Table of Contents

IRS Form 5498 – IRA Contribution Information – Retirement savings remain a cornerstone of financial security, with over 35% of U.S. households holding IRAs valued at a collective $13 trillion in 2025. For trustees, custodians, and account holders, IRS Form 5498, IRA Contribution Information, is the essential document that tracks contributions, rollovers, conversions, and fair market values (FMV) for traditional, Roth, SEP, and SIMPLE IRAs. As the IRS released updated instructions on May 12, 2025, incorporating inflation-adjusted limits and new reporting nuances like enhanced catch-up provisions under SECURE 2.0, accurate filing is more important than ever to support tax deductions and avoid penalties up to $630 per form for intentional disregard.

This SEO-optimized guide, based on the official 2025 Instructions for Forms 1099-R and 5498 and Publication 590-A, covers the form’s purpose, who files it, step-by-step completion, deadlines, and common errors. Whether you’re an IRA custodian streamlining compliance or an individual verifying your contributions for a deduction, mastering Form 5498 ensures eligibility for up to $7,000 in annual limits (plus $1,000 catch-up for age 50+). Let’s dive into how this form fuels your retirement strategy for 2025.

What Is IRS Form 5498?

Form 5498 is an informational return filed by IRA trustees or custodians to report contributions (including those made through April 15, 2026, for 2025), rollovers, conversions from traditional to Roth IRAs, and the account’s year-end FMV. It helps the IRS verify compliance with contribution limits and supports account holders in claiming deductions on Form 1040 (Schedule 1, line 20).

Key reporting elements:

- Box 1: Traditional IRA contributions (up to $7,000; $8,000 age 50+).

- Box 2: Rollover contributions.

- Box 3: Roth IRA conversions.

- Box 4: SEP contributions.

- Box 5: Year-end FMV.

- Box 7: SIMPLE IRA contributions.

- Box 10: RMD amount (if applicable).

- Box 11: Checkbox for age 73+ RMD requirement.

For 2025, the form includes updated references to SECURE 2.0’s higher catch-up limits ($1,100 for ages 50–59, $1,500 for 60–63 in certain plans) and clarifies recharacterizations (Code N for same-year, Code R for prior-year). Unlike Form 1099-R (for distributions), 5498 focuses on inflows and values—no tax is due upon receipt, but it’s crucial for audits and excess contribution penalties (6% excise tax).

Key Fact: Contributions through April 15, 2026, count for 2025 deductions, but Form 5498 won’t reflect them until the May 2026 filing—use your records for your 2025 return.

Who Must File and Receive Form 5498?

Filers: Trustees, custodians, or issuers (e.g., banks, brokerages like Fidelity or Vanguard) must file Form 5498 for each person with an IRA (traditional, Roth, SEP, SIMPLE, or deemed under section 408(q)) maintained during 2025, even if no contributions occurred. This applies to:

- Financial institutions holding IRAs.

- Employers sponsoring SEP/SIMPLE plans.

- Any entity acting as IRA custodian.

Recipients:

- IRS: Copy A for compliance tracking.

- Account Holder: Copy B by May 31, 2026 (FMV/RMD by January 31, 2026, optional but recommended).

Exceptions: No filing for inactive accounts closed before 2025 or non-IRA arrangements. E-filing is mandatory for 10+ forms; paper for fewer. Account holders don’t file the form but use it to substantiate deductions—mismatches can trigger IRS notices.

Step-by-Step Guide: How to Complete IRS Form 5498 for 2025

The 2025 Form 5498 (Rev. December 2024) is a two-page PDF—use IRS-approved software for e-filing or official red-ink for paper. Aggregate from account statements; designate an account number for tracking.

1. Gather Data

- Contributions/rollovers through April 15, 2026 (for 2025).

- FMV as of December 31, 2025.

- RMD details (if age 73+; $0 if waived first year).

2. Header and Participant Info

- Trustee/Issuer Details: Name, address, TIN (full, no truncation).

- Participant’s TIN/Name/Address: SSN/ITIN; truncate on Copy B for privacy.

- Account Number: Required for multiple accounts.

3. Boxes 1–7: Contributions and Types

- Box 1: Traditional IRA contributions ($7,000 limit; include catch-up).

- Box 2: Rollover contributions (direct/indirect).

- Box 3: Roth conversions (FMV of amount converted).

- Box 4: SEP contributions.

- Box 5: FMV (December 31, 2025).

- Box 6: Checkbox for designated Roth contributions (SEP/SIMPLE).

- Box 7: SIMPLE IRA contributions.

