Table of Contents

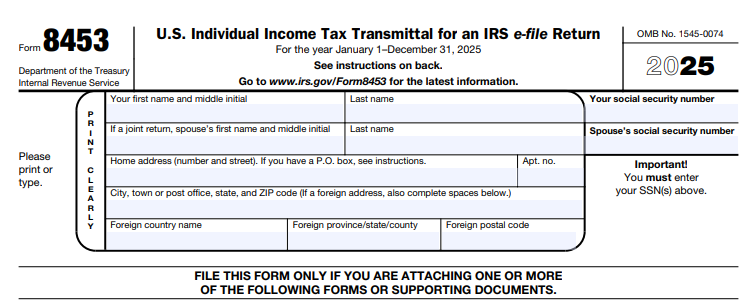

IRS Form 8453 – U.S. Individual Income Tax Transmittal for an IRS e-file Return – In an era where over 90% of individual tax returns are filed electronically for faster refunds and fewer errors, certain paper documents still require a bridge to the digital world. IRS Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return, serves as that essential cover sheet, allowing taxpayers to mail supporting paperwork—like Form 1098-T for education credits or Form 5329 for excess IRA contributions—without delaying their e-filed Form 1040. As the IRS gears up for the 2025 filing season with instructions released in late 2024, this form remains unchanged in structure but underscores the importance of timely mailing (within 48 hours of e-file acceptance) to avoid processing delays or penalties up to $340 per return for intentional disregard.

This SEO-optimized guide, based on the official 2025 Form 8453 (Rev. November 2025) and related IRS resources, covers the form’s purpose, who needs it, step-by-step instructions, deadlines, and common pitfalls. Whether you’re a first-time e-filer claiming a historic structures credit or an itemizer attaching Form 4952 for investment interest, Form 8453 ensures your paper attachments are properly transmitted. Download the latest PDF from IRS.gov and streamline your 2025 filing—e-file acceptance doesn’t mean your work is done until the mail drops.

What Is IRS Form 8453?

Form 8453 is a one-page transmittal document used exclusively with IRS e-file returns to authorize and accompany paper forms or supporting statements that cannot be electronically submitted. It acts as a signature authorization for your electronic return originator (ERO)—like a tax preparer or software provider—while listing the attached documents, ensuring the IRS matches them to your e-filed 1040.

Key features for 2025:

- Checkboxes: For 13 specific forms/statements (e.g., Form 8839 for qualified adoption expenses, Form 4136 for credit for federal tax paid on fuels).

- Signature Section: Taxpayer’s wet signature under penalty of perjury.

- Direct Deposit: Optional authorization for refunds.

The form doesn’t hold up e-file processing—your return is accepted immediately—but attachments must arrive within 48 hours to avoid IRS requests for originals. For 2025, the revision date is November 2025, with Cat. No. 62766T and OMB No. 1545-0074, emphasizing foreign address handling and no payment attachments (use Form 1040-V instead). It’s not filed standalone; always pair with an e-filed return.

Key Fact: Form 8453 is taxpayer-specific—only the primary taxpayer (or spouse for joint returns) signs, and it’s retained by the ERO after mailing.

Who Must File Form 8453?

You must use Form 8453 if you’re e-filing Form 1040 (or 1040-SR) and have one or more of the 13 listed paper forms/statements to attach. This includes:

- Individual Taxpayers: Claiming credits requiring originals, like Form 8839 (adoption) or Form 2120 (multiple support declaration).

- Itemizers: Attaching Form 4952 (investment interest) or Form 1116 (foreign tax credit) if not e-fileable.

- Joint Filers: Both spouses sign if authorizing direct deposit or power of attorney.

When Required: Check the 13 boxes on the form—if any apply (e.g., Form 1098-C for charitable vehicle contributions), complete and mail.

Exceptions:

- Pure e-file returns with no paper needs: Skip Form 8453.

- Amended returns: Use Form 8453-X instead.

- Estates/trusts: Use Form 8879 (or variants like 8453-FE).

EROs (preparers) retain the signed original; taxpayers keep copies for 3 years.

Step-by-Step Guide: How to Complete IRS Form 8453 for 2025

The 2025 Form 8453 is simple—download the fillable PDF from IRS.gov and complete after e-file acceptance. Sign by hand; no e-signature.

