Table of Contents

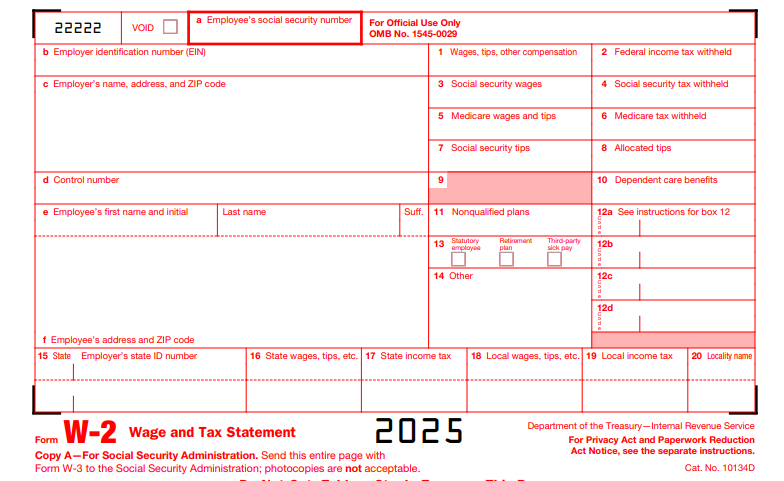

IRS Form W-2 – Wage and Tax Statement – As the end of 2025 approaches, employers and employees alike must prepare for one of the most critical tax documents: IRS Form W-2, the Wage and Tax Statement. This form reports annual wages, tips, and withheld taxes, serving as the foundation for individual tax returns and Social Security credits. With the Social Security wage base increasing to $176,100—up $7,500 from 2024—and inflation-adjusted penalties rising to $60–$680 per form for filings after December 31, 2025, accuracy is non-negotiable. The IRS released updated instructions on February 27, 2025, including a new OMB control number (1545-0029) and fax options for extensions via Form 15397.

This SEO-optimized guide, based on the official 2025 General Instructions for Forms W-2 and W-3 and Publication 15 (Circular E), covers the form’s purpose, filing requirements, step-by-step completion, deadlines, and avoidance of common errors. Whether you’re an employer generating W-2s or an employee verifying your copy, this resource ensures compliance and maximizes tax accuracy. Download the 2025 form from IRS.gov today to stay ahead.

What Is IRS Form W-2?

Form W-2 is an informational return employers use to report employee wages, tips, other compensation, and withheld taxes (federal income, Social Security, Medicare) to the Social Security Administration (SSA) and IRS. Employees receive it to file Form 1040, claiming credits like the Earned Income Tax Credit (EITC) if AGI is under $64,430 (no children) or higher with dependents.

The six-copy form includes:

- Copy A: For SSA (red ink required).

- Copy B: For employee (federal return).

- Copy C: Employer copy.

- Copies 1/2/D: State/local and employer records.

For 2025, key thresholds include a health FSA limit of $3,300 and the new OMB number across W-2 variants (e.g., W-2AS for territories). No major structural changes from 2024, but instructions clarify Roth SIMPLE IRA reporting in Box 12 (Code S).

Key Fact: Over 150 million W-2s are filed annually; errors contribute to 40% of SSA notices, potentially delaying refunds.

Who Must File Form W-2?

Employers must file Form W-2 for each employee paid $600+ in 2025 (or any amount if taxes were withheld), including noncash payments. This covers:

- Businesses: Corporations, partnerships, non-profits with U.S. wages.

- Government Entities: Federal/state employers.

- Agents/Third Parties: Separate W-2s per employer (Rev. Proc. 2013-39).

Employees Receiving It:

- U.S. residents/nonresidents with U.S.-source wages.

- Household employees (if $2,700+ wages).

Exceptions:

- Statutory employees report on Form 1040 Schedule C.

- Clergy/ministers: Use Form 1099-MISC if electing out of FICA.

- Agricultural/domestic workers under thresholds.

E-filing mandatory for 10+ forms; all must furnish employee copies by January 31, 2026.

Step-by-Step Guide: How to Complete IRS Form W-2 for 2025

Use the 2025 form (Rev. Dec. 2024) from IRS.gov—online fillable for Copies B/C/1/2/D, but Copy A requires official red-ink printing. Payroll software automates; manual filers tally from records.

1. Gather Data

- Wages/tips from payroll; FICA withholdings (SS: 6.2% up to $176,100; Medicare: 1.45% uncapped + 0.9% additional >$200K single).

