Table of Contents

IRS Form 4952 – Investment Interest Expense Deduction – In the world of investment strategies, borrowing to amplify returns can be a smart move—but it comes with tax implications. Enter IRS Form 4952, the Investment Interest Expense Deduction, a crucial tool for investors who finance their portfolios with debt. This form calculates how much of your margin interest or loan costs you can deduct on Schedule A (Form 1040), potentially saving thousands while carrying forward excess expenses indefinitely. For the 2025 tax year, with no major structural changes from prior years but inflation-adjusted thresholds influencing itemized deductions, Form 4952 remains a staple for high-net-worth individuals navigating the 2% AGI floor suspension on miscellaneous expenses through 2025.

This SEO-optimized guide, based on the official 2025 Form 4952 instructions (Rev. December 2024) and IRS Publication 550 (Investment Income and Expenses), breaks down everything from eligibility and calculation to filing steps, deadlines, and pitfalls. Whether you’re leveraging a brokerage margin account or financing rental properties, understanding Form 4952 can optimize your tax strategy amid the TCJA’s ongoing suspension of certain itemized deductions. Download the 2025 PDF from IRS.gov and start tracing your interest today.

What Is IRS Form 4952?

Form 4952 is a one-page worksheet used by individual taxpayers, estates, and trusts to compute the deductible portion of investment interest expense under Internal Revenue Code Section 163(d). It limits the deduction to your net investment income (e.g., interest, dividends, short-term capital gains), with any excess carried forward to future years—no expiration.

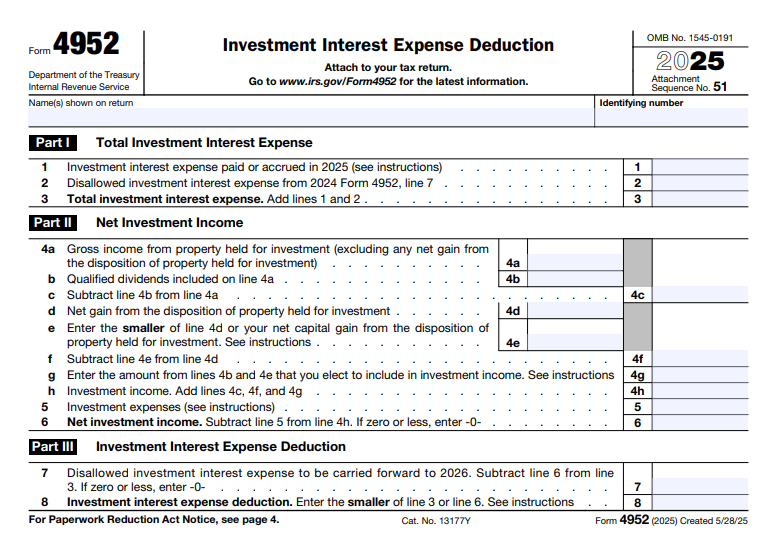

The form divides into:

- Part I: Total investment interest expense (current year + carryover).

- Part II: Net investment income (taxable income from investments minus expenses).

- Part III: Deduction calculation (smaller of expense or income) and carryforward.

For 2025, the form retains its structure but references updated Publication 550 guidance on tracing rules (Temp. Regs. Sec. 1.163-8T) for allocating debt proceeds. Attach it to Schedule A, line 9, if itemizing—crucial since the standard deduction rose to $15,750 (single) or $31,500 (joint). No changes from 2024, but note the suspension of miscellaneous investment expenses (e.g., advisory fees) through 2025 under TCJA Sec. 67(g).

Key Fact: Unlike business interest (limited by Sec. 163(j) to 30% of adjusted taxable income), investment interest is capped solely by net investment income—no EBITDA adjustment needed.

Who Must File Form 4952?

File Form 4952 if you have investment interest expense and want to deduct any amount on Schedule A—mandatory for claiming the deduction, even if fully offset by income. This applies to:

- Individual Investors: Those borrowing for stocks, bonds, or mutual funds (e.g., margin loans).

- Rental Property Owners: Interest on debt for depreciable real estate held for income production.

- Estates and Trusts: Reporting on Form 1041, Schedule A.

- Traders: If electing mark-to-market (Sec. 475(f)), interest may qualify as business, bypassing Form 4952.

Exceptions:

- No filing if expense ≤ net investment income and no carryforward.

- Personal interest (e.g., credit cards, home equity not traced to investments) is nondeductible.

- Tax-exempt interest (e.g., municipal bonds) reduces allowable income.

Itemizers only—compare to the 2025 standard deduction ($15,750 single, $31,500 joint) to ensure benefits.

Step-by-Step Guide: How to Complete IRS Form 4952 for 2025

The 2025 Form 4952 is straightforward—download the PDF from IRS.gov and use tax software for auto-population from Schedule B/D. Trace debt per Pub. 550; complete in black ink.

1. Gather Your Data

- Investment interest paid (Form 1098 or lender statements).