4. Boxes 8–11: RMD and Other

- Box 8: Repayments (e.g., qualified disaster).

- Box 9: FMV of specified assets.

- Box 10: RMD amount.

- Box 11: Age 73+ RMD checkbox (new for tracking).

5. Box 12: Account Type

- Checkbox: Traditional, Roth, SEP, SIMPLE, or Deemed IRA.

Pro Tip: For recharacterizations, pair with 1099-R (Code N/R); report FMV in Box 3, $0 taxable.

Deadlines and How to File Form 5498 for 2025

Timing ensures IRS matching—late filings incur $60–$310 penalties per form:

- FMV/RMD to Participants: January 31, 2026 (optional; fax Form 15397 for 30-day extension).

- All Other to Participants: May 31, 2026.

- File with IRS: May 31, 2026 (paper with 1096; e-file for 10+ via FIRE system).

Methods:

- E-File: FIRE (mandatory 10+; test by April 2026).

- Paper: Mail to IRS per instructions; limited use.

- Extensions: Form 8809 (30 days, pre-deadline); no furnishing extension beyond 15397.

Common Mistakes to Avoid When Filing Form 5498

Errors lead to 25% of IRA audit triggers—here’s a table of 2025 pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| Missing Post-April Contributions | Forgetting deadline extensions. | Include through April 15, 2026; update records. | $60–$310/form; deduction denials. |

| Incorrect FMV (Box 5) | Using mid-year value. | Calculate December 31, 2025; include assets. | Mismatch audits. |

| TIN/Name Errors | Typos or truncation on Copy A. | Verify SSN/ITIN; full on A, truncate optional on B. | $60/form. |

| Omitting RMD Checkbox (Box 11) | Overlooking age 73+ rule. | Check for 1952+ births; report amount in Box 10. | 25% RMD penalty. |

| Late E-Filing | Missing May 31 for 10+ forms. | Use FIRE; request 8809 early. | $310+/form (max $4M/year). |

| No Separate Forms for Multiple IRAs | Bundling accounts. | File per IRA type/account number. | Incomplete reporting. |

Correct with amended 5498 marked “CORRECTED”; retain 3 years.

2025 Updates and Special Considerations for Form 5498

The 2025 instructions (Rev. May 2025) reflect SECURE 2.0 and inflation:

- Contribution Limits: $7,000 under 50; $8,000 (50+); Roth phase-out $150K–$165K single ($236K–$246K joint).

- Catch-Ups: $1,000 standard (50+); higher for 60–63 in employer plans (up to $11,250, optional adoption).

- Recharacterizations: Codes N/R clarified; FMV reporting for revocations.

- RMD Age: Box 11 tracks 73+ (born 1952+); first RMD 2025 for many.

- E-Filing: 10+ mandatory; Pub. 1220 for specs.

- Excess Contributions: Withdraw by October 15, 2026, to avoid 6% tax (Form 5329).

For Roth SEP/SIMPLE, report in Box 6; nonresidents use Form 1040-NR.

Final Thoughts: Leverage Form 5498 for Smarter IRA Planning in 2025

IRS Form 5498 is more than paperwork—it’s proof of your retirement progress, enabling deductions up to $8,000 while flagging limits to prevent penalties. For 2025, align contributions with the $7,000 cap and SECURE 2.0 boosts, filing by May 31, 2026, to stay compliant. Custodians: E-file via FIRE; holders: Use for Schedule 1 verification and Pub. 590-A guidance.

Consult a tax advisor for conversions or excesses. This guide is informational; refer to IRS.gov for your situation.

Not tax advice. Always use official IRS resources.

FAQs About IRS Form 5498

What is the 2025 IRA contribution limit reported on Form 5498?

$7,000 under age 50; $8,000 (50+ catch-up).

When is Form 5498 due for 2025?

File/furnish by May 31, 2026 (FMV/RMD optional by January 31).

Who files Form 5498?

IRA trustees/custodians for each maintained account.

What if I overcontribute to my IRA in 2025?

Withdraw excess + earnings by October 15, 2026; report on amended 5498 to avoid 6% tax.# IRS Form 5498: A Complete Guide to IRA Contribution Information Reporting for 2025

Retirement savings remain a cornerstone of financial security, with over 35% of U.S. households holding IRAs valued at a collective $13 trillion in 2025. For trustees, custodians, and account holders, IRS Form 5498, IRA Contribution Information, is the essential document that tracks contributions, rollovers, conversions, and fair market values (FMV) for traditional, Roth, SEP, and SIMPLE IRAs. As the IRS released updated instructions on May 12, 2025, incorporating inflation-adjusted limits and new reporting nuances like enhanced catch-up provisions under SECURE 2.0, accurate filing is more important than ever to support tax deductions and avoid penalties up to $630 per form for intentional disregard.