- Federal/state withholdings; Box 12 codes (e.g., DD: health coverage cost).

2. Header

- Employer’s Name/Address/EIN: Full details; no truncation.

- Employee’s SSN/Name/Address: Full SSN on Copy A; truncate first 5 digits on B/C/2 (optional since 2022).

- Control Number: Optional.

3. Boxes 1–6: Wages/Taxes

- Box 1: Wages/tips/compensation ($ exclude pre-tax benefits).

- Box 2: Federal income tax withheld.

- Box 3: SS wages (≤$176,100).

- Box 4: SS tax withheld (≤$10,918.20).

- Box 5: Medicare wages (uncapped).

- Box 6: Medicare tax withheld.

4. Boxes 7–14: Additional

- Box 7: SS tips.

- Box 10: Dependent care (≤$5,000).

- Box 12: Codes (e.g., C: Group life >$50K).

- Box 13: Checkboxes (e.g., Retirement plan).

- Box 14: Other (e.g., state disability).

5. Boxes 15–20: State/Local

- Employer’s state ID; state wages/withheld; locality if applicable.

Pro Tip: For excess SS tax (>$10,918.20), employees claim on Form 1040; agents file separate W-2s.

Deadlines and How to File Form W-2 for 2025

For 2025 wages:

- Furnish to Employees (B/C/2): January 31, 2026 (fax Form 15397 for 30-day extension).

- File with SSA (A + W-3): February 2, 2026 (paper/e-file; mandatory e-file 10+ via BSO).

- State Copies: Vary (e.g., Jan. 31 for most); check Pub. 15-T.

Methods:

- E-File: SSA BSO (free; generates W-3).

- Paper: Mail to Wilkes-Barre, PA; flat envelopes.

- Extensions: Form 8809 (30 days, pre-deadline).

Common Mistakes to Avoid When Filing Form W-2

W-2 errors trigger CP2100 notices—here’s a table of 2025 pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| SSN/Name Mismatch | Typos or truncation on Copy A. | Verify via SSA; full SSN on A, truncate optional on others. | $60/form; notices. |

| Incorrect Withholdings (Boxes 2/4/6) | Payroll miscalculations. | Reconcile with Forms 941/944. | $60–$680/form. |

| Wage Base Errors (Box 3) | Exceeding $176,100 SS cap. | Cap at $176,100; report excess tips separately. | Refunds delayed. |

| Missing Box 12 Codes | Omitting health FSA ($3,300 limit). | Use codes for deferrals; update for Roth SIMPLE. | Audit risks. |

| Late Filing | Missing Feb. 2 deadline. | E-file early; Form 8809 for extension. | $340+/form (intentional $680). |

| No Corrections (W-2c) | Ignoring errors post-filing. | File W-2c/W-3c promptly. | Cumulative penalties. |

Correct with W-2c; retain 4 years.

IRS Form W-2 Download and Printable

Download and Print: IRS Form W-2

2025 Updates and Special Considerations for Form W-2

The 2025 instructions highlight:

- OMB Number: 1545-0029 across W-2 series.

- Wage Base: SS $176,100; max withholding $10,918.20.

- Health FSA: $3,300 limit.

- EITC: AGI limits $64,430 (no kids); valid SSNs required.

- No OBBBA Changes: Tips/overtime deductions start 2026; 2025 unchanged.

- Extensions: Form 15397 fax for employee copies.

For territories, use W-2AS; nonresidents follow Pub. 519.

Final Thoughts: Master Form W-2 Compliance for 2025

IRS Form W-2 is the cornerstone of payroll reporting, ensuring accurate tax filings and Social Security credits. For 2025, prioritize e-filing by February 2, 2026, verify data against payroll, and correct errors swiftly to dodge penalties. Employers: Use BSO for efficiency; employees: Review for EITC eligibility.

Download instructions from IRS.gov and consult Pub. 15 for details. This guide is informational; seek professional advice.

Not tax advice. Refer to IRS resources.

FAQs About IRS Form W-2

What is the 2025 Social Security wage base on Form W-2?

$176,100; withhold 6.2% up to this amount.

When must employers furnish 2025 W-2s to employees?

January 31, 2026.

How do I correct a 2025 Form W-2 error?

File Form W-2c with the SSA; issue corrected copy to employee.

Is e-filing required for 2025 W-2s?

Yes, for 10+ forms; use SSA BSO.