Table of Contents

IRS Form 8906 – Distilled Spirits Credit – In the competitive world of alcohol distribution and production, every tax break counts. If you’re a wholesaler, importer, or qualified distiller holding inventory of bottled distilled spirits, the IRS Distilled Spirits Credit could reduce your federal income tax liability. Enter IRS Form 8906, Distilled Spirits Credit—the essential tool for claiming this incentive under IRC Section 5011. Searching for “how to file Form 8906 for 2025” or “Distilled Spirits Credit eligibility”? This SEO-optimized guide, based on the latest IRS resources, walks you through everything from qualifications to filing.

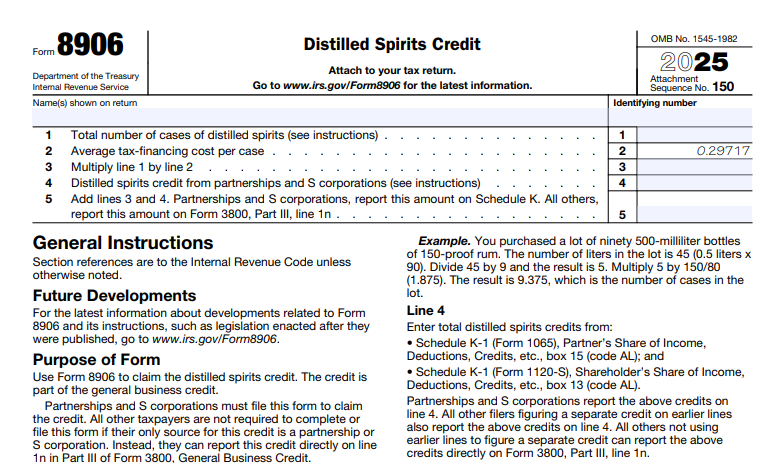

For tax year 2025, the credit rate remains at an average tax-financing cost of $0.29717 per case, helping offset excise taxes on inventory carried in your business. Download the 2025 Form 8906 PDF from IRS.gov and attach it to your return—potentially saving thousands on your 2026 filing. Let’s break it down.

What Is the Distilled Spirits Credit on IRS Form 8906?

The Distilled Spirits Credit reimburses eligible taxpayers for the average cost of carrying federal excise taxes on bottled distilled spirits in inventory. Enacted to ease the financial burden of pre-paid excise taxes (imposed under IRC Section 5001 at $13.50 per proof gallon), this nonrefundable credit is part of the general business credit reported on Form 3800. It’s calculated annually based on cases purchased or stored, not sold, during the tax year.

Key features for 2025:

- Credit Amount: $0.29717 per case (fixed for the year, based on the prior calendar year’s average excise tax cost).

- Case Definition: 12 bottles of 80-proof, 750 ml each (adjusted for other sizes/proofs via formula).

- No Carryback/Carryforward Changes: Follows general business credit rules—carryforward up to 20 years if unused.

This credit doesn’t apply to beer or wine; it’s strictly for distilled spirits like whiskey, vodka, rum, and gin. Partnerships and S corporations must file Form 8906, while others can report pass-through credits directly on Form 3800, Part III, line 1n.

Pro Tip: Track inventory meticulously—eligible cases must be U.S.-bottled and purchased directly from bottlers.

Who Qualifies for the Distilled Spirits Credit in 2025?

Not every alcohol handler can claim this credit. Eligibility under IRC Section 5011 targets those bearing the excise tax burden:

- Eligible Wholesalers: Holders of a Federal Alcohol Administration (FAA) Act wholesaler permit for distilled spirits. Excludes states, political subdivisions, or their agencies.

- Qualified Distillers and Importers: Businesses importing or distilling spirits that maintain taxable inventory subject to Section 5001.

- State Warehouse Storers: Persons subject to Section 5005 (tax on spirits stored in state-operated or affiliated warehouses where title hasn’t unconditionally passed via sale).

You must have purchased or stored eligible cases during 2025. No minimum inventory threshold, but the credit applies only to the taxable portion. Non-U.S. bottlings? Ineligible.

| Eligibility Type | Description | Examples |

|---|---|---|

| Wholesaler | FAA permit holder buying directly from bottlers | Regional liquor distributors |

| Importer | Brings in foreign spirits, pays excise on entry | International spirits companies |

| State-Affiliated | Stores in gov’t warehouses without title transfer | Bonded warehouse operators |

| Distiller | Produces and holds U.S.-bottled spirits | Craft distilleries with inventory |

If your business ceased operations in 2025, claim on your final return. Consult Pub. 510 (Excise Taxes) for nuances.

