasonable cause or de minimis errors for relief.

Making Corrections with Form W-2c

Discovered an error? Use Form W-2c (and W-3c for transmittal) to fix names, SSNs, or amounts on previously filed W-2SS forms. File with SSA as soon as possible—e-file if the original was electronic. No need to refile undeliverable employee copies, but keep records.

FAQs About IRS Form W-3SS

Do I need Form W-3SS if I e-file?

No—the SSA generates it automatically.

What’s the 2025 Social Security wage base?

$176,100; tax max is $10,918.20 per employee.

Can I get an extension for W-3SS?

Yes, but limited—use Form 8809 for 30 days.

How does W-3SS differ from Form W-3?

W-3SS is for territories only; W-3 is for the 50 states and D.C.

Conclusion: Stay Compliant with Form W-3SS in 2025

Filing IRS Form W-3SS correctly ensures smooth Social Security credits for your employees and avoids costly penalties for your business. With the 2025 deadline approaching, prioritize electronic filing via SSA’s BSO for efficiency. For personalized advice, consult a tax professional or visit IRS.gov. Bookmark this guide for quick reference—your territorial tax compliance starts here!

Last updated: November 2025. Always verify with official sources for changes.