Table of Contents

IRS Form 1095-B – Health Coverage – With the Affordable Care Act (ACA) continuing to shape U.S. healthcare despite the federal individual mandate’s penalty being reduced to $0 since 2019, accurate reporting of minimum essential coverage (MEC) remains crucial for insurers, employers, and government programs. IRS Form 1095-B, Health Coverage, serves as the official statement verifying that individuals had qualifying health insurance throughout 2025, helping reconcile premium tax credits (PTC) via Form 8962 and supporting state-level mandates in places like California and New Jersey. For 2025 coverage (filed in 2026), the IRS has released updated instructions on December 4, 2024, incorporating Paperwork Burden Reduction Act (PBRA) relief for on-request furnishing and encouraging—but not requiring—reporting for catastrophic plans.

This SEO-optimized guide, drawing from the official 2025 Instructions for Forms 1094-B and 1095-B and IRS Notice 2025-15, covers the form’s purpose, who files it, step-by-step completion, deadlines, and error avoidance. While the federal penalty is gone, states with their own mandates (e.g., NJ requiring transmission by March 31, 2026) make Form 1095-B vital for compliance and potential refunds averaging $1,400 via PTC. Download the 2025 PDF from IRS.gov and prepare—early filing supports smoother tax seasons.

What Is IRS Form 1095-B?

Form 1095-B is an informational tax form used by health coverage providers to report MEC provided to individuals and their families during the calendar year, confirming compliance with ACA requirements. It details policy information, covered months, and coverage type, aiding the IRS in verifying PTC eligibility and preventing erroneous subsidies.

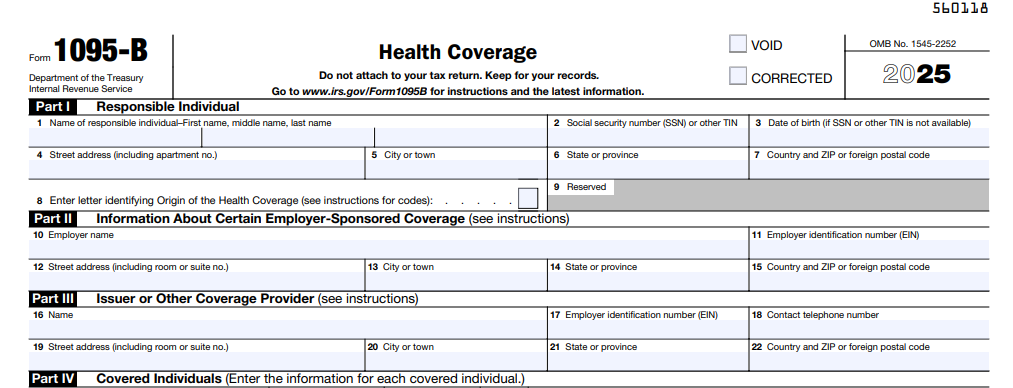

The form consists of:

- Part I: Policyholder and responsible individual details.

- Part II: Provider/sponsor information.

- Part III: Covered individuals (up to six; attach if more).

- Part IV: Coverage months (checkboxes for each month).

For 2025, instructions encourage reporting catastrophic Marketplace plans (not required) and clarify retroactive corrections, like adjusting for coverage ending mid-year. Unlike Form 1095-A (Marketplace) or 1095-C (ALEs), 1095-B covers non-employer-sponsored MEC, such as individual policies or Medicaid. No federal penalty exists for lacking coverage, but it’s key for state mandates and PTC reconciliation—over 80% of eligible households claim PTCs averaging $2,000.

Key Fact: MEC includes employer plans, Marketplace coverage, Medicare, Medicaid, and CHIP—Form 1095-B proves it, but you don’t attach it to your return; retain for records.

Who Must File and Receive Form 1095-B?

Filers: Providers of MEC—health insurers, government agencies (e.g., Medicaid/CHIP/Medicare), and small employers via SHOP—must file Form 1095-B for each policy covering one or more individuals in 2025. This includes:

- Health Insurance Issuers: For individual/family policies and SHOP coverage.

- Government Entities: Medicaid, CHIP, Medicare (optional for Part A).

- Self-Insured Small Employers: Non-ALEs (<50 FTEs) reporting coverage.

Recipients:

- IRS: Copy A with Form 1094-B transmittal.

- Policyholder: Copy B by January 31, 2026 (or on request under PBRA relief; post notice by March 2, 2026).

Exceptions: ALEs use Form 1095-C; Marketplace enrollees get 1095-A. No form for non-MEC (e.g., short-term plans). E-filing mandatory for 10+ forms; paper for fewer. States like NJ require separate transmission by March 31, 2026.

