Table of Contents

IRS Form 1095-C – Employer-Provided Health Insurance Offer and Coverage – In the evolving landscape of Affordable Care Act (ACA) compliance, Applicable Large Employers (ALEs)—those with 50 or more full-time equivalents—must navigate reporting requirements to verify health coverage offers and avoid penalties averaging $2,970 per uncovered employee per month. IRS Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, is the linchpin for this process, detailing monthly offers, affordability, and enrollment to the IRS. For the 2025 tax year, significant relief under the Paperwork Burden Reduction Act (PBRA) and Employer Reporting Improvement Act (ERIA) eliminates automatic furnishing to employees, shifting to an on-request model while maintaining strict IRS filing deadlines of March 2, 2026 (paper) or March 31, 2026 (electronic).

This SEO-optimized guide, based on the official 2025 Instructions for Forms 1094-C and 1095-C (Rev. December 2024) and IRS Notice 2025-15, breaks down the form’s essentials: purpose, eligibility, completion steps, deadlines, and pitfalls. With penalties rising to $340 per form (up to $660 for intentional disregard), ALEs can leverage these updates for streamlined compliance. Download the 2025 form from IRS.gov and prepare your reporting—it’s not just paperwork; it’s protection against 4980H assessments.

What Is IRS Form 1095-C?

Form 1095-C is an informational statement ALEs use to report health coverage offers and actual coverage provided to full-time employees (FTEs) during the calendar year, supporting IRS verification of ACA employer shared responsibility rules under Section 4980H. It details monthly compliance, including affordability (e.g., 8.39% of household income threshold) and minimum value, helping reconcile employee Premium Tax Credit (PTC) claims on Form 8962.

The form’s structure:

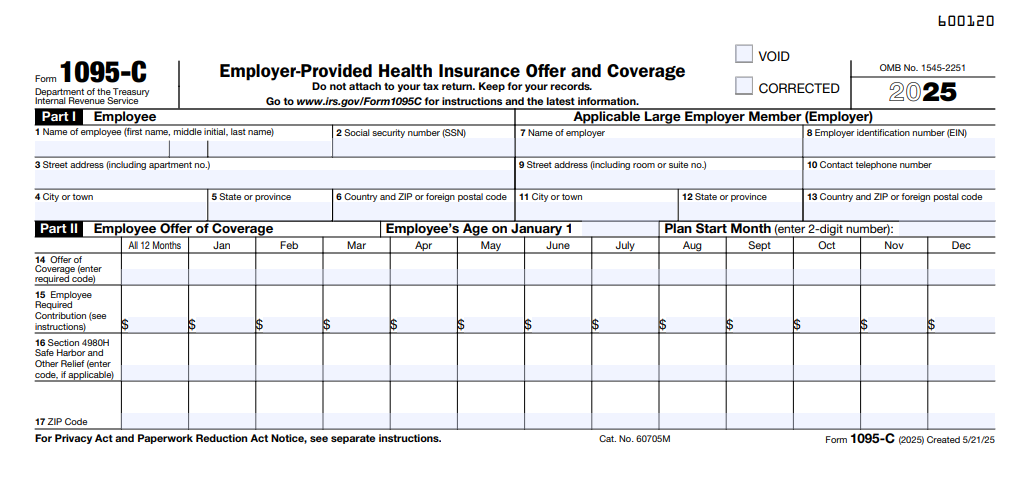

- Part I: Employee and employer identification.

- Part II: Covered individuals (up to three lines; attach if more).

- Part III: Monthly offer/coverage codes (Lines 14–16, 20–23, 25–26).

For 2025, no major structural changes, but instructions emphasize PBRA relief: ALEs post a notice instead of auto-sending forms, reducing costs while requiring a new “Plan Start Month” box for affordability calculations. Self-insured ALEs use it for coverage reporting; fully insured may opt for Form 1095-B if not ALEs.

Key Fact: 95% of FTEs must receive an offer of minimum essential coverage (MEC) to avoid penalties—Form 1095-C proves this via codes like 1E (offer to employee only).

Who Must File and Receive Form 1095-C?

Filers: ALEs—employers averaging 50+ FTEs in 2024—must file Form 1095-C for each FTE (30+ hours/week) in any 2025 month, plus covered non-FTEs under self-insured plans. This includes:

- Standalone ALEs and members of aggregated groups (common ownership).

- Self-insured sponsors reporting coverage.

- Third-party agents (e.g., PEOs) filing on behalf of ALEs.

Recipients:

- IRS: Copy A with Form 1094-C transmittal.

- Employees: Copy B on request (PBRA relief); post notice by March 2, 2026.

Exceptions: Non-ALEs use Form 1095-B; no form for part-time employees unless covered. E-filing mandatory for 10+ forms; aggregate all 1094/1095 types.

Step-by-Step Guide: How to Complete IRS Form 1095-C for 2025

The 2025 Form 1095-C (Rev. May 2025) is a two-page PDF—use ACA software like ACAwise for code validation and e-filing. Base on payroll/HR data; apply affordability safe harbors (W-2, FPL, rate-of-pay).

