Table of Contents

IRS Form W-4S – Request for Federal Income Tax Withholding from Sick Pay – Navigating sick pay during illness shouldn’t add tax headaches to your recovery. For employees receiving third-party sick pay—such as from insurance companies—IRS Form W-4S, Request for Federal Income Tax Withholding from Sick Pay, empowers you to control federal income tax deductions directly from those payments. With the 2025 version finalized on December 4, 2024, and incorporating updated standard deductions and tax rate schedules, timely use of this form can prevent underpayment penalties or overwithholding surprises when filing your 2025 taxes.

This SEO-optimized guide, sourced from official IRS publications like the 2025 Form W-4S instructions and Publication 15-A (Employer’s Supplemental Tax Guide), breaks down the form’s essentials: purpose, eligibility, step-by-step instructions, deadlines, and avoidance of common errors. Ideal for HR pros, payroll administrators, or workers facing extended leaves, this resource ensures compliance and financial peace of mind. Download the 2025 PDF from IRS.gov today and stay ahead.

What Is IRS Form W-4S?

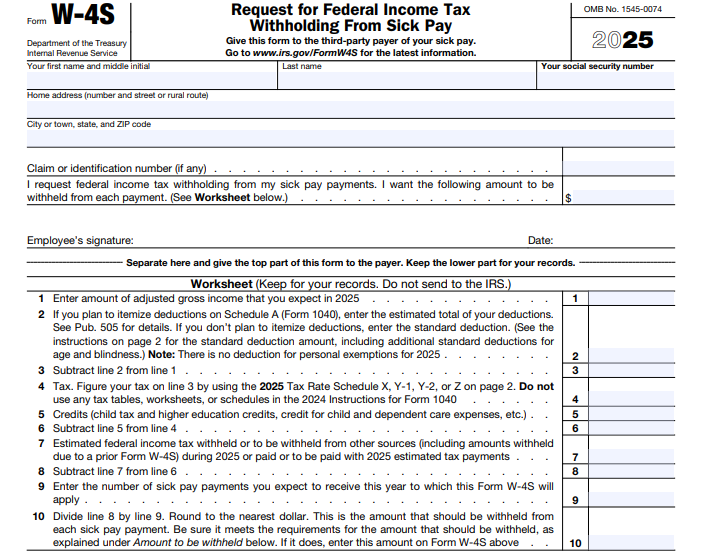

Form W-4S is a one-page certificate that employees submit to third-party sick pay payers (e.g., insurers) to request federal income tax withholding from non-wage sick benefits. Unlike employer-paid sick leave (handled via Form W-4), third-party sick pay under Section 3402(o) isn’t automatically subject to withholding—making this form voluntary but crucial for aligning deductions with your overall tax liability.

The form allows choices like a flat dollar amount per payment, a percentage (7%, 10%, 12%, or 22%), or no withholding. Payers report withheld amounts on your Form W-2 (Box 2 for federal tax), ensuring seamless integration with your annual return. For 2025, the worksheet includes inflation-adjusted figures, such as the standard deduction ($15,000 single/$30,000 married filing jointly), to help estimate needs accurately.

Key Fact: Sick pay is generally taxable as wages, but FICA (Social Security/Medicare) treatment varies—employer portions may be exempt after six months. Use W-4S to avoid a big tax bill come April 2026.

Who Must Use Form W-4S?

Form W-4S is optional for recipients of third-party sick pay who want federal income tax withheld; it’s not required if your employer handles it or if no withholding is desired. Submit it if:

- You’re receiving sick pay from a non-employer payer (e.g., disability insurer) for more than seven calendar days.

- You expect the payments to push you into a higher tax bracket or exceed $600 annually (triggering 1099 reporting, though W-2 for integrated sick pay).

- Changes in your situation (e.g., marriage, additional income) alter your withholding needs.

Exceptions:

- Employer-paid sick pay: Use Form W-4 instead.

- No tax liability expected: Skip withholding, but track for estimated payments via Form 1040-ES.

- Nonresident aliens: Follow Notice 1392 for supplemental rules.

Payers must honor valid forms but aren’t liable for underwithholding if you opt out.

Step-by-Step Guide: How to Complete IRS Form W-4S for 2025

The 2025 Form W-4S is straightforward—download from IRS.gov and complete in black ink or digitally. Use the included worksheet for estimates if choosing a custom amount; the IRS Tax Withholding Estimator (irs.gov/W4app) can refine calculations for complex situations.

1. Gather Your Information

- Social Security Number (SSN), full name, address.

- Expected 2025 adjusted gross income (AGI) from all sources.

- Number of sick pay payments anticipated.

- Deductions/credits estimates (e.g., standard deduction: $15,000 single filer).

2. Fill the Header

- Enter your SSN, name, address, and any claim/identification number (e.g., policy ID).

