Table of Contents

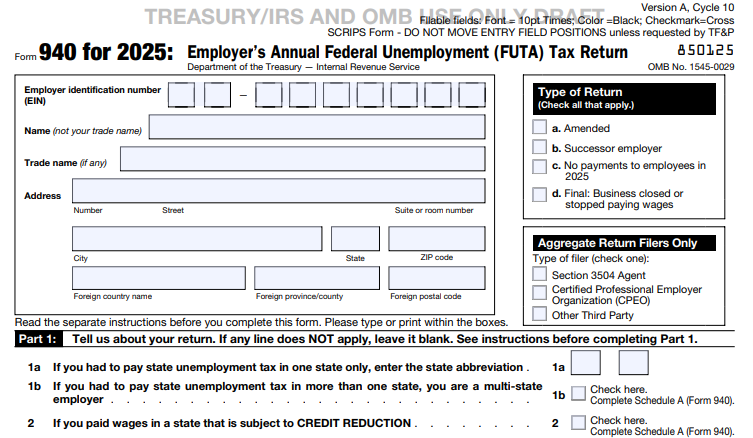

IRS Form 940 – Employer’s Annual Federal Unemployment (FUTA) Tax Return – As a business owner navigating payroll taxes, understanding IRS Form 940 is crucial for compliance and avoiding penalties. Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, reports your federal unemployment tax liability, helping fund benefits for workers who’ve lost jobs. If you’re searching for “Form 940 due date 2025,” “FUTA tax rate 2025,” or “who must file Form 940,” this SEO-optimized guide delivers step-by-step insights based on the latest IRS guidelines.

For tax year 2025, the FUTA wage base remains $7,000 per employee, with a standard 6% rate reducible to 0.6% via credits—though credit reduction states like California and New York face higher effective rates up to 1.2%. The form is due January 31, 2026, with e-filing recommended and electronic payments mandated for balances due. Download the 2025 Form 940 PDF from IRS.gov and prepare now—timely filing ensures smooth operations into 2026.

What Is IRS Form 940?

Form 940 is the annual return employers use to calculate, report, and pay FUTA taxes on the first $7,000 of each employee’s wages. Enacted under the Federal Unemployment Tax Act (FUTA), it complements state unemployment taxes (SUTA) to support national unemployment programs. Only employers pay FUTA—no deductions from employee wages.

The form reconciles quarterly deposits with your total liability, applies credits for state taxes paid, and handles adjustments for multi-state operations or credit reductions. For 2025, updates include electronic balance due payments per Executive Order 14247 and access to return transcripts via IRS.gov/BusinessTranscript for years 2023+. Attach Schedule A if operating in credit reduction states, and Schedule R for household employers allocating to clients.

Pro Tip: Unlike quarterly Forms 941 (for FICA), Form 940 is filed once yearly—pair it with SUTA filings for full compliance.

Who Must File IRS Form 940 for 2025?

Most U.S. employers with employees must file Form 940 if they meet any of these tests:

- General Test: Paid wages of $1,500+ in any calendar quarter or had at least one employee for 20+ weeks in 2025.

- Agricultural Test: Paid $20,000+ in cash wages to farmworkers or employed 10+ farmworkers for 20+ weeks.

- Household Test: Paid $1,000+ in cash wages to household employees (e.g., nannies) in any quarter.

Successor employers (acquiring a business) or those in credit reduction states also file, even if no tax is due—zero returns are required. Exemptions: Sole proprietors without employees, nonprofits under 501(c)(3), or certain Indian tribal governments.

| Test Type | Threshold | Applies To |

|---|---|---|

| General | $1,500 wages/quarter or 20 weeks/employee | Most businesses |

| Agricultural | $20,000 wages or 10 workers/20 weeks | Farms |

| Household | $1,000 wages/quarter | Domestic employers |

New businesses get auto-enrolled via EIN application. File a final return if closing in 2025.

Understanding FUTA Tax Rates and Credits for 2025

The FUTA tax rate is 6% on the first $7,000 of each employee’s wages (max $420/employee pre-credit). However, employers paying state unemployment taxes on time qualify for a 5.4% credit, dropping the effective rate to 0.6% ($42/employee).

Credit Reductions: States with outstanding federal loans (e.g., CA, NY, CT, VI) reduce the credit by at least 0.3%, raising the rate to 1.2% ($84/employee) or more with add-ons like the Benefit Cost Rate (BCR) for prolonged debts. The U.S. Department of Labor announces reductions annually; for 2025, check DOL.gov if operating multi-state.

No changes to the $7,000 wage base for 2025—tax applies only up to that per employee annually.

Step-by-Step Guide: How to Complete IRS Form 940 for 2025

Use payroll records and the 2025 instructions for accuracy. Here’s the line-by-line breakdown:

Part 1: Report Your FUTA Tax Before Adjustments (Lines 1–7)

- Line 1: Total payments to all employees (exclude non-wage items like reimbursements).

