Table of Contents

IRS Form 1041-ES – Estimated Income Tax for Estates and Trusts – Managing the tax obligations of an estate or trust can be complex, especially when income exceeds certain thresholds. IRS Form 1041-ES, Estimated Income Tax for Estates and Trusts, is the essential tool for fiduciaries to calculate and make quarterly payments, preventing underpayment penalties that can add up to 5% annualized interest. With the 2025 tax year underway, the IRS has released updated instructions reflecting inflation-adjusted brackets and exemptions, ensuring compliance amid rising asset values.

This SEO-optimized guide draws from official IRS sources, including the 2025 Form 1041-ES (Rev. December 2024) and Publication 505 (Tax Withholding and Estimated Tax), to cover the form’s purpose, eligibility, step-by-step instructions, deadlines, and strategies for avoidance of penalties. Whether you’re a trustee handling a revocable living trust or an executor for a decedent’s estate, mastering Form 1041-ES ensures timely payments and smooth IRS reconciliation. Let’s explore how to stay compliant for 2025.

What Is IRS Form 1041-ES?

Form 1041-ES is a worksheet and payment voucher used by fiduciaries of estates and trusts to estimate and remit quarterly federal income tax payments on undistributed income. Unlike Form 1041 (the annual U.S. Income Tax Return for Estates and Trusts), this form focuses on prepaying taxes to avoid the underpayment penalty under Section 6655, calculated via Form 2210 if payments fall short.

The package includes:

- Estimated Tax Worksheet: For computing total liability.

- Annualized Income Installment Worksheet: For uneven income (e.g., capital gains in Q4).

- Four Payment Vouchers: Labeled for each installment.

For 2025, the form incorporates updated tax rate schedules (e.g., 10% bracket up to $3,150 taxable income) and exemptions ($100 for simple trusts, $300 for complex ones). Payments cover income tax, alternative minimum tax (AMT), and net investment income tax (NIIT) at 3.8% for high earners.

Key Fact: Estates and trusts hit the top 37% bracket at just $15,650 taxable income in 2025—far quicker than individuals—making estimated payments vital for larger entities.

Who Must Use Form 1041-ES?

Fiduciaries must use Form 1041-ES if the estate or trust expects to owe at least $1,000 in tax for 2025 after credits and withholding, and withholding/credits cover less than the smaller of:

- 90% of the 2025 tax liability, or

- 100% of the 2024 tax (110% if 2024 AGI > $150,000).

Applicable Entities:

- Decedent’s Estates: Any year ending within 2 years of death.

- Simple Trusts: Required to distribute all income annually.

- Complex Trusts: Retain or accumulate income.

- Qualified Disability Trusts: Special exemptions apply.

- Electing Alaska Native Settlement Trusts: Follow Form 1041-N rules.

Exceptions:

- Qualified funeral trusts or bankruptcy estates (no estimates needed).

- If total tax < $1,000 or full payment made with Form 1041 by the due date.

- Farmers/fishermen trusts: Single payment by January 15, 2026, if ≥2/3 gross income from those sources.

Fiduciaries can allocate payments to beneficiaries via Form 1041-T, shifting liability.

Step-by-Step Guide: How to Complete IRS Form 1041-ES for 2025

Download the 2025 Form 1041-ES PDF from IRS.gov—it’s a 4-page package with worksheets. Use tax software for projections; manual filers reference Pub. 505 for details. Base estimates on 2024 Form 1041 or projected 2025 income.

1. Gather Data

- Projected 2025 income (interest, dividends, capital gains), deductions (e.g., estate tax), exemptions ($100/$300).

- 2024 tax liability from Form 1041, line 24.

- Credits (e.g., foreign tax, Form 4136 fuel credits).

2. Complete the Estimated Tax Worksheet (Page 2)

- Lines 1–6: Estimate AGI, exemptions, taxable income (subtract deductions/exemptions).

- Line 7: Compute tax using 2025 Tax Rate Schedule (e.g., 37% over $15,650) or Maximum Capital Gains Worksheet if applicable.

- Line 8: Add AMT (Form 1041, Schedule I) and NIIT (Form 8960).

- Lines 9–10: Subtract credits; net tax on line 10.

- Line 11: Self-employment tax (if applicable).

- Line 12: Other taxes (e.g., household employment).

- Line 13: Total tax (lines 10 + 11 + 12).

- Line 14: Required annual payment (smaller of 90% current or 100%/110% prior year).

- Line 15: Withholding/credits.

- Line 16: Balance requiring installments (line 13 – 15; if < $1,000, stop).

3. Figure Installments (Page 3)

- Divide line 16 by 4 for equal payments (25% each).

- Or use annualized method (Worksheet 2-7 in Pub. 505) for seasonal income: 22.5% Q1, 45% cumulative Q2, etc.

