Table of Contents

IRS Form 706-QDT – U.S. Estate Tax Return for Qualified Domestic Trusts – Estate planning for international couples often involves unique challenges, particularly when one spouse is a non-U.S. citizen. Enter IRS Form 706-QDT—the U.S. Estate Tax Return for Qualified Domestic Trusts (QDOTs). This specialized form helps defer estate taxes on assets left to a non-citizen surviving spouse, ensuring compliance while preserving wealth. In 2025, with the federal estate tax exemption at $13.99 million, QDOTs remain crucial for high-net-worth families navigating cross-border rules. This SEO-optimized guide covers everything from eligibility to filing tips, drawing on the latest IRS updates for accurate, actionable advice.

What Is IRS Form 706-QDT?

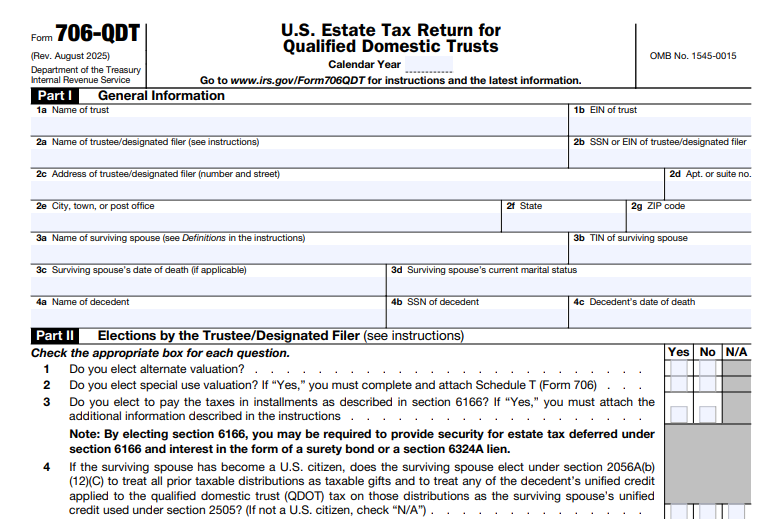

Form 706-QDT is an annual tax return used by trustees or designated filers of a QDOT to report and pay estate taxes on taxable distributions from the trust. A QDOT is a special irrevocable trust designed for U.S. citizens or residents married to non-citizen spouses, allowing a marital deduction for estate tax purposes while deferring taxes until distributions are made or the surviving spouse dies. The form calculates taxes on non-income distributions (like principal), the spouse’s death, or trust disqualification.

Key purposes include:

- Deferring Estate Tax: Avoids immediate taxation on the decedent’s estate by holding assets in trust.

- Reporting Taxable Events: Covers distributions exceeding the $250,000 initial corpus limit (or $2 million for certain real property), annuities, and hardship exceptions.

- Integration with Form 706: Recomputes the original estate tax from the decedent’s Form 706 based on cumulative distributions.

The form was redesigned in August 2025 for better efficiency, including electronic payment options and direct deposit fields. Download the latest version (Rev. August 2025) and instructions from IRS.gov.

Who Needs to File IRS Form 706-QDT in 2025?

Filing isn’t automatic—it’s triggered by specific events. QDOTs must meet strict IRS requirements: at least one U.S. citizen or corporation as trustee, trust terms prohibiting non-income distributions without tax payment, and compliance with section 2056A.

| Filing Trigger | Details for 2025 |

|---|---|

| Taxable Distributions | Any corpus or annuity payment (except income or hardship) from the QDOT. |

| Surviving Spouse’s Death | Full inclusion of remaining trust assets in the spouse’s estate. |

| QDOT Disqualification | Events like failure to pay taxes or improper distributions. |

| Hardship Distributions | Report even if exempt; claim deduction on Schedule B. |

| Multiple QDOTs | Executor designates one filer; trustees provide Schedule B data 60 days pre-deadline. |

Only the trustee files for a single QDOT; for multiples, a designated filer summarizes via Schedule A. Non-citizen spouses can’t receive direct bequests without a QDOT to qualify for the unlimited marital deduction.

Filing Deadlines and Extensions for Form 706-QDT

Timely filing prevents penalties and interest. Deadlines vary by event:

- Distributions or Hardship: April 15 of the year following the calendar year of the event.

- Spouse’s Death or Disqualification: 9 months after the event.

Request a 6-month automatic extension with Form 4768 (file before the original due date)—this extends filing but not payment. Pay estimated taxes by the original deadline via EFTPS, wire transfer, or check to avoid interest.

- Where to File: Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999-0002 (or private delivery service: 333 W. Pershing Road, Kansas City, MO 64108).

- Supplemental Returns: Mark as “Supplemental Information” and mail to IRS, 201 W. Rivercenter Blvd, Stop 200-FSC, Covington, KY 41011 for corrections.

For late portability or elections tied to the original Form 706, relief may apply under Rev. Proc. 2022-32.

Step-by-Step Guide to Completing IRS Form 706-QDT

Preparation starts with gathering the QDOT agreement, distribution records, asset appraisals, and the decedent’s original Form 706. The redesigned 2025 form streamlines reporting.

