Table of Contents

IRS Form 1095-A – Health Insurance Marketplace Statement – With over 22 million Americans relying on Affordable Care Act (ACA) Marketplace plans in 2025, understanding your tax documents is key to maximizing subsidies and avoiding surprises at tax time. IRS Form 1095-A, the Health Insurance Marketplace Statement, is your essential record of coverage, premiums paid, and advance premium tax credits (APTC) received—directly impacting your eligibility for the refundable Premium Tax Credit (PTC) on Form 8962. As enhanced PTCs are set to expire at the end of 2025 unless extended by Congress, this form will play a pivotal role in reconciling subsidies and potentially increasing out-of-pocket costs in 2026.

This SEO-optimized guide, based on the official 2025 Instructions for Form 1095-A (Rev. December 2024) and related IRS resources, covers everything from the form’s purpose and who receives it to step-by-step reconciliation, deadlines, and tips for handling the looming subsidy cliff. Whether you’re a Marketplace enrollee or tax professional, arm yourself with this knowledge to file accurately and claim up to $3,000+ in credits per household. Let’s break it down for the 2025 tax year.

What Is IRS Form 1095-A?

Form 1095-A is an informational statement issued by Health Insurance Marketplaces (e.g., HealthCare.gov or state-based exchanges) to report details of your qualified health plan enrollment, monthly premiums, and any APTC used to lower costs. It doesn’t mean you owe taxes—it’s a reconciliation tool to compare advance subsidies against your actual eligibility based on final income.

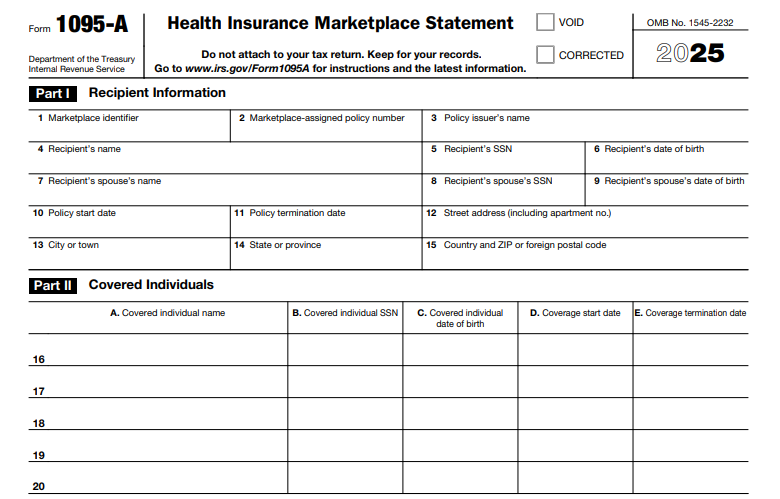

Key sections:

- Part I: Policyholder and Marketplace info.

- Part II: Covered individuals (up to 5; additional forms if more).

- Part III: Monthly enrollment premiums (SLCSP), second lowest cost silver plan (SLCSP) benchmarks, and APTC.

For 2025, the form remains unchanged structurally but emphasizes accurate reporting of enhanced PTCs, which cap contributions at 0–8.5% of income (up to 400%+ FPL) through year-end. Use it with Form 8962 to claim or repay credits—overuse leads to repayment (capped at $350–$1,800 based on income), underuse to a refund.

Key Fact: Enhanced subsidies kept average net premiums at $888 annually in 2025; expiration could double them to $1,904 in 2026 without extension.

Who Must File and Receive Form 1095-A?

Marketplaces must issue Form 1095-A to every policyholder enrolled in a qualified health plan for any part of 2025, even if APTC was $0. This includes:

- Individuals/families with Marketplace coverage (QHPs via HealthCare.gov or state exchanges).

- Those receiving APTC or cost-sharing reductions (CSRs).

- Shared policies: Separate forms for each tax family (e.g., divorced parents).

Exceptions:

- Catastrophic plans or stand-alone dental/vision.

- Coverage <1 month or non-QHPs (e.g., short-term plans).

- Nonresident aliens without U.S. tax filing requirements.

Recipients: You (Copy B) and the IRS (Copy A). No need to attach to your return—keep for records and use on Form 8962. E-delivery requires consent; otherwise, mailed by January 31, 2026.

Step-by-Step Guide: How to Complete and Use IRS Form 1095-A for 2025

Marketplaces prepare and send the form—you use it for taxes. If correcting errors (e.g., wrong SSN), contact your Marketplace; they’ll issue a “CORRECTED” version. Download a blank 2025 PDF from IRS.gov for reference.