Step-by-Step Guide: How to Complete IRS Form 1095-B for 2025

The 2025 Form 1095-B (Rev. December 2024) is a four-part PDF—use e-filing software for bulk or fillable for small volumes. Report per policy, not individual; include all covered family members.

1. Gather Data

- Policy number, coverage months (full/partial).

- Covered individuals’ names, SSNs/DOBs (use DOB if TIN unavailable).

- Coverage type (e.g., A: SHOP).

2. Part I: Policyholder Info

- Name, address, SSN/ITIN (or DOB).

- Policy number.

3. Part II: Provider/Sponsor

- Name, address, TIN.

- Coverage type code (A–F; e.g., B: Individual market).

4. Part III: Covered Individuals

- List up to six (name, SSN/DOB, relationship).

- Checkbox months covered (January–December).

5. Part IV: Additional

- Indicate if more than six covered (attach list).

Pro Tip: For retroactive changes (e.g., Medicaid approval mid-year), issue corrected forms marked “CORRECTED” by March 2, 2026.

Deadlines and How to File Form 1095-B for 2025

Compliance avoids $60–$330 penalties per form (up to $660 intentional):

- Furnish to Recipients: January 31, 2026 (or on request; post PBRA notice by March 2, 2026, retain through October 15, 2026).

- File with IRS (with 1094-B):

- Paper: March 2, 2026 (<10 forms).

- Electronic: March 31, 2026 (mandatory 10+ via AIR system).

Extensions: Form 8809 (30 days, pre-deadline); Form 15397 fax for furnishing. Mail paper to IRS Austin; e-file per Pub. 5165. States like CA extend to May 31, 2026.

Common Mistakes to Avoid When Filing Form 1095-B

Errors trigger CP2000 notices—here’s a table of 2025 pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| Incomplete Coverage Months (Part IV) | Partial-year oversight. | Checkbox all months; correct retroactively. | $60–$330/form; PTC mismatches. |

| TIN/DOB Errors | Missing SSNs. | Use DOB if unavailable; verify via W-9. | $60/form. |

| Wrong Coverage Type (Part II) | Misclassifying SHOP/Medicaid. | Use codes A–F; reference Pub. 974. | Audit risks. |

| No PBRA Notice | Forgetting post-requirement. | Post by March 2, 2026; include request instructions. | $330/statement. |

| Late E-Filing | Missing March 31 for 10+ forms. | Use AIR; Form 8809 early. | $330+/form (max $4M/year). |

| State Non-Compliance | Ignoring NJ/CA mandates. | Transmit by March 31, 2026 (NJ); check local rules. | State fines up to $100/form. |

Correct with “CORRECTED” forms; file within 30 days for reduced penalties.

IRS Form 1095-B Download and Printable

Download and Print: IRS Form 1095-B

2025 Updates and Special Considerations for Form 1095-B

The 2025 instructions (Rev. Dec. 2024) focus on relief and encouragement:

- PBRA Relief: On-request furnishing; post notice (sample in Notice 2025-15) by March 2, 2026.

- Catastrophic Plans: Encouraged reporting (not required) for Marketplace enrollees.

- Penalties: $60–$330 per form ($660 intentional); max $4,098,500/year.

- E-Filing: 10+ mandatory; AIR schemas updated.

- State Mandates: CA/NJ/RI/DC enforce individual requirements; NJ deadline March 31, 2026.

- Federal Mandate: Penalty $0, but reporting aids PTC (enhanced through 2025).

For Medicaid, report retroactive approvals; Medicare Part A optional.

Final Thoughts: Stay ACA-Compliant with Form 1095-B in 2025

IRS Form 1095-B verifies MEC, supporting PTC claims and state mandates amid a penalty-free federal landscape. For 2025, embrace PBRA on-request furnishing by posting your notice early and e-file by March 31, 2026, to minimize risks. Providers: Use AIR for accuracy; recipients: Retain for Form 8962 and state filings.

Consult Pub. 974 for PTC or a tax pro for state specifics. This guide is informational; verify at IRS.gov.

Not tax advice. Refer to official IRS resources.

FAQs About IRS Form 1095-B

What is the 2025 deadline for furnishing Form 1095-B?

January 31, 2026 (or on request; post PBRA notice by March 2, 2026).

Who receives Form 1095-B in 2025?

Policyholders of non-employer MEC; IRS via 1094-B.

Is the ACA individual mandate enforced federally in 2025?

No—penalty $0 since 2019, but states like CA/NJ enforce their own.

Do I need Form 1095-B to file 2025 taxes?

No—retain for PTC reconciliation; not attached to return.