This SEO-optimized guide, based on the official 2025 Instructions for Forms 1099-R and 5498 and Publication 590-A, covers the form’s purpose, who files it, step-by-step completion, deadlines, and common errors. Whether you’re an IRA custodian streamlining compliance or an individual verifying your contributions for a deduction, mastering Form 5498 ensures eligibility for up to $7,000 in annual limits (plus $1,000 catch-up for age 50+). Let’s dive into how this form fuels your retirement strategy for 2025.

What Is IRS Form 5498?

Form 5498 is an informational return filed by IRA trustees or custodians to report contributions (including those made through April 15, 2026, for 2025), rollovers, conversions from traditional to Roth IRAs, and the account’s year-end FMV.

Key reporting elements:

- Box 1: Traditional IRA contributions (up to $7,000; $8,000 age 50+).

- Box 2: Rollover contributions.

- Box 3: Roth IRA conversions.

- Box 4: SEP contributions.

- Box 5: Year-end FMV.

- Box 7: SIMPLE IRA contributions.

- Box 10: RMD amount (if applicable).

- Box 11: Checkbox for age 73+ RMD requirement.

For 2025, the form includes updated references to SECURE 2.0’s higher catch-up limits ($1,100 for ages 50–59, $1,500 for 60–63 in certain plans) and clarifies recharacterizations (Code N for same-year, Code R for prior-year). Unlike Form 1099-R (for distributions), 5498 focuses on inflows and values—no tax is due upon receipt, but it’s crucial for audits and excess contribution penalties (6% excise tax).

Key Fact: Contributions through April 15, 2026, count for 2025 deductions, but Form 5498 won’t reflect them until the May 2026 filing—use your records for your 2025 return.

Who Must File and Receive Form 5498?

Filers: Trustees, custodians, or issuers (e.g., banks, brokerages like Fidelity or Vanguard) must file Form 5498 for each person with an IRA (traditional, Roth, SEP, SIMPLE, or deemed under section 408(q)) maintained during 2025, even if no contributions occurred. This applies to:

- Financial institutions holding IRAs.

- Employers sponsoring SEP/SIMPLE plans.

- Any entity acting as IRA custodian.

Recipients:

- IRS: Copy A for compliance tracking.

- Account Holder: Copy B by May 31, 2026 (FMV/RMD by January 31, 2026, optional but recommended).

Exceptions: No filing for inactive accounts closed before 2025 or non-IRA arrangements. E-filing is mandatory for 10+ forms; paper for fewer. Account holders don’t file the form but use it to substantiate deductions—mismatches can trigger IRS notices.

Step-by-Step Guide: How to Complete IRS Form 5498 for 2025

The 2025 Form 5498 (Rev. December 2024) is a two-page PDF—use IRS-approved software for e-filing or official red-ink for paper. Aggregate from account statements; designate an account number for tracking.

1. Gather Data

- Contributions/rollovers through April 15, 2026 (for 2025).

- FMV as of December 31, 2025.

- RMD details (if age 73+; $0 if waived first year).

2. Header and Participant Info

- Trustee/Issuer Details: Name, address, TIN (full, no truncation).

- Participant’s TIN/Name/Address: SSN/ITIN; truncate on Copy B for privacy.

- Account Number: Required for multiple accounts.

3. Boxes 1–7: Contributions and Types

- Box 1: Traditional IRA contributions ($7,000 limit; include catch-up).

- Box 2: Rollover contributions (direct/indirect).

- Box 3: Roth conversions (FMV of amount converted).

- Box 4: SEP contributions.

- Box 5: FMV (December 31, 2025).

- Box 6: Checkbox for designated Roth contributions (SEP/SIMPLE).

- Box 7: SIMPLE IRA contributions.

4. Boxes 8–11: RMD and Other

- Box 8: Repayments (e.g., qualified disaster).

- Box 9: FMV of specified assets.

- Box 10: RMD amount.

- Box 11: Age 73+ RMD checkbox (new for tracking).

5. Box 12: Account Type

- Checkbox: Traditional, Roth, SEP, SIMPLE, or Deemed IRA.

Pro Tip: For recharacterizations, pair with 1099-R (Code N/R); report FMV in Box 3, $0 taxable.