3. Select Withholding Method (Lines 1–2)

- Line 1: Check if you want withholding; skip to signature if none.

- Line 2: Choose:

- Flat amount (e.g., $50 per payment)—use worksheet below for guidance.

- Percentage: 7% (lowest bracket), 10%, 12%, or 22% (supplemental rate).

4. Complete the Worksheet (Keep for Records)

- Line 1: Expected AGI.

- Line 2: Adjustments (e.g., IRA contributions).

- Line 3: Taxable income (AGI minus deductions).

- Line 4: Use 2025 Tax Rate Schedule (e.g., 10% on first $11,925 single).

- Line 5: Credits (e.g., Child Tax Credit).

- Line 6: Estimated tax liability.

- Line 7: Other withholdings/estimated payments.

- Line 8: Additional needed from sick pay.

- Line 9: Number of payments.

- Line 10: Amount per payment (Line 8 ÷ Line 9).

5. Sign and Date

- Sign under penalty of perjury; date it. Give to payer before first payment. Invalid without signature.

Pro Tip: If AGI exceeds $200,000 (single) or $400,000 (married), consider 22% to cover backup withholding risks.

When and How to Submit Form W-4S for 2025

Submit Form W-4S before your first sick pay payment to ensure withholding starts immediately—no fixed IRS deadline, but delays mean manual estimated payments. It remains effective until revoked or updated.

- Changes: Submit a new form or written notice anytime (e.g., recovery, income shift). To revoke, write “Revoked” in the amount box and resubmit.

- Delivery: Hand or mail to the third-party payer (e.g., insurer); they apply it to future payments.

- End-of-Year: Expect a Form W-2 by January 31, 2026, showing withheld sick pay taxes.

For electronic systems, payers may accept digital signatures per Pub. 15-A.

Common Mistakes to Avoid When Using Form W-4S

Underwithholding sick pay contributes to 20% of IRS underpayment penalties—avoid these traps with the 2025 updates in mind. Key errors:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| Outdated Form Use | Submitting 2024 version with wrong deductions. | Download 2025 PDF; note $15,000 single standard deduction. | Inaccurate withholding; $435+ underpayment fine. |

| Forgetting Worksheet | Guessing flat amount without AGI estimate. | Use lines 1–10; integrate IRS Estimator for credits. | Tax bill + interest (up to 5% annualized). |

| No Signature/Date | Oversight in haste. | Always sign; form invalid otherwise. | Payer ignores; no withholding applied. |

| Ignoring Other Income | Omitting freelance/employer pay in AGI. | Include all sources on Line 1; update for changes. | Bracket creep; backup withholding at 24%. |

| Late Submission | Waiting post-first payment. | Submit pre-payment; revoke promptly if recovered. | Quarterly estimates due; $100–$500 failure-to-pay. |

| Percentage Mismatch | Choosing 7% despite high AGI. | Opt 22% for supplemental over $1M; use worksheet. | IRS notice CP2000; audit risk. |

Revoke or amend anytime—no penalty for adjustments.

IRS Form W-4S Download and Printable

Download and Print: IRS Form W-4S

2025 Updates and Special Considerations for Form W-4S

The IRS released the finalized 2025 Form W-4S on December 4, 2024, with inflation-driven tweaks to support accurate withholding:

- Standard Deductions: $15,000 (single/head of household), $30,000 (married filing jointly), $22,500 (qualifying surviving spouse)—up from 2024.

- Tax Rate Schedules: Updated brackets (e.g., 10% on $0–$11,925 single); worksheet reflects OBBBA adjustments.

- No Major Structural Changes: Like W-4, emphasizes Estimator for self-employment integration; no allowances.

- Sick Pay Nuances: Third-party FICA exemption after 6 months (Pub. 15-A); report state withholding separately if applicable.

For disability retirees, coordinate with Form W-4P for pension overlaps.

Final Thoughts: Secure Your Sick Pay Taxes with Form W-4S

IRS Form W-4S bridges the gap in third-party sick pay withholding, helping you avoid penalties while recovering. For 2025, leverage updated deductions and the Estimator for precision—submit early and review quarterly. Download from IRS.gov, consult Pub. 505 for estimates, and consider a tax pro for multi-source income.

This guide is informational only—not tax advice. Verify with IRS resources for your circumstances.

FAQs About IRS Form W-4S

What is the 2025 standard deduction on Form W-4S?

$15,000 for single filers, $30,000 for married filing jointly.

Is Form W-4S required for sick pay?

No—optional for third-party payers; mandatory withholding doesn’t apply.

How do I revoke Form W-4S withholding?

Submit a new form with “Revoked” in the amount box.

When will I receive my W-2 for sick pay?

By January 31, 2026, from the payer.