1. Gather Data

- FTE counts per month (measurement method: 130-hour threshold).

- Offer codes (1A–1H for affordability); coverage codes (1D–1J).

- Employee contributions (Line 15); Plan Start Month (new required field).

2. Part I: Employee and Employer Info

- Lines 1–3: Employee name, SSN (or DOB if unavailable per ERIA), address.

- Line 4: Employer EIN, name, address.

3. Part II: Covered Individuals

- List up to three (name, SSN/DOB, coverage months via checkboxes).

- Use for self-insured dependents; skip if employee-only.

4. Part III: Coverage Details (Lines 14–28)

- Line 14: Monthly offer code (e.g., 1E: MEC to employee).

- Line 15: Employee required contribution (monthly; safe harbor calc).

- Line 16: Shared responsibility code (e.g., 2C: FTE not offered).

- Lines 20–23: Safe harbor codes (e.g., 2C for variable-hour).

- Line 24: Section 4980H transition relief (if applicable).

- Line 25: Multiemployer plan month.

- Line 26: Plan Start Month (required for affordability).

- Line 28: Other coverage info.

Pro Tip: Use codes from instructions (e.g., 1H for affordability via rate-of-pay at 9.83% single-rate premium).

Deadlines and How to File Form 1095-C for 2025

For 2025 coverage (filed in 2026), PBRA/ERIA updates ease furnishing but not IRS filing:

- Furnish to Employees: On request only; post notice by March 2, 2026 (retain until October 15, 2026). Respond within 30 days of request.

- File with IRS (with 1094-C):

- Paper: March 2, 2026 (<10 forms).

- Electronic: March 31, 2026 (mandatory 10+; AIR system).

Extensions: Form 8809 (30 days, pre-deadline); no furnishing extension, but ERIA allows prior consent reliance. Mail paper to IRS per Pub. 5165; e-file via vendors.

Common Mistakes to Avoid When Filing Form 1095-C

IRS Letters 226J assess based on 1095-C data—errors amplify ESRP exposure. Here’s a table of 2025 pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| Incorrect Codes (Lines 14/16) | Misapplying affordability (e.g., ignoring Plan Start Month). | Validate with safe harbors; use 8.39% FPL threshold. | $340/form; ESRP up to $2,970/employee/month. |

| TIN/DOB Substitution Errors | Failing ERIA DOB use for unavailable TINs. | Use full name/DOB for dependents; verify annually. | $60–$340/form. |

| No Notice Posting (PBRA) | Skipping website notice. | Post clear notice by March 2, 2026; retain 7 months. | $330/statement (up to $660 intentional). |

| FTE Count Mismatches | Wrong 130-hour threshold. | Apply look-back/stability period; audit monthly. | 4980H assessments. |

| Late E-Filing | Missing March 31 for 10+ forms. | Use AIR vendors; Form 8809 early. | $340/form (max $4,098,500/year). |

| Ignoring State Mandates | Overlooking CA/NJ requirements. | Check state rules; furnish if mandated. | State fines up to $100/form. |

Correct via “CORRECTED” forms; respond to 226J within 90 days (ERIA).

IRS Form 1095-C Download and Printable

Download and Print: IRS Form 1095-C

2025 Updates and Special Considerations for Form 1095-C

The 2025 instructions (Rev. Dec. 2024) incorporate PBRA/ERIA:

- Furnishing Relief: On-request only; post notice (sample in Notice 2025-15) by March 2, 2026.

- DOB Substitution: Statutory for TIN-unavailable dependents (ERIA).

- Response Time: 90 days for Letters 226J (post-Dec. 23, 2024).

- Plan Start Month: Required box for affordability (e.g., prorated contributions).

- Penalties: $330/form ($660 intentional); ESRP $2,970/month A (no offer), $4,460 B (offer but no PTC subsidy).

- E-Filing: 10+ mandatory; aggregate threshold.

States like CA require furnishing—verify local mandates. For ICHRAs, report age-banded contributions.

Final Thoughts: Simplify ACA Compliance with Form 1095-C in 2025

IRS Form 1095-C empowers ALEs to demonstrate 95% MEC offers, shielding against 4980H penalties while enabling PTC reconciliations. With PBRA/ERIA relief slashing furnishing burdens, focus on accurate e-filing by March 31, 2026—post your notice early and audit codes rigorously. Download from IRS.gov, use Pub. 5165 for specs, and integrate with payroll for efficiency.

For aggregated ALEs, designate authority; consult experts for safe harbors. This guide is informational; seek tailored advice.

Not tax advice. Refer to IRS.gov for your ALE.

FAQs About IRS Form 1095-C

What is the 2025 furnishing deadline for Form 1095-C?

On request; post notice by March 2, 2026 (PBRA relief).

Who files Form 1095-C in 2025?

ALEs (50+ FTEs) for each FTE month.

What are 2025 penalties for late Form 1095-C filing?

$330/form ($660 intentional); ESRP up to $4,460/employee/month.

Does ERIA allow DOB instead of TIN on 2025 Form 1095-C?

Yes, for unavailable TINs on dependents.