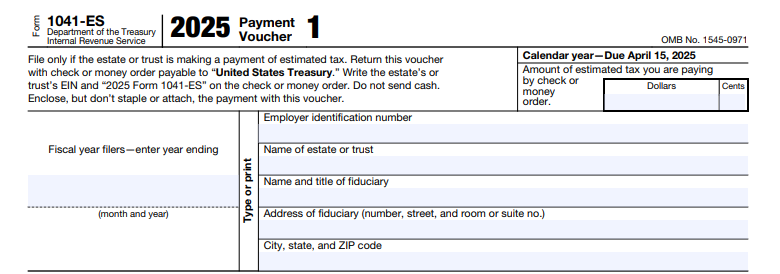

4. Fill Payment Vouchers (Pages 4–7)

- Enter EIN, name, address.

- Note installment amount and due date.

- No signature required; attach check payable to “United States Treasury” with “2025 Form 1041-ES” and EIN.

Pro Tip: For short tax years, prorate required payments; overpayments credit to next year or refunds.

Due Dates and How to File Form 1041-ES for 2025

Calendar-year estates/trusts follow these deadlines (next business day if weekend/holiday):

- Q1: April 15, 2025 (25% of required annual payment).

- Q2: June 16, 2025 (additional 25%).

- Q3: September 15, 2025 (additional 25%).

- Q4: January 15, 2026 (final 25%).

Fiscal-year filers: 15th of 4th, 6th, 9th months, and 1st month of next year. Farmers/fishermen: One payment January 15, 2026.

Payment Methods:

- Electronic (Preferred): EFTPS.gov (mandatory if >$2,500 annually); schedule recurring.

- Mail: Vouchers to P.O. Box 932400, Louisville, KY 40293-2400; no staples.

- Credit/Debit: IRS.gov/payments (fees apply).

Reconcile on 2025 Form 1041 (due April 15, 2026; extendable to September 30 via Form 7004, but pay by original due).

Common Mistakes to Avoid with IRS Form 1041-ES

Underpayments trigger penalties from the due date—here’s a table of pitfalls from IRS guidance:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| Underestimating Liability | Using prior-year safe harbor without 110% adjustment for AGI >$150K. | Apply 110% if applicable; project gains accurately. | 5% annualized on shortfall (Form 2210). |

| Wrong Due Dates | Missing June 16 shift (weekend). | Check IRS calendar; use EFTPS reminders. | Interest from due date. |

| Mailing to Wrong Address | Sending to Form 1041 lockbox. | Use Louisville P.O. Box for vouchers. | Delayed credit; additional penalties. |

| Ignoring Annualized Method | Equal payments on lumpy income (e.g., year-end sales). | Use Pub. 505 Worksheet for 22.5%/45% schedule. | Overpayment or full-year penalty. |

| Forgetting NIIT/AMT | Omitting lines 8/12. | Include Form 8960/Schedule I projections. | Underpayment exposure. |

| No Allocation to Beneficiaries | Retaining full liability unnecessarily. | File Form 1041-T by March 5, 2026, for distribution. | Missed credits for beneficiaries. |

Amend via additional payments; no formal correction form—adjust next voucher.

IRS Form 1041-ES Download and Printable

Download and Print: IRS Form 1041-ES

2025 Updates and Special Considerations for Form 1041-ES

The 2025 instructions (embedded in the form PDF) align with TCJA extensions and inflation:

- Tax Brackets/Exemptions: Exemption $100 (simple)/$300 (complex); brackets: 10% $0–$3,150, 24% $3,150–$11,450, up to 37% >$15,650.

- Safe Harbor: 110% of 2024 tax if AGI >$150K; no prior-year base if short year.

- EFTPS Mandate: Required for large payers; integrates with Form 1041 e-filing.

- Special Rules: Qualified disability trusts use individual brackets; allocate via Form 1041-T for DNI distributions.

Monitor Pub. 509 for holiday shifts; nonresidents follow Form 1041-NR rules.

Final Thoughts: Streamline Estate and Trust Taxes with Form 1041-ES

IRS Form 1041-ES is a fiduciary’s safeguard against penalties, ensuring quarterly payments keep pace with compressed tax brackets for 2025. By estimating accurately—using safe harbors or annualized methods—you’ll minimize interest and support beneficiaries. Download the 2025 package from IRS.gov, enroll in EFTPS, and consult Pub. 505 for projections. For intricate trusts, engage a tax advisor.

This guide is informational; not tax advice. Verify with IRS.gov for your entity.

FAQs About IRS Form 1041-ES

What is the $1,000 threshold for Form 1041-ES in 2025?

Estates/trusts owing ≥$1,000 after credits must pay estimates if withholding <90% current or 100%/110% prior tax.

When are the 2025 Form 1041-ES payments due?

April 15, June 16, September 15, 2025; January 15, 2026 (calendar year).

Can estates allocate estimated payments to beneficiaries?

Yes, via Form 1041-T, filed by the 65th day after year-end (March 5, 2026, for calendar).

How do I avoid penalties on Form 1041-ES?

Pay 90% of 2025 tax or 100%/110% of 2024; use annualized for uneven income.