- Part I: General Information – Enter decedent, spouse, and trust details (EIN, trustee info).

- Part II: Trustee Election – Trustee files the full return; otherwise, note designated filer.

- Schedule B (Per QDOT) – Detail distributions (Part II), property at death/disqualification (Part III), and deductions (Parts IV-V for marital/charitable).

- Schedule A (If Designated Filer) – Summarize totals from multiple Schedule Bs.

- Part III: Tax Computation – Recompute original estate tax, subtract credits, and calculate due/overpayment.

- Payments and Attachments – Elect installments (Line 3), attach trust instrument (first filing), death certificate (if applicable), and sign.

Use the IRS instructions for line-by-line details; e-filing isn’t available—paper only.

IRS Form 706-QDT Download and Printable

Download and Print: IRS Form 706-QDT

How to Value Assets on IRS Form 706-QDT

Valuation uses fair market value (FMV) on the distribution date, death, or disqualification— the price a willing buyer/seller would agree on, neither under duress.

- Stocks and Bonds: Average high/low trading prices on valuation date; prorate for nearest dates if no trades.

- Real Estate and Other Property: Provide descriptions enabling IRS appraisal; no forced-sale discounts.

- Alternate Valuation Election (Line 1): Value 6 months post-death (or distribution date) if it reduces both value and tax—irreversible and applies trust-wide.

- Special-Use Valuation (Line 2): For qualified farms/business realty, use actual use value via Schedule T; 2025 maximum reduction is $1,420,000 (up from $1,390,000 in 2024).

Document valuations thoroughly to support audits; hire qualified appraisers for complex assets.

Calculating the Estate Tax on Form 706-QDT

Taxes defer until taxable events, then hit at rates up to 40%. The form recomputes the decedent’s original tax as if distributions occurred at death.

- Taxable Amount: Sum corpus distributions (Schedule B, Part II) minus hardship exemptions.

- Recompute Net Estate (Lines 7-11): Add cumulative distributions to original taxable estate/gifts; apply unified credit ($13.99 million exemption equivalent).

- Tax Due (Line 14): Highest marginal rate if multiple QDOTs or no final Form 706 determination; subtract prior payments/credits.

- Installment Option: Elect under section 6166 for up to 14 years if interest in closely held business exceeds 35% of estate.

Generation-skipping transfer (GST) tax may apply separately; allocate the $13.99 million exemption strategically.

Schedules and Key Elections on Form 706-QDT

- Schedule A: Aggregates data for multiple QDOTs.

- Schedule B: Core reporting per trust—distributions, property values, deductions.

- Portability Election: Not directly on 706-QDT; handled via original Form 706 for the decedent’s unused exemption.

- Spousal Election (Line 4): Treat distributions as qualified terminable interest property (QTIP) for GST exemption use.

- Hardship Deduction: Column (f) on Schedule B for health/maintenance distributions.

Attach exhibits like Form 706 Schedules M/O for deductions.

Common Mistakes When Filing Form 706-QDT and How to Avoid Them

QDOT filings are niche, so errors abound:

- Missing Attachments: Forgetting the trust instrument or death certificate—check the checklist.

- Valuation Pitfalls: Using outdated or forced-sale values; opt for professional appraisals.

- Hardship Misclaims: Overstating exemptions without documentation.

- Recompute Errors: Failing to use the highest tax bracket for multiples.

- Payment Delays: Not paying by original deadline despite extension.

Review with an estate tax specialist; the redesigned form reduces some redundancies.

Penalties for Late or Incorrect Form 706-QDT Filings

Compliance is enforced strictly:

- Late Filing/Payment: Up to 25% under section 6651 (waivable for reasonable cause).

- Underpayment: 20% for negligence or substantial/gross understatement.

- Preparer Penalties: $1,000+ for unreasonable positions; up to $5,000+ for willful errors.

- Interest: Accrues daily on unpaid balances.

Fraudulent evasion adds criminal risks. File extensions proactively.

Frequently Asked Questions About IRS Form 706-QDT

When is a QDOT required for a non-citizen spouse?

If the estate exceeds the $13.99 million exemption and no direct marital deduction applies without deferral.

Can hardship distributions avoid tax?

Yes, if for health, maintenance, or support—report but deduct on Schedule B.

What’s the difference between Form 706 and 706-QDT?

Form 706 is for the initial estate; 706-QDT handles ongoing QDOT taxes.

Is electronic filing available?

No—mail only, but pay electronically via EFTPS.

How does GST tax interact with QDOTs?

Distributions may trigger GST; elect QTIP treatment for exemption allocation.

Visit IRS.gov for more.

Final Thoughts: Navigate QDOT Taxes with Confidence in 2025

IRS Form 706-QDT safeguards cross-border estates, deferring taxes while honoring marital deductions for non-citizen spouses. With 2025 updates like the $1,420,000 special-use cap and form redesign, staying current is key. Whether managing distributions or planning for the spouse’s passing, professional guidance ensures accuracy and minimizes liabilities.

Download Form 706-QDT today from IRS.gov and consult a tax advisor for personalized strategies. Proper QDOT management isn’t just compliance—it’s legacy protection.

This article provides general information, not tax advice. Always verify with IRS resources or a qualified professional.