Table of Contents

IRS Form 8050 – Direct Deposit of Tax Exempt or Government Entity Tax Refund – In the fast-paced world of corporate finance, waiting weeks for a paper check to arrive can disrupt cash flow and delay reinvestments. That’s where IRS Form 8050, Direct Deposit of Corporate Tax Refund, comes in—allowing corporations to request electronic funds transfers (EFT) straight to their bank account for quicker, safer access to overpayments from Forms 1120, 1120-S, 1120-POL, 990-T, or 990-PF. For the 2025 tax year, the form (Rev. December 2025) streamlines this process with no major updates from 2024, but emphasizes secure routing details amid rising cyber threats, ensuring refunds hit accounts in as little as 3 business days for e-filed returns.

This SEO-optimized guide, based on the official 2025 Form 8050 instructions and IRS resources, covers the form’s purpose, who uses it, step-by-step completion, deadlines, and tips for error-free filing. With corporate refunds averaging $10,000+ and e-filing at 95% adoption, Form 8050 is a must for efficient treasury management. Download the 2025 PDF from IRS.gov and attach to your return by March 15, 2026 (calendar-year C-corps)—unlock faster liquidity today.

What Is IRS Form 8050?

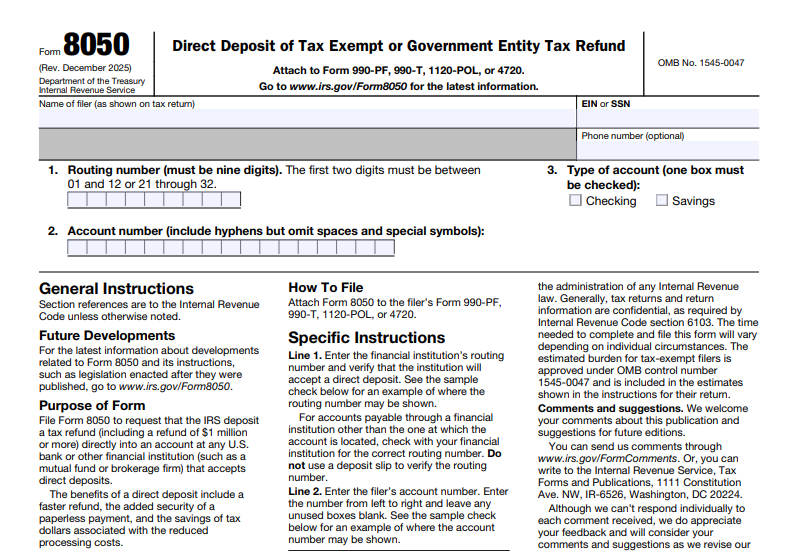

Form 8050 is a simple one-page authorization form that instructs the IRS to deposit a corporate tax overpayment directly into a designated U.S. bank account via EFT, bypassing paper checks for speed and security. It applies only to original returns claiming refunds, not amended or estimated payments, and supports single refunds or splits across multiple accounts.

Key fields:

- Part I: Corporation details (name, EIN, address).

- Part II: Bank information (routing/transit number, account number, type).

- Part III: Refund allocation (up to 3 accounts; total must equal overpayment).

- Signature: Authorized officer under perjury.

For 2025 (Rev. December 2025), the form’s Cat. No. 38886A and OMB No. 1545-1872 confirm compatibility with e-file systems like Modernized e-File (MeF), where direct deposit details can be entered electronically without the paper form. Attach to the return (e.g., page 5 of Form 1120); no separate submission. It’s voluntary—opt for paper if preferred—but EFT reduces theft risk and speeds delivery (3 days vs. 4–6 weeks for checks).

Key Fact: Form 8050 is exclusive to corporations and tax-exempt entities filing Forms 1120 series, 990-T, or 990-PF—unlike Form 8888 for individuals.

Who Must Use Form 8050?

Any corporation or tax-exempt entity expecting a refund on an original return can use Form 8050 to request direct deposit—it’s optional but highly recommended for efficiency. Eligible filers include:

- C-Corporations: Filing Form 1120 with overpayment.

- S-Corporations: Form 1120-S refunds (rare, but possible for overwithholding).

- Political Organizations: Form 1120-POL overpayments.

- Tax-Exempt Entities: Form 990-T (unrelated business income) or 990-PF (private foundations) refunds.

- Multiple Accounts: Up to 3 splits (e.g., 70% to operating, 30% to savings).

When Required: Only for paper-filed returns requesting EFT; e-filers enter details directly in the return software.

Exceptions:

- Amended returns (Form 1120-X): Use separate EFT request.

- No refund: Not applicable.

- Foreign banks: Must be U.S. financial institutions accepting EFT.