Deadlines and How to File Form 5498 for 2025

Timing ensures IRS matching—late filings incur $60–$310 penalties per form:

- FMV/RMD to Participants: January 31, 2026 (optional; fax Form 15397 for 30-day extension).

- All Other to Participants: May 31, 2026.

- File with IRS: May 31, 2026 (paper with 1096; e-file for 10+ via FIRE system).

Methods:

- E-File: FIRE (mandatory 10+; test by April 2026).

- Paper: Mail to IRS per instructions; limited use.

- Extensions: Form 8809 (30 days, pre-deadline); no furnishing extension beyond 15397.

Common Mistakes to Avoid When Filing Form 5498

Errors lead to 25% of IRA audit triggers—here’s a table of 2025 pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| Missing Post-April Contributions | Forgetting deadline extensions. | Include through April 15, 2026; update records. | $60–$310/form; deduction denials. |

| Incorrect FMV (Box 5) | Using mid-year value. | Calculate December 31, 2025; include assets. | Mismatch audits. |

| TIN/Name Errors | Typos or truncation on Copy A. | Verify SSN/ITIN; full on A, truncate optional on B. | $60/form. |

| Omitting RMD Checkbox (Box 11) | Overlooking age 73+ rule. | Check for 1952+ births; report amount in Box 10. | 25% RMD penalty. |

| Late E-Filing | Missing May 31 for 10+ forms. | Use FIRE; request 8809 early. | $310+/form (max $4M/year). |

| No Separate Forms for Multiple IRAs | Bundling accounts. | File per IRA type/account number. | Incomplete reporting. |

Correct with amended 5498 marked “CORRECTED”; retain 3 years.

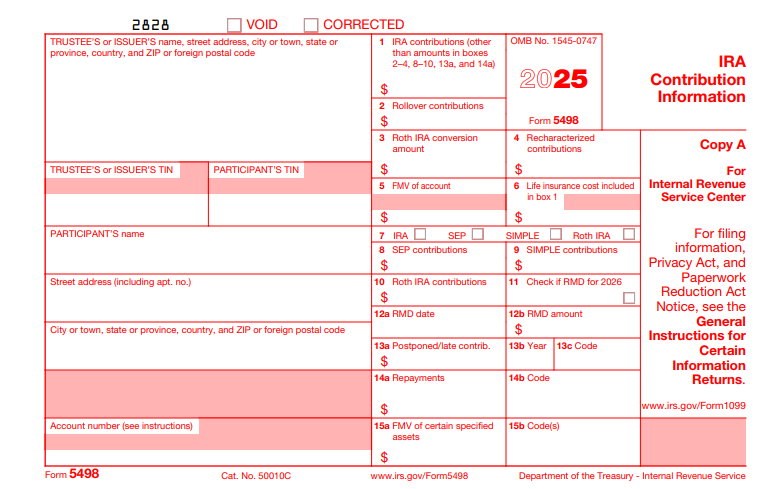

IRS Form 5498 Download and Printable

Download and Print: IRS Form 5498

2025 Updates and Special Considerations for Form 5498

The 2025 instructions (Rev. May 2025) reflect SECURE 2.0 and inflation:

- Contribution Limits: $7,000 under 50; $8,000 (50+); Roth phase-out $150K–$165K single ($236K–$246K joint).

- Catch-Ups: $1,000 standard (50+); higher for 60–63 in employer plans (up to $11,250, optional adoption).

- Recharacterizations: Codes N/R clarified; FMV reporting for revocations.

- RMD Age: Box 11 tracks 73+ (born 1952+); first RMD 2025 for many.

- E-Filing: 10+ mandatory; Pub. 1220 for specs.

- Excess Contributions: Withdraw by October 15, 2026, to avoid 6% tax (Form 5329).

For Roth SEP/SIMPLE, report in Box 6; nonresidents use Form 1040-NR.

Final Thoughts: Leverage Form 5498 for Smarter IRA Planning in 2025

IRS Form 5498 is more than paperwork—it’s proof of your retirement progress, enabling deductions up to $8,000 while flagging limits to prevent penalties. For 2025, align contributions with the $7,000 cap and SECURE 2.0 boosts, filing by May 31, 2026, to stay compliant. Custodians: E-file via FIRE; holders: Use for Schedule 1 verification and Pub. 590-A guidance.

Consult a tax advisor for conversions or excesses. This guide is informational; refer to IRS.gov for your situation.

Not tax advice. Always use official IRS resources.

FAQs About IRS Form 5498

What is the 2025 IRA contribution limit reported on Form 5498?

$7