Table of Contents

IRS Form 8979 – Partnership Representative Designation or Resignation – Are you a partnership leader navigating the complexities of IRS audits under the Bipartisan Budget Act (BBA)? Designating or updating your Partnership Representative (PR) via IRS Form 8979 is essential to ensure smooth communication with the IRS and avoid costly penalties. Revised in September 2025, this streamlined one-page form simplifies the process for revocations, designations, and resignations—replacing the previous three-page version with clearer options for BBA partnerships. In this expert guide to Form 8979, we’ll cover its role in centralized audits, who must file, step-by-step instructions, and key 2025 changes—so your partnership stays compliant and audit-ready.

Whether you’re appointing a new PR amid leadership changes or handling a resignation, mastering Partnership Representative Designation or Resignation keeps your entity aligned with IRC sections 6223 and beyond. Let’s break it down.

What Is IRS Form 8979?

IRS Form 8979, now titled Partnership Representative Designation or Resignation, is a critical IRS document used by partnerships subject to the BBA audit regime to manage their PR and Designated Individual (DI). Introduced post-2017 Tax Cuts and Jobs Act, it ensures every eligible partnership has a designated point of contact for IRS examinations, adjustments, and proceedings. The PR—either an individual or entity—represents the partnership exclusively, binding it to IRS decisions without direct partner involvement.

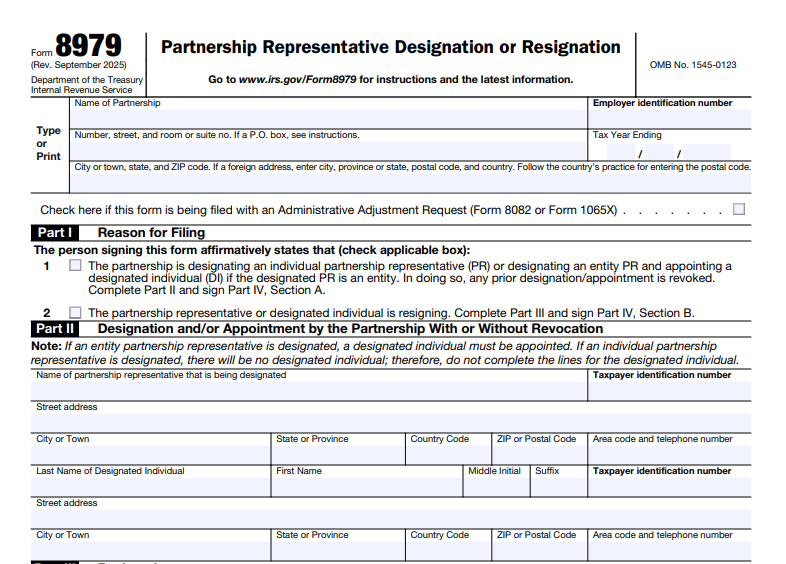

The September 2025 revision (Catalog No. 68726V, OMB No. 1545-0123) shortens the form to one page and eliminates revocation as a separate step: New designations automatically revoke prior ones. It’s filed in specific scenarios like exams or Administrative Adjustment Requests (AARs), with an estimated 30-minute burden. Download the PDF from IRS.gov for electronic or paper submission.

Who Needs to File IRS Form 8979?

BBA partnerships—those with 100 or fewer partners electing out via Form 1065—must designate a PR annually if none exists or changes occur. This includes:

- Domestic and foreign partnerships filing Form 1065.

- Upper-tier partnerships receiving adjustments from lower-tier entities.

- Entities in exams, AARs (Forms 8082/1065X), or statute extensions (e.g., PLR requests).

The partnership’s authorized person files for designations; the PR or DI files for resignations. No filing if a valid PR is already in place from the timely filed Form 1065. Multi-member LLCs treated as partnerships and certain disregarded entities may also apply—consult IRC section 6231(a)(7) for eligibility.

Purpose and Benefits of IRS Form 8979

Under the BBA (IRC sections 1101–1106), Form 8979 centralizes IRS interactions, preventing fragmented partner notifications and streamlining audits for partnerships with over $10 million in assets (mandatory) or smaller ones not electing out. It designates a PR to receive notices, contest adjustments, and elect payment options like partnership-level taxes.

Benefits include:

- Audit Efficiency: One representative handles IRS correspondence, reducing errors and delays.