1. Verify Part I: Policy and Recipient Details

- Confirm your name, SSN, address, Marketplace identifier, and policy number.

- Flag mismatches with your tax ID—update via Marketplace account.

2. Review Part II: Covered Individuals

- Lists up to 5 enrollees (name, SSN/DOB, coverage start/end dates).

- Ensure tax family members match; non-family get separate forms.

3. Analyze Part III: Coverage and Premium Info (Lines 21–33)

- Lines 21/33a: Monthly/enrollment premiums for your plan.

- Lines 22/33b: SLCSP premiums (benchmark for PTC calculation).

- Lines 23/33c: Monthly APTC received.

- Lines 24–32: Coverage indicators (1 if enrolled that month).

4. Reconcile on Form 8962

- Transfer monthly data to Form 8962 (Part II for PTC).

- Calculate eligibility: PTC = SLCSP premium – required contribution (0–8.5% income).

- If APTC > PTC: Repay excess (sliding scale: $0 if <200% FPL).

- File with Form 1040; software like TurboTax imports 1095-A data.

Pro Tip: Log into HealthCare.gov > “Tax Forms” to download/view; use IRS PTC Calculator for projections.

Deadlines and How to Obtain Form 1095-A for 2025

Timing ensures smooth 2025 tax filing (due April 15, 2026):

- Issued By: January 31, 2026 (Marketplace to you/IRS; electronic if consented by Dec. 31, 2025).

- IRS Filing: Marketplaces e-file by March 31, 2026 (10+ forms); paper by Feb. 28.

- Tax Use: Attach reconciliation to 2025 Form 1040; no extensions needed for 1095-A itself.

Didn’t receive? Contact Marketplace (1-800-318-2596); check online account first. Corrections issued promptly.

Common Mistakes to Avoid When Using Form 1095-A

Errors can lead to IRS notices (CP2000) or missed refunds—92% of enrollees get subsidies, so accuracy matters. Top pitfalls for 2025:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Ignoring Form 1095-A | Assuming APTC auto-adjusts. | Always reconcile on Form 8962; use SLCSP data. | Missed refund or excess repayment ($350–$1,800). |

| Income Mismatch | Forgetting to report all (MAGI includes SSI). | Use final 1040 AGI; project via IRS tool. | Subsidy clawback; audit. |

| Wrong SLCSP | Using plan premium instead of benchmark. | Verify Line 33b; request correction if blank. | Underclaimed PTC. |

| Shared Policy Errors | Not getting separate forms. | Request per tax family; coordinate with ex-spouse. | Incomplete reconciliation. |

| Late Download | Missing mail; no online check. | Access via account by mid-Feb 2026. | Delayed filing; penalties up to $630. |

| Subsidy Cliff Oversight | Not planning for 2026 expiration. | Model 2026 costs; consider Roth conversions. | Premiums double ($1,016 avg increase). |

Amend via corrected 1040 if needed; retain 3 years.

IRS Form 1095-A Download and Printable

Download and Print: IRS Form 1095-A

2025 Updates and Special Considerations for Form 1095-A

The 2025 instructions (Rev. Dec. 2024) focus on enhanced PTCs while noting expiration risks:

- Enhanced PTCs: Available through Dec. 31, 2025—no income cap (100–400%+ FPL); caps at 8.5% income. Expiration reverts to 400% FPL cliff, potentially doubling premiums.

- DACA Recipients: Eligible for PTCs/CSRs starting Nov. 1, 2025.

- E-Filing: Mandatory for Marketplaces with 10+ forms; secure TIN transmission.

- CSRs: Paired with silver plans; report on 1095-A if applicable.

Monitor Congress for extensions; use KFF calculator for 2026 impacts.

Final Thoughts: Harness Form 1095-A for ACA Tax Savings in 2025

IRS Form 1095-A is your lifeline to reconciling Marketplace subsidies, potentially unlocking thousands in PTC refunds while navigating 2025’s enhanced benefits. With expiration looming, review early, reconcile accurately, and plan ahead—download from your Marketplace account and pair with Form 8962 for seamless filing. For complex cases (e.g., mid-year changes), consult a tax advisor or IRS Pub. 974.

This guide is informational only—not tax advice. Always check IRS.gov for your situation.

FAQs About IRS Form 1095-A

When will I receive my 2025 Form 1095-A?

By January 31, 2026 (mid-February mail; download from Marketplace account).

Do I attach Form 1095-A to my tax return?

No—use data for Form 8962; keep as record.

What if enhanced PTCs expire after 2025?

Premiums could rise 114% avg ($1,016/year); no subsidy cliff under current law through 2025.

Who issues Form 1095-A?

Health Insurance Marketplaces (federal/state); not insurers.