Table of Contents

IRS Form 8919 – Uncollected Social Security and Medicare Tax on Wages – In the gig economy era, where over 36% of U.S. workers are freelancers or independent contractors, misclassification by employers can lead to unexpected tax headaches. If you were treated as a contractor but believe you qualified as an employee, IRS Form 8919, Uncollected Social Security and Medicare Tax on Wages, allows you to report and pay your share of these payroll taxes—ensuring credits toward future benefits without the full self-employment tax burden. For the 2025 tax year, the Social Security wage base rises to $176,100 (up from $168,600 in 2024), meaning more earnings could trigger additional reporting, while penalties for late filing climb to $60–$340 per form after December 31, 2025.

This SEO-optimized guide, based on the official 2025 Form 8919 (Rev. December 2024) and IRS Publication 15 (Circular E, Employer’s Tax Guide), covers the form’s purpose, eligibility, step-by-step instructions, deadlines, and avoidance of common errors. Whether you’re a rideshare driver or a consultant receiving 1099s instead of W-2s, Form 8919 protects your Social Security record while minimizing penalties. Download the 2025 PDF from IRS.gov and file with your Form 1040 by April 15, 2026—don’t let misclassification cost you retirement credits.

What Is IRS Form 8919?

Form 8919 is a one-page worksheet that enables employees misclassified as independent contractors to calculate and report their share of uncollected Social Security (6.2%) and Medicare (1.45%) taxes on wages, as if properly withheld. It shifts the burden from self-employment tax (15.3% total) to half (7.65%), crediting earnings to your Social Security record for future benefits like retirement or disability.

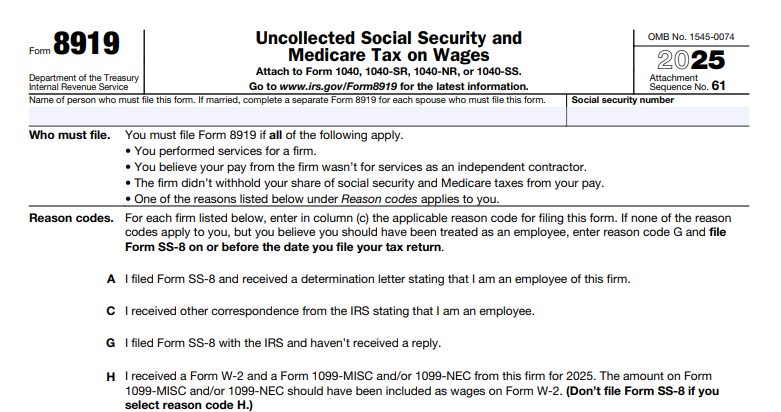

The form requires selecting a reason code (A–G) explaining the misclassification, then computing taxes on the disputed income (from Form 1099-MISC/NEC or W-2). Attach to Form 1040 (Schedule 2, line 13) or 1040-SR; e-file supported. For 2025, line 7 pre-fills the SS wage base at $176,100, and instructions stress filing Form SS-8 first for IRS determination if code G applies.

Key Fact: Unlike self-employment tax on Schedule SE, Form 8919 only charges your employee share—your employer remains liable for theirs, but you get SS credits without double taxation.

Who Must File Form 8919?

File Form 8919 if you received compensation treated as non-wage (e.g., 1099) but had a reasonable basis to believe you were an employee, and no Social Security/Medicare taxes were withheld. This applies to:

- Misclassified Workers: Employees issued 1099s instead of W-2s (code A).

- Prior IRS Rulings: Previous SS-8 determination as employee (code B).

- Mixed Forms: W-2 and 1099 from same employer for same work (code C).

- State Rulings: State/local determination as employee (code D).

- Prior W-2s: Employee treatment in prior year for similar work (code E).

- IRS Correspondence: Letter stating employee status (code F).

- Pending SS-8: Filed but no reply yet (code G; attach SS-8 copy).

Threshold: Any uncollected taxes on wages up to $176,100 (SS base); no de minimis.

Exceptions:

- True independent contractors (report on Schedule C/SE).

- Wages properly reported on W-2.

- No reasonable basis (file SS-8 first).

Married filers complete separate forms per spouse; attach to joint 1040.

Step-by-Step Guide: How to Complete IRS Form 8919 for 2025

The 2025 Form 8919 is concise—download the PDF from IRS.gov and use software for math. One form per employer; additional for >5.