1. Prepare Your E-File Return

- Use software (e.g., TurboTax) to generate Form 1040; note acceptance date/time.

- Identify attachments: Review the 13 checkboxes (e.g., Form 1116 if foreign taxes >$300).

2. Fill the Header

- Your Name/Address: Print or type; use foreign format if applicable (no P.O. box unless necessary).

- SSN: Primary taxpayer’s full number.

3. Check Applicable Boxes (Lines 1–13)

- Mark each required form/statement (e.g., Line 1: Form 2120; Line 13: General election/statement).

- Attach originals or copies as specified (e.g., certified transcripts for Line 11).

4. Direct Deposit (Line 14)

- Optional: Enter routing/transit number, account type (checking/savings), and account number for refunds.

5. Power of Attorney (Line 15)

- If authorizing an agent, attach Form 2848 specifying e-file signature rights.

6. Sign and Date

- Taxpayer (and spouse for joint) signs under penalty; date within 48 hours of acceptance.

- ERO enters their PTIN/firm info; no ERO signature needed.

Pro Tip: Mail to the address in the instructions based on your state (e.g., Andover, MA for Northeast); use certified mail for tracking.

Deadlines and How to File Form 8453 for 2025

Form 8453 ties to your e-filed return—due April 15, 2026, but mail within 48 hours of IRS acceptance to match records. Extensions for the return (Form 4868) don’t extend mailing.

- Mailing Address: Varies by state (e.g., Fresno, CA for West; full list in instructions).

- No E-File for 8453: Always paper; no payment attached (use 1040-V).

- Retention: ERO keeps signed original; taxpayer retains copies 3 years.

If attachments arrive late, the IRS may request resubmission—delaying refunds.

Common Mistakes to Avoid When Filing Form 8453

Delays from mismatches affect 15% of e-files—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Mailing >48 Hours Post-Acceptance | Delaying after e-file. | Print/sign/mail immediately; track certified. | IRS request for originals; refund delay. |

| Wrong Checkbox (Lines 1–13) | Attaching non-listed forms. | Review list (e.g., no Form W-2); use 1099 for others. | $60–$340/form penalty. |

| SSN/Address Errors | Typos in header. | Double-check vs. 1040; full foreign address. | Mismatch notice (CP2000). |

| No Signature/Date | Forgetting wet ink. | Sign by hand; date timely. | Invalid authorization; return rejection. |

| Wrong Mailing Address | Using general IRS. | Follow state-specific (e.g., Kansas City for Midwest). | Lost documents; refiling. |

| Attaching Payments | Including check with 8453. | Use Form 1040-V separately. | Processing errors. |

Amend via e-filed 1040X; resend attachments if needed.

IRS Form 8453 Download and Printable

Download and Print: IRS Form 8453

2025 Updates and Special Considerations for Form 8453

The 2025 Form 8453 (Rev. November 2025) is largely unchanged, but instructions note:

- OMB No.: 1545-0074; Cat. No. 62766T.

- 48-Hour Rule: Strict enforcement for attachments.

- Direct Deposit: Still optional; no changes to routing.

- Power of Attorney: Form 2848 must specify e-file rights.

- E-File Push: 90%+ adoption; 8453 for the remaining paper needs.

- Penalties: $60–$340 late; up to $680 intentional (inflation-adjusted post-12/31/2025).

For foreign filers, use international addresses; nonresidents attach to 1040-NR.

Final Thoughts: Simplify E-File Attachments with Form 8453 in 2025

IRS Form 8453 bridges e-file convenience with paper necessities, ensuring your credits and deductions aren’t lost in the digital shuffle. For 2025, e-file your 1040 by April 15, 2026, then mail attachments within 48 hours—use certified mail and keep records to sidestep delays. With 13 specific checkboxes, review early to avoid surprises.

Tax pros: Guide clients on signatures; filers: Leverage software for prep. This guide is informational; consult IRS.gov for your return.

Not tax advice. Always refer to official IRS guidance.

FAQs About IRS Form 8453

What is Form 8453 used for in 2025?

Transmitting paper forms/statements with e-filed 1040 returns.

When must I mail Form 8453 for 2025?

Within 48 hours of IRS e-file acceptance.

Do I attach payments to Form 8453?

No—use Form 1040-V separately.

Who signs Form 8453?

The taxpayer (and spouse for joint); ERO enters PTIN but doesn’t sign.