Table of Contents

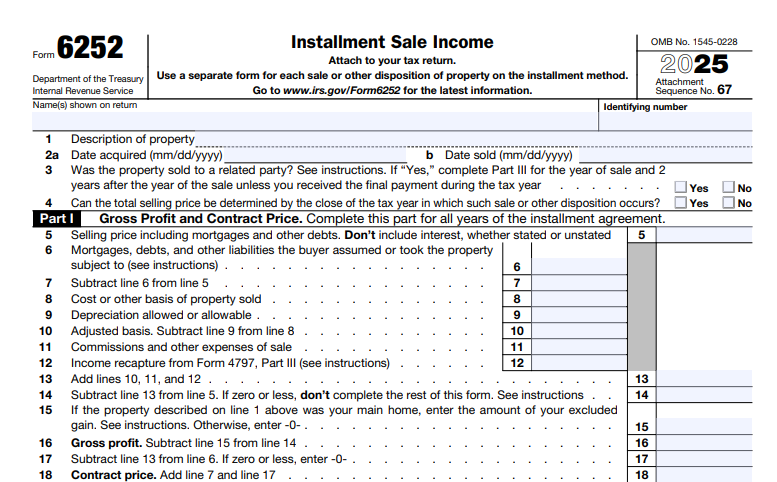

IRS Form 6252 – Installment Sale Income – Selling property or assets on an installment basis—where payments stretch over multiple years—offers flexibility for buyers and sellers alike, but it demands careful tax reporting to avoid overpaying Uncle Sam. IRS Form 6252, Installment Sale Income, is your essential tool for calculating the taxable portion of each payment, spreading gains proportionally to defer taxes until cash flows in. For the 2025 tax year, the form remains unchanged from 2024, with instructions emphasizing ordinary income recapture from prior-year sales and coordination with Form 4797 for depreciation adjustments, ensuring accurate reporting amid rising asset values.

This SEO-optimized guide, based on the official 2025 Form 6252 (Rev. December 2025) and IRS Publication 537 (Installment Sales), covers the form’s purpose, eligibility, step-by-step completion, deadlines, and strategies for compliance. Whether you’re a real estate investor in California or a business owner selling equipment, Form 6252 helps you report gains without accelerating taxes—potentially saving thousands by matching income to receipts. Download the 2025 PDF from IRS.gov and attach to your Form 1040 by April 15, 2026, to keep your finances on track.

What Is IRS Form 6252?

Form 6252 is a two-part worksheet used to report income from installment sales—dispositions of property where at least one payment is received after the tax year of the sale—under the installment method of Internal Revenue Code Section 453. It computes the gross profit percentage (selling price minus basis) and applies it to each installment, recognizing gain proportionally rather than upfront.

The form divides into:

- Part I: Sale details (selling price, basis, depreciation recapture).

- Part II: Income for the current year (payments received × gross profit %).

- Part III: Installment sale income (gain portion).

For 2025, the form (OMB No. 1545-0228) requires reporting remaining recapture from prior years on line 16 and excludes unstated interest (report via Form 8396 if applicable). Attach to Schedule D (Form 1040) for capital gains or Form 4797 for ordinary income; e-file supported. Elect out of installment method on timely return if preferring accrual.

Key Fact: Installment sales apply to casual dispositions of real/personal property (not dealers); report each year of payments until complete, even if no gain.

Who Must File Form 6252?

File Form 6252 for each installment sale where payments span tax years, unless you elect out (attach statement). This includes:

- Individuals: Selling homes, land, or equipment on terms (e.g., seller-financed mortgage).

- Sole Proprietors: Business assets on Schedule C.

- Partnerships/S-Corps: Partners/shareholders report via K-1; entity may file if dealer.

- Estates/Trusts: Distributions on installment.

Qualifying Sales:

- Casual (non-inventory) property; at least one post-sale payment.

- Includes like-kind exchanges deferred under Sec. 1031.

Exceptions:

- Dealer dispositions (inventory; use accrual).

- Total payment in year of sale (report full gain).

- Elect-out: For accrual taxation (e.g., if gain small).

One form per sale; carryforward for multi-year.

Step-by-Step Guide: How to Complete IRS Form 6252 for 2025

The 2025 Form 6252 is straightforward—download from IRS.gov and use software for ratios. Year 1: Parts I/II; subsequent: Part II only.

1. Part I: Sale Details (Lines 1–18) – Year of Sale

- Line 1: Description (e.g., “Residence at 123 Main St”).