- Compliance Protection: Avoids default IRS appointments or $10,000+ penalties for non-designation (IRC 6223(c)).

- Flexibility: Entity PRs appoint DIs for granular representation; resignations trigger 30-day successor requirements.

- Risk Mitigation: Automatic revocation in new designations simplifies transitions, per 2025 interim guidance.

In 2025, amid rising partnership audits (up 20% per IRS data), timely PR designation safeguards against imputed underpayments exceeding $100,000.

Step-by-Step Guide: How to Fill Out IRS Form 8979

Access the fillable PDF on IRS.gov/Form8979. Use black ink or type; e-file isn’t available—submit via mail, fax, or directly to IRS contacts. Time: 30 minutes.

- Gather Details: Collect partnership EIN, tax year-end date, PR/DI info (name, U.S. address, phone, TIN/SSN), and filing context (e.g., with AAR).

- Header: Enter partnership name, address, EIN, and tax year. Check “Filed with AAR” if applicable.

- Part I: Purpose: Check Box 1 for designation (individual PR or entity PR + DI) or Box 2 for resignation (PR or DI).

- Part II: Designation Details: For Box 1—enter PR name/entity, address, phone, TIN; if entity, add DI details. Automatic prior revocation.

- Part III: Resignation: For Box 2—specify resigning party (PR/DI), effective date (not retroactive).

- Part IV: Signatures: Authorized partnership signer (Section A); resigning party (Section B). Include titles and dates under perjury penalties.

- Review and Submit: Attach to AAR or send to IRS point of contact (e.g., revenue agent for exams).

Tip: For 2025, no need to identify revoked PR—new form assumes it. Retain copies for records.

IRS Form 8979 Download and Printable

Download and Print: IRS Form 8979

Key Sections of IRS Form 8979 Explained

The revised 2025 form is user-friendly with four parts:

Header and Part I (Purpose Selection)

- Partnership info and checkboxes: Box 1 (designate/revoke prior), Box 2 (resign).

Part II (Designation)

- PR details: Name, U.S. address (no foreign), phone, TIN. Entity PR requires DI appointment with same info.

Part III (Resignation)

- Resigning party’s name, role, and effective date. Partnership must designate successor within 30 days.

Part IV (Signatures)

- Section A: Partnership authorized signer. Section B: Resigning signature.

Privacy Notice: Data protected under IRC 6109; used for BBA administration only. No fees apply.

Submission Process for Form 8979

Submit based on context—no central filing address:

- Exams: Directly to IRS contact (revenue agent, appeals).

- AARs: Attach to Form 8082/1065X; mail to Ogden, UT (see instructions).

- Other Requests: With Forms 8985/8988 or PLRs—fax or email per guidance.

- Resignations: Same channels; IRS confirms within 60 days.

File anytime a change occurs; no fixed deadline but required before IRS actions. Amended designations via new Form 8979. Track via certified mail.

Privacy, Security, and Important Notes

Protected under Privacy Act (5 U.S.C. 552a); disclosures limited to BBA enforcement. 2025 Notes:

- Streamlined from 7 options to 2—reduces errors in multi-filing scenarios.

- PR/DI must have U.S. TIN and address; substantial presence required.

- Pair with Form 1065 for initial designations; late filings risk IRS appointment.

Penalties: Up to partnership-level adjustments if no PR.

Frequently Asked Questions (FAQs) About IRS Form 8979

What’s new in the 2025 Form 8979 revision?

Title simplified; one-page format with auto-revocation—no separate revocation box.

Can an entity be the Partnership Representative?

Yes—appoint a DI to handle IRS interactions.

What happens if a PR resigns without a successor?

Partnership has 30 days to designate; IRS may appoint one, binding all partners.

Is Form 8979 required with every Form 1065?

Only if no prior valid designation; otherwise, updates as needed.

Where to submit for an ongoing audit?

Directly to the IRS examiner—check exam notice for details.

Conclusion: Secure Your Partnership’s Future with Form 8979

IRS Form 8979 is your partnership’s shield in the BBA era, ensuring a clear PR voice for IRS dealings and averting audit pitfalls. With the efficient September 2025 update, designating or resigning has never been simpler—act now to maintain compliance. Download from IRS.gov and consult a tax advisor for tailored strategy.

Explore more at the IRS Partnerships Page. Stay ahead: Review your PR annually.

This article is informational only and not official IRS guidance. Refer to IRS.gov for authoritative details.