- Line 2: Check if multi-state employer; attach Schedule A if yes.

- Line 3: Subtotal (Line 1 minus exempt payments like those over $7,000/employee).

- Line 4: State wage exclusions (e.g., certain disability benefits).

- Line 5: Successor wages (if applicable).

- Line 6: Subtotal (Line 3 + 4 + 5).

- Line 7: Total taxable FUTA wages (Line 3 – Line 6; cap at $7,000/employee).

Part 2: FUTA Tax After Adjustments (Lines 8–12)

- Line 8: Multiply Line 7 by 0.06 (6% gross tax).

- Line 9: State credits (up to 5.4% of Line 7).

- Line 10: Adjustments (e.g., late state payments or exclusions; use worksheet).

- Line 11: Credit reduction (from Schedule A if applicable).

- Line 12: Total FUTA after adjustments (Line 8 – 9 + 10 + 11).

Part 3: Total FUTA Tax (Lines 13–15)

- Line 13: Overpayment from prior year (if applying).

- Line 14: Balance due (Line 12 – deposits – Line 13).

- Line 15: Overpayment (if Line 12 < deposits; apply to next year or refund).

Part 4: Sign Here

- Sign and date; include third-party designee if authorizing.

Part 5: Paid Preparer Use Only

- For CPAs or services.

Example Calculation: 5 employees, $50,000 total wages (all under $7,000 each). Gross tax: $35,000 × 6% = $2,100. With 5.4% credit: $2,100 – ($35,000 × 5.4%) = $210 due.

Tools like payroll software (e.g., OnPay) automate this.

2025 Due Date, Deposits, and Filing Options for Form 940

Filing Due Date: January 31, 2026, for 2025 taxes. If all deposits timely, extend to February 10, 2026. Holidays shift to the next business day.

Deposits: Quarterly via EFTPS if $500+ in a quarter (April 30, July 31, Oct 31, Jan 31). Under $500? Pay with return.

| Quarter | Deposit Due | Threshold |

|---|---|---|

| Q1 | April 30, 2026 | $500+ |

| Q2 | July 31, 2026 | $500+ |

| Q3 | Oct 31, 2026 | $500+ |

| Q4 | Jan 31, 2027 | $500+ |

Filing Methods:

- E-File (Recommended): Free via IRS-approved providers; mandatory for 10+ returns.

- Paper: Mail to state-specific addresses (with/without payment) per instructions.

- Payments: EFTPS, IRS Direct Pay, or check with Form 940-V (write “Form 940, 2025”).

E-file for transcripts and faster processing.

IRS Form 940 Download and Printable

Download and Print: IRS Form 940

Penalties for Late Filing or Payment of Form 940

Late filing: 5% of unpaid tax per month (up to 25%). Late payment: 0.5% per month (up to 25%) + interest (~8% for 2025). Deposit failures: 2–15% tiers. Waivers for reasonable cause (e.g., disasters) via written request.

Avoid by depositing quarterly and filing on time—no penalty if total due < $500 and paid with return.

Related Forms: Schedule A, Schedule R, and Form 940-X

- Schedule A (Form 940): For multi-state employers or credit reductions—allocate wages and compute reductions.

- Schedule R (Form 940): Household employers allocating to clients.

- Form 940-X: Amended returns—e-file supported; file within 3 years for refunds.

5 Tips for Filing IRS Form 940 in 2025

- Deposit Quarterly: Use EFTPS to track and avoid failures-to-deposit penalties.

- Monitor Credit States: If in CA/NY, complete Schedule A early—reductions add up.

- E-File for Efficiency: Skip paper hassles; get instant confirmation.

- Review Payroll Software: Automate calculations to catch errors.

- Consult a Pro: For multi-state or household setups, get CPA guidance.

Frequently Asked Questions (FAQs) About IRS Form 940

What’s the FUTA tax rate for 2025?

6% on first $7,000/employee, reducible to 0.6% with credits (higher in reduction states).

When is Form 940 due for 2025?

January 31, 2026 (or February 10 if deposits timely).

Do I file Form 940 if no tax is due?

Yes, for zero returns if you meet filing tests.

What’s the difference between Form 940 and 941?

940 for annual FUTA; 941 for quarterly FICA/income tax withholding.

Where do I get the 2025 Form 940?

Download from IRS.gov/forms-pubs/about-form-940—draft available now.

Mastering IRS Form 940 keeps your FUTA obligations in check and supports unemployed workers. For personalized help, visit IRS.gov/Form940 or a tax advisor. Share your filing experiences below!

This article is informational based on 2025 IRS guidelines—not tax advice. Verify with official sources.