Table of Contents

IRS Form 2106 – Employee Business Expenses – In an era where remote work and gig opportunities are reshaping careers, claiming unreimbursed employee business expenses can feel like a relic from a bygone tax era. Enter IRS Form 2106, Employee Business Expenses, a specialized form that allows certain workers—such as Armed Forces reservists, qualified performing artists, fee-basis government officials, and those with impairment-related work costs—to deduct ordinary and necessary job-related outlays like travel, vehicle use, and supplies. However, for the vast majority of W-2 employees, the Tax Cuts and Jobs Act (TCJA) suspended these miscellaneous itemized deductions from 2018 through 2025, rendering Form 2106 largely obsolete unless you fall into one of the exempt categories.

This SEO-optimized guide, based on the official 2025 Instructions for Form 2106 (Rev. December 2024) and IRS Publication 463 (Travel, Gift, and Car Expenses), explores the form’s current relevance, who qualifies, step-by-step completion, and strategies for compliance. With the TCJA suspension set to expire after 2025—potentially reviving broader use—now’s the time to understand Form 2106, especially if you’re in a qualifying group. Download the 2025 PDF from IRS.gov and attach to your Form 1040 by April 15, 2026, to ensure you’re not leaving deductions on the table.

What Is IRS Form 2106?

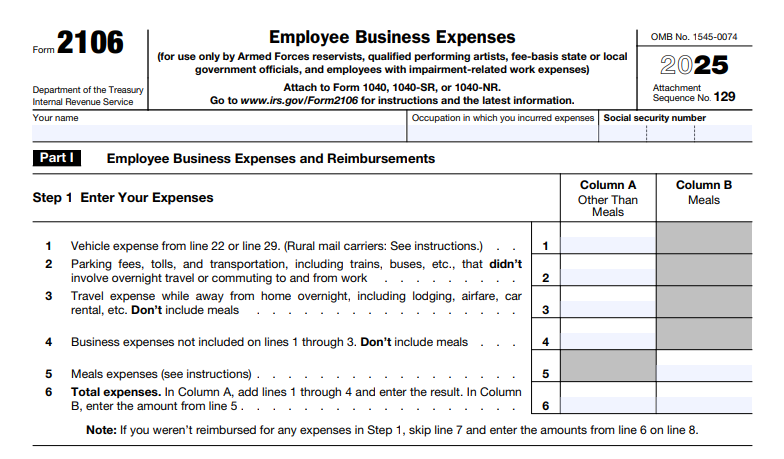

Form 2106 is a two-part worksheet designed for eligible employees to itemize and deduct unreimbursed business expenses, such as vehicle mileage, travel, meals, and office supplies, that aren’t reimbursed by their employer. Part I tallies total expenses and reimbursements, while Part II focuses on vehicle deductions (standard mileage or actual costs).

Under pre-TCJA rules, these were miscellaneous itemized deductions on Schedule A (Form 1040), subject to a 2% AGI floor—deductible only if exceeding 2% of adjusted gross income (AGI). The TCJA suspended this for 2018–2025, eliminating the deduction for most, but exempts specific groups who report as adjustments to income (above-the-line) on Schedule 1 (Form 1040), line 12.

For 2025, the form (OMB No. 1545-0074) includes updated standard mileage rates (70 cents/mile for business) and depreciation limits ($20,200 for passenger autos with bonus depreciation). Attach to Form 1040 or 1040-NR; no e-file restrictions.

Key Fact: Eligible filers can deduct expenses without itemizing, making Form 2106 a powerful above-the-line tool—unlike the suspended 2%-floor deductions for others.

Who Can Use Form 2106 in 2025?

The TCJA’s suspension means most W-2 employees cannot deduct unreimbursed expenses—but four categories remain eligible through 2025, reporting on Form 2106 as adjustments to income (not Schedule A). These include:

- Armed Forces Reservists: National Guard or reserve members with travel >100 miles from home for meetings (up to 1 day/month).

- Qualified Performing Artists: Employees performing in ≥2 employers’ productions, AGI <$16,000 ($32,000 joint), expenses >10% AGI.

- Fee-Basis State/Local Officials: Government workers paid fees, not salary, for services (e.g., elected officials).

- Employees with Impairment-Related Work Expenses: Those with disabilities deducting costs for accessibility (e.g., attendant care, modifications) without 2% floor.

Ineligible: Regular employees, self-employed (use Schedule C), or post-2025 if TCJA expires (miscellaneous deductions return with 2% floor).

File if expenses > reimbursements and qualify; otherwise, report excess as income.

Eligible Expenses on Form 2106: What Can You Deduct in 2025?

Form 2106 covers “ordinary and necessary” unreimbursed expenses—common/accepted in your field and helpful/appropriate for your job. Common categories:

- Vehicle Expenses: Standard mileage (70 cents/mile) or actual (gas, repairs, depreciation; luxury auto limits $20,200 with bonus).