- Prior-year carryforward (from 2024 Form 4952, line 7).

- Net investment income: Taxable interest/dividends (Schedule B), short-term gains (Schedule D), ordinary annuities minus expenses.

2. Part I: Total Investment Interest Expense (Lines 1–3)

- Line 1: Current-year expense (e.g., margin interest).

- Line 2: Carryforward from prior year.

- Line 3: Total (sum lines 1+2).

3. Part II: Net Investment Income (Lines 4a–6)

- Line 4a: Gross investment income (interest + dividends + short-term gains).

- Line 4b: Qualified dividends/long-term gains (do not include to preserve preferential rates).

- Line 4c: Subtract 4b from 4a.

- Line 4d: Net short-term gain (Schedule D).

- Line 4e: Ordinary income from annuities/royalties.

- Line 4f–h: Sum and subtract expenses (e.g., safe deposit box fees; note: miscellaneous suspended).

- Line 5: Investment expenses (limited post-2017).

- Line 6: Net (line 4h – 5).

4. Part III: Investment Interest Expense Deduction (Lines 7–9)

- Line 7: Smaller of line 3 or 6.

- Line 8: Elective inclusion (from 4b/4e) to boost deduction.

- Line 9: Total deduction (7 + 8); enter on Schedule A, line 9.

5. Carryforward (Line 10)

- Disallowed expense (line 3 – line 9) carries to 2026.

Pro Tip: Elect to include qualified dividends on line 8 if marginal rate >15%—boosts deduction but taxes them at ordinary rates.

When and Where to File Form 4952 for 2025

Attach Form 4952 to your 2025 Form 1040 (or 1041) when filing—due April 15, 2026 (or October 15 with extension via Form 4868/7004). No separate submission; e-file via tax software for faster processing.

- Itemizers Only: Weigh against standard deduction ($15,750 single, $31,500 joint in 2025).

- AMT Impact: Deduction may trigger alternative minimum tax—use Form 6251 to check.

- Carryforwards: Indefinite; track annually.

File electronically for refunds under 21 days; paper if mailing.

Common Mistakes to Avoid When Filing Form 4952

Tracing errors lead to 20% of investment audit adjustments—here’s a table of frequent issues:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Improper Tracing (Part I) | Mixing personal/business debt. | Use Temp. Regs. 1.163-8T; document loan proceeds. | Full disallowance; audit. |

| Excluding Qualified Income (Part II) | Omitting long-term gains. | Include on line 4b; elect on line 8 if beneficial. | Reduced deduction; carryforward loss. |

| Forgetting Carryforward (Line 2) | Prior-year oversight. | Retain old forms; add to line 1. | Permanent loss of expense. |

| AMT Oversight (Line 9) | Ignoring preference item. | Run Form 6251; adjust if AMTI exceeds exemption. | Underpayment penalty (0.5%/month). |

| Not Itemizing | Taking standard despite benefits. | Compare totals; use software simulation. | Missed savings up to 37% of expense. |

| Suspended Expenses (Line 5) | Including advisory fees. | Exclude misc. items through 2025; focus on direct costs. | IRS adjustment + interest. |

Amend via Form 1040X if errors found post-filing.

IRS Form 4952 Download and Printable

Download and Print: IRS Form 4952

2025 Updates and Special Considerations for Form 4952

The 2025 instructions (Rev. December 2024) align with TCJA extensions:

- No Form Changes: Structure identical to 2024; references Pub. 550 for tracing.

- Standard Deduction Impact: $15,750 single/$31,500 joint—threshold for itemizing viability.

- Suspended Expenses: Misc. investment costs (e.g., fees) nondeductible through 2025 (Sec. 67(g)).

- AMT Exemption: $85,700 single/$133,300 joint (phase-out at $609,350/$1,218,700).

- Carryforwards: Unlimited; ideal for volatile markets.

- Traders: Business treatment under Sec. 475(f) election avoids limits.

For partnerships/S corps, use K-1 adjustments; nonresidents file with 1040-NR.

Final Thoughts: Unlock Savings with Form 4952 in 2025

IRS Form 4952 empowers investors to deduct borrowing costs up to net income, carrying forward the rest for future gains—essential for leveraged portfolios in a high-rate environment. For 2025, confirm tracing per Pub. 550, itemize wisely, and attach to your April 15, 2026, return. With TCJA suspensions ending post-2025, now’s the time to maximize.

Consult a CPA for tracing or AMT. This guide is informational; verify IRS.gov for your situation.

Not tax advice. Refer to official IRS resources.

FAQs About IRS Form 4952

What is the limit on the investment interest deduction for 2025?

Limited to net investment income; excess carries forward indefinitely.

Do I need Form 4952 to claim investment interest in 2025?

Yes, if deducting any amount on Schedule A.

Can I deduct margin interest on Form 4952?

Yes, if traced to taxable investments.

What if I’m subject to AMT in 2025?

The deduction may be reduced; use Form 6251 to calculate.