Table of Contents

IRS Form 1094-B – Transmittal of Health Coverage Information Returns – As healthcare reporting under the Affordable Care Act (ACA) evolves, providers of minimum essential coverage (MEC) play a pivotal role in verifying compliance for millions of Americans. IRS Form 1094-B, Transmittal of Health Coverage Information Returns, acts as the summary cover sheet for batches of Forms 1095-B, ensuring the IRS receives accurate data on health coverage provided in 2025. With the IRS releasing updated instructions on December 4, 2024, including Paperwork Burden Reduction Act (PBRA) relief for on-request furnishing and inflation-adjusted penalties rising to $340 per return (up from $330), timely and precise filing is essential to avoid assessments up to $4,098,500 annually.

This SEO-optimized guide, based on the official 2025 Instructions for Forms 1094-B and 1095-B and IRS Notice 2025-15, explores the form’s purpose, who must file, step-by-step completion, deadlines, and strategies for compliance. Whether you’re an insurer handling individual policies or a small self-insured employer, understanding Form 1094-B safeguards against penalties and supports premium tax credit (PTC) reconciliations. Download the 2025 form from IRS.gov today—e-filing is mandatory for 10+ returns, with deadlines looming in early 2026.

What Is IRS Form 1094-B?

Form 1094-B is a one-page transmittal form that accompanies Forms 1095-B when filing with the IRS, summarizing the total number of health coverage returns and filer details for MEC provided during the calendar year. It enables the IRS to track ACA compliance, reconcile PTC claims on Form 8962, and audit coverage gaps, even though the federal individual mandate penalty is $0 since 2019.

The form includes:

- Part I: Filer identification (name, EIN, contact).

- Part II: Summary of returns (total 1095-B forms, covered individuals).

- Part III: Authorization for third-party filing.

For 2025, updates emphasize PBRA’s alternative furnishing method (on-request statements with posted notice) and encourage reporting for catastrophic plans, though not required. Unlike Form 1094-C (for ALEs), 1094-B focuses on non-employer-sponsored MEC, such as individual market policies or Medicaid.

Key Fact: Form 1094-B is filed only with the IRS—not recipients—and aggregates data for up to 250 1095-B forms per transmittal; multiple may be needed for larger batches.

Who Must File Form 1094-B?

Any entity providing MEC must file Form 1094-B as the transmittal for Forms 1095-B, unless using Form 1094-C for ALE self-insured plans. Primary filers include:

- Health Insurance Issuers/Carriers: For individual market, SHOP, or employer-sponsored insured coverage.

- Small Self-Insured Employers: Non-ALEs (<50 FTEs) sponsoring self-insured group health plans.

- Government Agencies: Medicaid, CHIP, Medicare (Part A optional), or Basic Health Programs.

- Third-Party Administrators: Filing on behalf of sponsors.

Threshold: One 1094-B per batch of 1095-B forms; file if any MEC was provided in 2025, regardless of amount.

Exceptions:

- ALEs self-insured: Use Form 1094-C, Part III of 1095-C.

- Marketplace plans: Covered by Form 1095-A.

- Excepted benefits (e.g., dental-only, short-term): No reporting required.

E-filing is mandatory for 10+ returns (aggregate all 1094/1095 types); paper allowed for fewer. Designated government entities file for non-ALE government employers.

Step-by-Step Guide: How to Complete IRS Form 1094-B for 2025

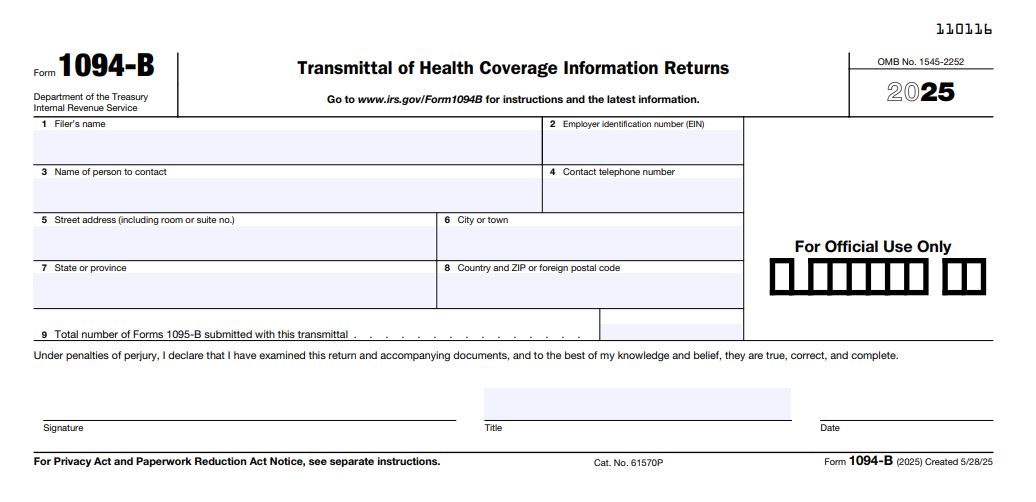

The 2025 Form 1094-B (Rev. May 2025) is a concise transmittal—use the fillable PDF from IRS.gov or e-filing software compliant with Pub. 5165 schemas (updated October 24, 2025). Attach 1095-B forms; sign under perjury.

