Table of Contents

IRS Form 1040-ES – Estimated Tax for Individuals – Navigating the U.S. tax system can feel overwhelming, especially if you’re self-employed, a freelancer, or earning income outside traditional W-2 wages. That’s where IRS Form 1040-ES comes in—your key tool for making estimated tax payments throughout the year. If you’re wondering, “Do I need to pay quarterly taxes?” or “How do I calculate estimated taxes for 2025?”, this guide breaks it down step by step. We’ll cover everything from eligibility to deadlines, using the latest IRS guidelines for tax year 2025. Stay compliant and avoid surprises come April 2026.

Whether you’re a gig worker, investor, or small business owner, understanding Form 1040-ES ensures you pay taxes as you earn, aligning with the IRS’s “pay-as-you-go” principle. Let’s dive in.

What Is IRS Form 1040-ES?

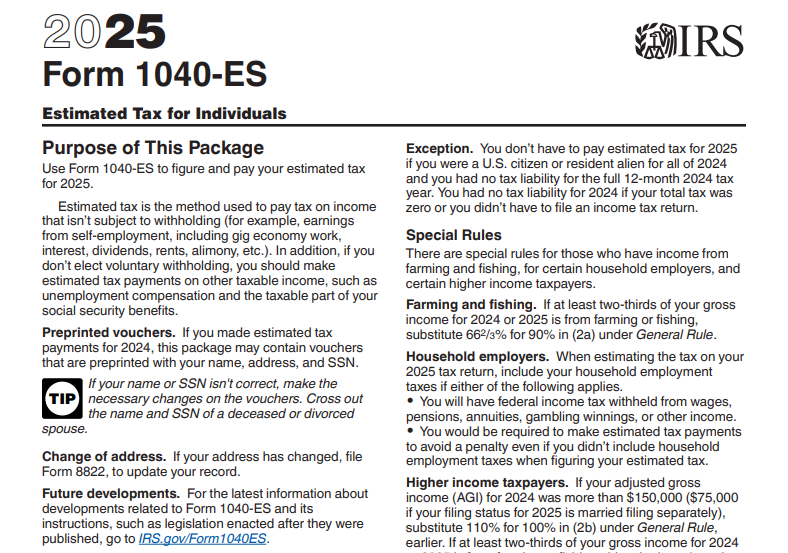

Form 1040-ES, Estimated Tax for Individuals, is the IRS worksheet and voucher used to calculate and pay estimated taxes on income not subject to automatic withholding. This includes earnings from self-employment, interest, dividends, rental income, alimony, unemployment compensation, and even the taxable portion of Social Security benefits. Unlike your annual Form 1040, which reports last year’s income, 1040-ES focuses on the current year—helping you spread out tax liability to avoid a big bill (or penalty) later.

The form includes:

- Worksheets to estimate your adjusted gross income (AGI), deductions, credits, and total tax.

- Payment vouchers for mailing checks or money orders.

- Instructions tailored for U.S. residents, with a separate Form 1040-ES (NR) for nonresident aliens.

For 2025, the form accounts for updates like the Social Security wage base limit of $176,100 for self-employment taxes. Download the latest PDF from the IRS website to get started.

Who Needs to Make Estimated Tax Payments?

Not everyone files Form 1040-ES, but if your income sources skip withholding, it’s likely you do. The IRS requires estimated tax payments if:

- You expect to owe at least $1,000 in taxes for 2025 after subtracting withholding and refundable credits.

- Your withholding and credits are expected to cover less than 90% of your 2025 tax liability or 100% of your 2024 tax (110% if your 2024 AGI was over $150,000, or $75,000 if married filing separately).

Common scenarios include:

- Self-employed individuals (sole proprietors, freelancers, contractors) owing self-employment tax (15.3% on net earnings).

- Investors with significant interest, dividends, or capital gains.

- Partners or S corporation shareholders receiving pass-through income.

- Retirees with taxable IRA distributions or pensions without voluntary withholding.

Farmers and fishermen have special rules: If at least two-thirds of your 2025 gross income is from farming or fishing, you only need one payment due January 15, 2026. Household employers may also qualify under relaxed thresholds.

Pro Tip: Use the IRS worksheet in Form 1040-ES to check eligibility—it’s based on your prior year’s return, adjusted for 2025 changes like salary increases or new side hustles.