1. Header: Name and SSN

- Full name; SSN/ITIN.

- If joint, separate per spouse.

2. Lines 1–5: Employer and Wages

- Line 1: Employer name/address.

- Line 2: Compensation (1099 Box 1 or W-2 equivalent).

- Line 3: Select reason code (A–G); explain if G.

- Line 4: Total wages from all W-2s (Box 1).

- Line 5: Wages subject to SS/Medicare (exclude tips/RRTA).

3. Lines 6–13: Social Security Tax

- Line 6: Total from line 5 across forms.

- Line 7: SS wage base ($176,100).

- Line 8: Total SS wages (line 6, capped).

- Line 9: Multiply line 8 by 6.2% (your share).

- Line 10–13: Adjustments for prior credits; final SS tax.

4. Lines 14–19: Medicare Tax

- Line 14: Total Medicare wages (uncapped).

- Line 15: Multiply by 1.45%.

- Line 16: Additional Medicare (if >$200K single/$250K joint; 0.9%).

- Line 17–19: Final Medicare tax.

5. Line 20: Total Tax

- Sum SS + Medicare; enter on Schedule 2, line 13.

Pro Tip: For code G, file SS-8 by April 15, 2026; attach copy—IRS determination takes 6 months but protects you.

Deadlines and How to File Form 8919 for 2025

Attach to your 2025 Form 1040/1040-SR—due April 15, 2026 (extendable to October 15 via Form 4868). E-file (90%+ returns) or paper mail to IRS center.

- SS-8 Prerequisite: For code G, file by return due date; no wait required.

- Amended: Use 1040-X within 3 years if reclassified.

- Payment: Include with return; no separate remittance.

Refunds (if overpaid) in 21 days e-file; pay owed to avoid 0.5% monthly penalty.

Common Mistakes to Avoid When Filing Form 8919

Misclassification disputes lead to 20% of small business audits—here’s a table of errors:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Wrong Reason Code (Line 3) | Choosing without basis. | Select A–G matching facts; file SS-8 for G. | Denial; full SE tax (15.3%). |

| Overstating Wages (Line 2) | Including non-wage 1099. | Limit to employee-like compensation. | Overpayment; no refund if misfiled. |

| Ignoring SS Base (Line 7) | Using 2024 $168,600. | Enter $176,100 for 2025. | Underreported tax; penalty. |

| No SS-8 for Code G | Filing without determination. | Attach SS-8 copy; expect 6-month wait. | IRS rejection; audit. |

| Joint Filing Oversight | One spouse only. | Separate forms per spouse; attach to joint 1040. | Missed credits for both. |

| Late Filing | Missing April 15. | Extend with 4868; pay estimate to avoid interest. | 0.5%/month penalty + interest. |

Amend with 1040-X; retain 1099s/W-2s 3 years.

IRS Form 8919 Downoad and Printable

Download and Print: IRS Form 8919

2025 Updates and Special Considerations for Form 8919

The 2025 Form 8919 (Rev. Dec. 2024) includes minor tweaks:

- SS Wage Base: $176,100 (line 7; up $7,500).

- Medicare Rates: 1.45% employee share; additional 0.9% >$200K single/$250K joint (via Form 8959).

- Reason Codes: Unchanged A–G; code G requires SS-8 by filing date.

- E-File: Supported; integrate with 1040.

- Penalties: $60–$340 late; $680 intentional (inflation-adjusted).

- SS-8 Timing: File anytime; determination retroactive but protects Form 8919.

For expats, coordinate with Form 2555; states may not follow federal classification.

Final Thoughts: Reclaim Your Payroll Taxes with Form 8919 in 2025

IRS Form 8919 empowers misclassified workers to pay only their employee share of SS/Medicare taxes, securing retirement credits without full SE burdens. For 2025, select the right code, cap at $176,100 base, and file by April 15, 2026—pair with SS-8 for IRS backing. With gig growth, don’t let misclassification erode your benefits.

Consult Pub. 15 or a CPA for disputes. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 8919

What is the 2025 Social Security wage base for Form 8919?

$176,100; withhold 6.2% up to this limit.

When must I file Form 8919 for 2025?

With your Form 1040 by April 15, 2026.

Do I need Form SS-8 before Form 8919?

For code G only—attach copy; other codes require reasonable basis.

How does Form 8919 affect self-employment tax?

It avoids full 15.3% SE tax, charging only 7.65% employee share.