1. Gather Data

- Total 1095-B forms and covered individuals from records.

- Filer EIN, contact details.

- Third-party authorization if applicable.

2. Part I: Filer Identification

- Line 1: Filer’s full name (e.g., insurer or employer).

- Line 2: EIN (9 digits).

- Line 3: Contact name.

- Line 4: Contact phone/email.

3. Part II: Transmittal Summary

- Line 5: Calendar year (2025).

- Line 6: Total Forms 1095-B submitted.

- Line 7: Total covered individuals (aggregate from Part III of 1095-Bs).

4. Part III: Authorization

- Check if authorizing third-party (e.g., service provider); include their EIN.

5. Sign and Attach

- Sign and date under penalties of perjury.

- Attach 1095-Bs (up to 250 per 1094-B).

Pro Tip: For e-filing, use AIR schemas (version 1.0, updated October 24, 2025); test files by February 2026.

Deadlines and How to File Form 1094-B for 2025

For 2025 coverage (filed in 2026), deadlines align with ACA rules, adjusted for PBRA:

- Furnish 1095-B to Recipients: January 31, 2026 (or on request; post PBRA notice by March 2, 2026, retain through October 15, 2026).

- File with IRS (1094-B + 1095-Bs):

- Paper: March 2, 2026 (<10 forms).

- Electronic: March 31, 2026 (mandatory 10+ via AIR).

Extensions: Automatic 30 days via Form 8809 (file by March 2/31); Form 15397 fax for furnishing. Mail paper to IRS Austin, TX; e-file per Pub. 5165 (updated October 3, 2025). State deadlines vary (e.g., NJ: March 31, 2026).

Common Mistakes to Avoid When Filing Form 1094-B

Filing errors contribute to 30% of ACA notices—here’s a table of 2025 pitfalls based on IRS guidance:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Penalty |

|---|---|---|---|

| Incorrect Total Counts (Line 6/7) | Mismatching 1095-B aggregates. | Reconcile before attaching; use software validation. | $340/form; up to $4,098,500/year. |

| EIN/Contact Errors | Typos in filer details. | Verify EIN; include accurate phone/email. | Rejection; $340/form. |

| Missing PBRA Notice | Overlooking on-request furnishing. | Post by March 2, 2026; retain 7 months. | $340/statement (intentional $680). |

| Paper Filing >9 Forms | Exceeding threshold. | E-file for 10+; use AIR schemas v1.0. | $340/form. |

| No Third-Party Authorization | Omitting for agents. | Check Part III; include EIN. | Processing delays. |

| State Deadline Miss | Ignoring NJ/CA rules. | File by March 31, 2026 (NJ); verify locally. | State fines up to $100/form. |

Amend with “CORRECTED” 1094-B; file within 30 days for abatement.

IRS Form 1094-B Download and Printable

Download and Print: IRS Form 1094-B

2025 Updates and Special Considerations for Form 1094-B

The 2025 instructions (Rev. December 2024) highlight PBRA and inflation adjustments:

- PBRA Relief: On-request 1095-B furnishing; post notice (Notice 2025-15 sample) by March 2, 2026.

- Penalties: $340/return ($680 intentional); max $4,098,500/year (up from $3,987,000).

- E-Filing: 10+ mandatory; schemas v1.0 (October 24, 2025).

- Catastrophic Plans: Encouraged reporting.

- State Mandates: Enforced in CA, NJ, RI, DC, MA, VT, WA, D.C.

For Medicaid/CHIP, report retroactively; self-insured non-ALEs must file.

Final Thoughts: Ensure ACA Reporting Success with Form 1094-B in 2025

IRS Form 1094-B streamlines health coverage transmittals, enabling IRS oversight of MEC while supporting PTC claims amid a $0 federal penalty. For 2025, capitalize on PBRA’s on-request model by posting your notice early and e-file by March 31, 2026, to evade $340+ penalties. Providers: Leverage AIR for accuracy; small employers: Confirm self-insured status.

Download from IRS.gov and consult Pub. 5165 for schemas. This guide is informational; seek professional guidance for state specifics.

Not tax advice. Refer to IRS.gov for your situation.

FAQs About IRS Form 1094-B

Who must file Form 1094-B in 2025?

MEC providers like insurers, small self-insured employers, and government agencies for 1095-B batches.

What is the 2025 e-filing deadline for Form 1094-B?

March 31, 2026 (mandatory for 10+ forms).

Does PBRA change 2025 Form 1094-B furnishing?

Yes—on-request 1095-B; post notice by March 2, 2026.

What are 2025 penalties for late Form 1094-B filing?

$340 per return ($680 intentional); max $4,098,500/year.