How to Calculate Your Estimated Taxes for 2025

Figuring out quarterly estimated taxes doesn’t have to be guesswork. Follow these steps using the Form 1040-ES worksheet:

- Estimate Your AGI: Project your total income for 2025, including wages, business profits, investments, and other sources. Subtract adjustments like IRA contributions or student loan interest.

- Calculate Taxable Income: Deduct your standard deduction ($15,000 for singles, $30,000 for married filing jointly in 2025—subject to IRS updates) or itemized deductions, then apply tax brackets.

- Add Self-Employment Tax: If applicable, compute 15.3% on net earnings (92.35% of profits), but remember half is deductible.

- Factor in Credits and Other Taxes: Subtract credits (e.g., child tax credit) and add alternative minimum tax if relevant.

- Divide by Four: Aim for equal quarterly payments, or use the annualized method if income is uneven (e.g., seasonal businesses).

Tools like tax software (TurboTax) or the IRS’s Publication 505 simplify this—input last year’s Form 1040 data and tweak for 2025 projections. Overestimate to play it safe; you can adjust later quarters.

2025 Estimated Tax Payment Deadlines

Timeliness is crucial to dodge penalties. For calendar-year taxpayers, 2025 estimated tax payments are due on these dates:

| Quarter | Due Date | Covers Income From |

|---|---|---|

| 1st | April 15, 2025 | January 1 – March 31 |

| 2nd | June 16, 2025 | April 1 – May 31 |

| 3rd | September 15, 2025 | June 1 – August 31 |

| 4th | January 15, 2026 | September 1 – December 31 |

If a due date falls on a weekend or holiday, it shifts to the next business day. Miss one? Pay as soon as possible to minimize interest.

IRS Form 1040-ES Download and Printable

Download and Print: IRS Form 1040-ES

How to Make Estimated Tax Payments

The IRS offers flexible options beyond mailing vouchers:

- Electronic Federal Tax Payment System (EFTPS): Free online or phone payments—enroll at eftps.gov.

- IRS Direct Pay: Instant transfers from your bank account via irs.gov.

- Credit/Debit Card: Through approved processors (fees apply).

- Check or Money Order: Use the preprinted vouchers from Form 1040-ES, mailed to the address for your state.

Track payments on your Form 1040 (Line 26) when filing next year. For nonresidents, use 1040-ES (NR) and follow international mailing instructions.

Penalties for Underpaying Estimated Taxes

The IRS charges an underpayment penalty if you don’t pay enough throughout the year—calculated quarterly via Form 2210. It’s essentially interest on the shortfall, at the federal short-term rate plus 3% (around 8% for 2025).

Avoid it by meeting the safe harbor rules:

- Pay 90% of your actual 2025 tax, or

- 100% of your 2024 tax (whichever is smaller).

No penalty if you owe under $1,000 after withholding. Waivers apply for disasters, retirement after age 62, or disability. Farmers/fishermen get leeway at 66⅔% threshold.

5 Tips for Managing IRS Form 1040-ES in 2025

- Start Early: Review your 2024 return in January to baseline estimates.

- Use Software: Apps like QuickBooks Self-Employed automate calculations and reminders.

- Adjust Quarterly: Life changes? Recalculate and amend payments.

- Elect Withholding: If possible, opt for voluntary withholding on pensions or IRA distributions to reduce 1040-ES needs.

- Seek Help: Consult a tax pro if your situation involves complex income streams.

By staying proactive, you’ll keep more control over your cash flow and avoid IRS headaches.

Frequently Asked Questions (FAQs) About Form 1040-ES

Do I need Form 1040-ES if I’m retired?

Yes, if you have taxable pensions, IRAs, or investments without withholding.

What if I overpay my estimated taxes?

You’ll get a refund or credit on your 2026 Form 1040.

Where can I get the 2025 Form 1040-ES?

Download from irs.gov or order by mail—available by late January 2025.

Is there a Spanish version?

Yes, Form 1040-ES (sp) for Spanish speakers.

Mastering IRS Form 1040-ES empowers you to handle estimated tax payments like a pro. For personalized advice, visit irs.gov or consult a CPA. Got questions? Drop them in the comments below!

This article is for informational purposes only and not tax advice. Always verify with the IRS for your situation.