How to Calculate the Distilled Spirits Credit for 2025

The formula is simple: Number of Eligible Cases × $0.29717. But accuracy hinges on proper case counting.

- Determine Eligible Cases (Line 1): Count U.S.-bottled cases purchased directly (wholesalers) or stored without title passage (others). Use the adjustment formula for non-standard lots:

- Liters in lot ÷ 9 × (Proof ÷ 80) = Cases.

- Example: 90 bottles of 500 ml (0.5 L) at 150 proof = 45 L ÷ 9 = 5; 5 × (150/80) = 9.375 cases.

- Apply Rate (Line 2): Enter $0.29717 (IRS-provided for 2025).

- Multiply (Line 3): Line 1 × Line 2.

- Add Pass-Throughs (Line 4): Include credits from Schedule K-1 (Form 1065, box 15 code AL; Form 1120-S, box 13 code AL).

- Total Credit (Line 5): Sum Lines 3 + 4. Report on Form 3800.

No worksheets needed beyond the case formula—keep records for 3+ years per IRC Section 6001.

Step-by-Step Guide: Completing IRS Form 8906 for 2025

This one-page form attaches to your income tax return (e.g., Form 1120 for corporations). Here’s how:

Header

- Enter name and EIN/SSN from your return.

Line 1: Total Cases

- Input calculated cases as described. Round to whole numbers? Use decimals for precision (e.g., 9.375).

Line 2: Average Cost

- Pre-filled: 0.29717 (or $0.29717—enter with dollar sign if required by software).

Line 3: Multiplication

- Auto-calculates in e-file software.

Line 4: Pass-Through Credits

- Aggregate from K-1s. Partnerships/S corps report total on Schedule K.

Line 5: Total Credit

- Transfer to Form 3800, Part III, line 1n (other credits).

Sign and date if preparing manually. E-file via modernized systems for faster processing.

2025 Filing Deadlines and Where to File Form 8906

Attach Form 8906 to your timely filed 2025 return:

- Individuals/S corps/Partnerships: March 15, 2026 (or September/October with extension).

- Corporations: April 15, 2026 (or October 15 extended).

- Excise Tax Filers: Align with Form 720 if applicable.

No separate due date—late filing risks losing the credit. Paper file to your return’s address; e-file recommended for accuracy.

Potential Limitations and Common Errors

The credit is nonrefundable but carries forward. Watch for:

- Overcounting ineligible imports.

- Forgetting proof adjustments.

- Mismatching with Form 3800 limitations (e.g., tentative minimum tax).

IRS audits focus on inventory records—use software like QuickBooks for tracking.

5 Tips for Maximizing Your Distilled Spirits Credit in 2025

- Audit Your Permits: Confirm FAA wholesaler status early.

- Inventory Precisely: Use ERP systems to log cases monthly.

- Coordinate with Partners: Ensure K-1s reflect accurate shares.

- E-File for Speed: Avoid paper delays; claim sooner on 3800.

- Consult Experts: For importers, pair with Pub. 510 and a tax pro.

Frequently Asked Questions (FAQs) About IRS Form 8906

Who is considered an eligible wholesaler for Form 8906?

Any FAA Act permit holder for distilled spirits wholesaling, excluding government entities.

What’s the 2025 credit rate per case?

$0.29717, based on average excise tax financing costs.

Do I need to file Form 8906 if only receiving pass-through credits?

No—report directly on Form 3800, line 1n. Partnerships/S corps must file.

Can the credit be carried forward?

Yes, up to 20 years under general business credit rules.

Where do I download the 2025 Form 8906?

From IRS.gov/forms-pubs/about-form-8906—PDF posted November 3, 2025.

Unlocking the Distilled Spirits Credit via IRS Form 8906 can boost your bottom line in the spirits industry. For personalized guidance, visit IRS.gov or a CPA. Share your tips in the comments!

This article is informational, based on 2025 IRS guidelines—not tax advice. Verify with official sources.

IRS Form 8906 Download and Printable

Download and Print: IRS Form 8906