- Line 2: Date acquired/sold.

- Line 3: Selling price (including debt relief; exclude interest).

- Line 4: Mortgages/debts assumed by buyer (add to 3).

- Line 5: Total contract price (3+4 minus seller notes).

- Line 6: Basis (cost + improvements – depreciation).

- Line 7: Depreciation allowed/allowable.

- Line 8: Adjusted basis (6–7).

- Line 9: Commissions/expenses.

- Line 10: Recapture (Form 4797, Part III).

- Line 11: Basis for gain (8+9+10).

- Line 12: Gross profit (3+4 – 11).

- Line 13: Gross profit % (12/5 × 100).

- Line 14: Payments received (principal only).

- Line 15: Taxable (14 × 13%).

- Line 16: Recapture remaining.

- Line 17: Total gain (15+16).

- Line 18: Capital/ordinary split (attach if needed).

2. Part II: Current Year Income (Lines 19–25) – All Years

- Line 19: Payments in 2025.

- Line 20: Taxable (19 × 13% from prior).

- Line 21: Recapture (line 16 remaining).

- Line 22: Total (20+21).

- Line 23: Capital/ordinary.

- Line 24: Report on Schedule D/4797.

- Line 25: Carry to next year (if any).

3. Part III: Installment Sale Income (Line 26)

- Gain portion for year (attach to return).

Pro Tip: For like-kind exchanges, report deferred gain on initial 6252; accelerate on disposition.

Deadlines and How to File Form 6252 for 2025

Attach to your 2025 Form 1040/1040-SR—due April 15, 2026 (extendable to October 15 via Form 4868). E-file (90%+ returns) or paper mail to IRS center.

- Year of Sale: File with that return.

- Subsequent Years: Annual until payments end.

- Elect-Out: Statement by due date.

- Amended: 1040-X within 3 years for errors.

Refunds in 21 days e-file; retain contracts 3+ years.

Common Mistakes to Avoid When Filing Form 6252

Installment errors cause 10% of capital gains audits—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Including Interest (Line 3) | Mixing stated/unstated interest. | Exclude; report via Form 8396 if unstated. | Overreported income; audit. |

| Wrong Gross Profit % (Line 13) | Forgetting debt relief (Line 4). | Include buyer-assumed mortgages. | Underpaid tax; penalty + interest. |

| Recapture Oversight (Line 10) | Skipping Form 4797 Part III. | Report depreciation recapture first. | Ordinary income hit; $5,000 penalty. |

| Payments > Contract Price | Excess reducing % retroactively. | Adjust % in year received; refile if needed. | Overpayment; amended return. |

| Elect-Out Late | Missing statement. | Attach by due date; irrevocable. | Stuck with installment. |

| No Multi-Year Filing | Stopping after year 1. | Annual until complete; carry % forward. | Unreported income; negligence penalty. |

Amend with 1040-X; retain sales contracts 3 years.

IRS Form 6252 Download and Printable

Download and Print: IRS Form 6252

2025 Updates and Special Considerations for Form 6252

The 2025 Form 6252 (Rev. Dec. 2025) is structurally identical to 2024:

- OMB No.: 1545-0228; Cat. No. 24438A.

- Recapture: Remaining from prior (line 16); coordinate with 4797.

- Unstated Interest: Form 8396 for below-market loans.

- Like-Kind Exchanges: Deferred gain on initial; accelerate on boot.

- Dealer Inventory: Accrual method; no Form 6252.

- Partnerships: Partners report via K-1; entity files if dealer.

For depreciable property, recapture first; post-TCJA, no changes but monitor sunset.

Final Thoughts: Defer Taxes Smartly with Form 6252 in 2025

IRS Form 6252 turns installment sales into tax-efficient strategies, recognizing gains as payments arrive to match cash flow with obligations. For 2025, compute gross profit accurately, report recapture promptly, and file annually by April 15, 2026—ideal for real estate flips or equipment sales. With no updates, leverage prior-year % for simplicity.

Consult Pub. 537 or a CPA for like-kind/debt relief. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 6252

What sales require Form 6252 in 2025?

Casual dispositions with post-sale payments; exclude dealers/inventory.

How is gross profit percentage calculated on Form 6252?

(Gross profit / Contract price) × 100; apply to each payment.

Can I elect out of installment reporting on Form 6252?

Yes—attach statement by due date for full accrual taxation.

When is Form 6252 due for 2025 sales?

With Form 1040 by April 15, 2026; annual for ongoing.