- Travel: Airfare, lodging, 50% meals (per diem options for substantiation).

- Meals: 50% of business meals (receipts if >$75).

- Gifts: Up to $25/person (e.g., client appreciation).

- Education: Courses maintaining/improving skills (not minimum requirements).

- Supplies/Uniforms: Job-specific tools/clothes not suitable for everyday wear.

- Impairment-Related: For disabled employees, full costs without limits.

Ineligible: Commuting, lavish expenses, or reimbursed items (accountable plans). Track with logs/receipts (Pub. 463).

Step-by-Step Guide: How to Complete IRS Form 2106 for 2025

The 2025 Form 2106 is two pages—download from IRS.gov and complete after gathering receipts. Use software for mileage/depreciation.

1. Part I: Employee Business Expenses (Lines 1–28)

- Lines 1–4: Vehicle (standard or actual; Part II if vehicle).

- Line 5: Parking/tolls.

- Line 6: Travel (away from home overnight).

- Line 7: Meals (50%; per diem OK).

- Line 8: Gifts ($25 max/person).

- Line 9: Education/dues.

- Line 10: Impairment-related (full).

- Line 11–12: Other (list; e.g., supplies).

- Line 13: Total (sum 5–12).

- Line 14–15: Reimbursements (W-2 Box 1 if accountable; excess income).

- Line 16: Subtract 15 from 13 (deductible if >0).

- Lines 17–28: Adjustments for special categories (e.g., reservists travel).

2. Part II: Vehicle Expenses (Lines 29–44) – If Applicable

- Section A: General (miles driven, business %).

- Section B: Standard mileage (total miles × 70 cents × %).

- Section C: Actual (gas, repairs, depreciation; luxury limits).

- Line 44: Total vehicle (B or C); enter on line 1.

3. Total Deduction (Line 28)

- Enter on Schedule 1, line 12 (above-the-line).

Pro Tip: For reservists, deduct >100-mile travel as adjustment; artists/officials follow AGI tests.

Deadlines and How to File Form 2106 for 2025

Attach to Form 1040/1040-SR/1040-NR—due April 15, 2026 (extendable to October 15 via Form 4868). E-file or paper mail to IRS center.

- Records: Keep 3+ years (mileage logs, receipts).

- Amended: 1040-X within 3 years for missed deductions.

- State Conformity: Varies; some states allow despite federal suspension.

Refunds in 21 days e-file.

Common Mistakes to Avoid When Filing Form 2106

Suspension trips up filers—here’s a table of errors:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Filing as Non-Eligible | Ignoring TCJA suspension. | Confirm category (reservist/artist); else skip. | Disallowance; $5,000 penalty. |

| Vehicle Double-Dip | Claiming standard + actual. | Choose one (B or C); actual for depreciation. | Audit; repayment. |

| Reimbursement Oversight | Not subtracting accountable plans. | Exclude W-2 Box 1 inclusions; excess income. | Over-deduction; interest. |

| Meals at 100% | Forgetting 50% limit. | Deduct half; per diem for substantiation. | Adjustment; negligence penalty. |

| No Logs | Poor recordkeeping. | Maintain mileage/receipts (Pub. 463). | Full disallowance. |

| Post-2025 Assumption | Expecting revival. | Suspension through 2025; monitor legislation. | Missed planning. |

Amend with 1040-X; retain 3 years.

IRS Form 2106 Download and Printable

Download and Print: IRS Form 2106

2025 Updates and Special Considerations for Form 2106

The 2025 instructions (Rev. Dec. 2024) reflect TCJA continuity:

- Mileage Rate: 70 cents/mile (up from 67 cents).

- Auto Limits: $20,200 depreciation (with bonus; luxury rules apply).

- Suspension: Through 2025; revival post-2025 unless extended.

- Eligible Groups: Unchanged; above-the-line reporting.

- Per Diem: Updated rates in Pub. 463 (e.g., $85 meals high-cost).

- Impairment: Full deduction; no AGI limit.

States may allow; check conformity.

Final Thoughts: Navigate Employee Deductions with Form 2106 in 2025

IRS Form 2106 offers a lifeline for select employees to deduct unreimbursed costs above-the-line through 2025, bypassing itemization hurdles. Confirm eligibility, track meticulously per Pub. 463, and file by April 15, 2026—potentially saving $1,000+ on travel/vehicles. With TCJA sunset looming, plan for 2026 revival.

Consult a CPA for impairment/gifts. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 2106

Who can file Form 2106 in 2025?

Armed Forces reservists, qualified performing artists, fee-basis officials, and impairment-related employees.

What is the 2025 standard mileage rate for Form 2106?

70 cents per mile for business use.

Is Form 2106 suspended after 2025?

Yes—TCJA ends 2025; deductions may return unless extended.

Where do Form 2106 deductions go?

Schedule 1 (Form 1040), line 12 (above-the-line).