Sign by an authorized officer (president, treasurer, etc.); retain copy for records.

Step-by-Step Guide: How to Complete IRS Form 8050 for 2025

The 2025 Form 8050 is straightforward—download the fillable PDF from IRS.gov and complete after finalizing your return. Use black ink; no attachments needed.

1. Part I: Corporation Information (Lines 1–4)

- Line 1: Full corporate name (as on return).

- Line 2: EIN (Employer Identification Number).

- Line 3: Mailing address (street, city, state, ZIP).

- Line 4: Refund amount (from Form 1120, line 35; or equivalent).

2. Part II: Bank Information (Lines 5–7)

- Line 5: Bank name and address (U.S. only).

- Line 6: Routing/transit number (9 digits; verify via check or bank).

- Line 7: Account number (up to 17 digits; checking/savings).

3. Part III: Refund Allocation (Lines 8–13)

- Line 8: Amount to first account (line 7).

- Lines 9–11: Additional accounts (up to 3 total; names/routing/account).

- Lines 12–13: Totals (must equal line 4).

4. Signature (Line 14)

- Authorized officer signs/dates; title (e.g., CFO).

- Preparer info if applicable (PTIN/firm).

Pro Tip: Verify routing with your bank (ABA format); test EFT via ACH pull first to avoid errors.

Deadlines and How to File Form 8050 for 2025

Attach Form 8050 to your original tax return—due dates vary by form:

- Form 1120/1120-S (C/S-Corps): March 15, 2026 (calendar year; extend to September 15 via Form 7004, pay by original due).

- Form 990-T/990-PF: May 15, 2026 (extend to November 15).

- Form 1120-POL: February 28, 2026.

E-file: Enter details in return software (no paper needed); paper: Staple to page 5 of return and mail to IRS center (e.g., Ogden, UT for most). Refunds in 3 days e-file/4 weeks paper; track via IRS “Where’s My Refund?” (EIN-based).

No extensions for the form itself—file with return.

Common Mistakes to Avoid When Filing Form 8050

EFT errors delay 10% of refunds—here’s a table of pitfalls:

| Mistake | Why It Happens | How to Fix/Avoid | Potential Consequence |

|---|---|---|---|

| Invalid Routing (Line 6) | Wrong 9-digit ABA. | Verify via bank or fedwirefunds.com; test ACH. | Refund returned as check; 4-week delay. |

| Account Mismatch (Line 7) | Typo in number/type. | Double-check; use checking for faster. | Bounced EFT; reissue fees. |

| Allocation Error (Part III) | Totals ≠ line 4. | Sum lines 8–10 = refund; no partials. | IRS rejects; manual processing. |

| Paper with E-File | Attaching to electronic. | Enter in software; paper only for non-e-file. | Ignored; paper refund. |

| Wrong Return | Using for amended. | Original only; 1120-X uses separate request. | Delayed amended refund. |

| No Signature (Line 14) | Oversight. | Officer signs; PTIN if preparer. | Invalid; check issued. |

Revoke by calling IRS (800-829-4933); retain copy 3 years.

IRS Form 8050 Download and Printable

Download and Print: IRS Form 8050

2025 Updates and Special Considerations for Form 8050

The 2025 Form 8050 (Rev. Dec. 2025) is unchanged structurally:

- OMB No.: 1545-1872; Cat. No. 38886A.

- E-File Integration: Direct entry in MeF; no paper for electronic.

- Account Limits: Up to 3 splits; U.S. banks only.

- Foreign Corps: Eligible if U.S.-filed (1120-F).

- 990-T/PF: For exempt orgs; attach to return.

- Penalties: None for form errors, but late return triggers 5%/month on unpaid tax.

For S-corps, refunds rare but possible; states may require separate forms.

Final Thoughts: Accelerate Your Corporate Refunds with Form 8050 in 2025

IRS Form 8050 is a low-effort powerhouse for corporations, routing refunds via EFT for 3-day access and fraud protection. For 2025, verify routing, allocate wisely, and attach by March 15, 2026 (1120)—ideal for optimizing liquidity in volatile markets. With e-file dominance, skip paper hassles.

Consult your tax advisor for multi-account splits. This guide is informational; verify IRS.gov.

Not tax advice. Refer to official IRS sources.

FAQs About IRS Form 8050

Who uses Form 8050 in 2025?

Corporations/tax-exempts filing 1120/990-T/990-PF with refunds.

What is the 2025 deadline for Form 8050 with Form 1120?

March 15, 2026 (extendable).

Can Form 8050 split refunds across accounts?

Yes—up to 3 U.S. bank accounts.

Is Form 8050 required for e-filed refunds?

No—enter details in return software.